Understanding ENB Stock: A Comprehensive Guide

ENB stock, representing Enbridge Inc., is a significant player in the energy sector, particularly in North America. Investors and analysts alike are keenly observing its performance, given the company’s pivotal role in energy transportation and distribution. This article delves deep into the intricacies of ENB stock, providing essential insights, trends, and future predictions that can help investors make informed decisions.

In this article, we will explore various facets of ENB stock including its market performance, the company’s business model, and the factors influencing its stock price. By the end, readers will have a comprehensive understanding of why ENB stock is considered a viable investment option and what potential risks and rewards it entails.

Furthermore, we will highlight expert opinions, historical data, and current market trends that shape the investment landscape for ENB stock. Whether you are a seasoned investor or a beginner, this guide aims to equip you with all the necessary information to navigate the world of ENB stock.

Table of Contents

- Biography of Enbridge Inc.

- Stock Performance Overview

- Enbridge's Business Model

- Factors Influencing ENB Stock Price

- Dividends and Returns

- Future Outlook for ENB Stock

- Expert Opinions on ENB Stock

- Conclusion

Biography of Enbridge Inc.

Founded in 1949, Enbridge Inc. is a Canadian multinational energy transportation company based in Calgary, Alberta. It is primarily known for its pipeline operations, which transport crude oil and natural gas across North America. Enbridge plays a crucial role in the North American energy infrastructure, making it a key player in the industry.

| Data Personal | Detail |

|---|---|

| Company Name | Enbridge Inc. |

| Founded | 1949 |

| Headquarters | Calgary, Alberta, Canada |

| Industry | Energy |

| Stock Symbol | ENB |

Stock Performance Overview

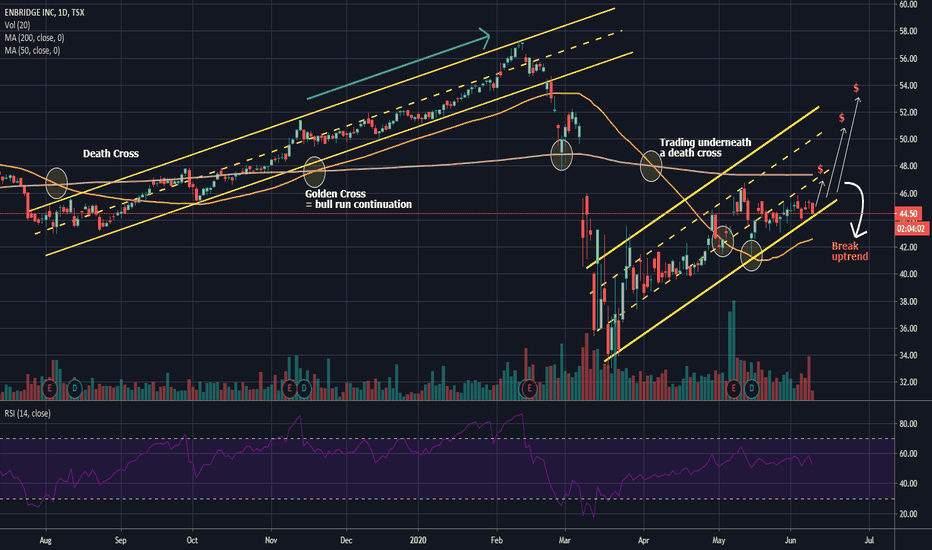

ENB stock has shown a resilient performance over the years, making it an attractive option for investors seeking stability and growth. Over the past five years, ENB stock has consistently provided dividends, along with moderate price appreciation.

Historical Stock Prices

- 2018: ENB stock started at $30.00 and ended at $37.00.

- 2019: The stock price increased from $37.00 to $41.00.

- 2020: Despite the pandemic, ENB stock showed resilience, fluctuating between $30.00 and $40.00.

- 2021: The stock peaked at $50.00, reflecting strong market confidence.

Recent Performance

As of the latest trading sessions, ENB stock is trading around $45.00, with analysts projecting a stable outlook in the near term. The stock has demonstrated a consistent upward trajectory, which can be attributed to the increasing demand for energy resources.

Enbridge's Business Model

Enbridge operates through various segments, primarily focusing on the transportation of crude oil and natural gas. The company’s business model is built around three core pillars:

- Transportation: Enbridge owns and operates the largest pipeline network in North America, transporting over 3 million barrels of oil per day.

- Distribution: The company also provides natural gas distribution services to millions of customers in Canada and the U.S.

- Renewable Energy: Enbridge is investing heavily in renewable energy projects, including wind and solar power, aligning with global sustainability trends.

Factors Influencing ENB Stock Price

Several external and internal factors influence the stock price of ENB, which investors should consider:

Economic Conditions

The overall economic climate plays a significant role in energy demand. Economic growth typically leads to increased energy consumption, positively impacting ENB stock.

Regulatory Environment

Changes in environmental regulations and energy policies can affect Enbridge’s operations and, subsequently, its stock price. Investors need to stay informed about legislative changes.

Dividends and Returns

One of the attractive features of ENB stock is its consistent dividend payments. Enbridge is known for its reliable dividend distribution, making it a favorite among income-focused investors.

- Current Dividend Yield: Approximately 6.5%

- Dividend Growth Rate: Enbridge has consistently increased its dividends over the past 25 years.

Future Outlook for ENB Stock

The future outlook for ENB stock appears promising, driven by several factors:

- Continued demand for energy resources, despite the shift towards renewables.

- Strategic investments in renewable energy projects.

- Strong financial fundamentals and cash flow generation.

Expert Opinions on ENB Stock

Financial analysts and market experts hold positive views regarding ENB stock. Many suggest that it remains a solid investment choice, particularly for those looking for stable income through dividends.

- Analyst Rating: Buy

- Average Price Target: $50.00

Conclusion

In conclusion, ENB stock presents a compelling investment opportunity for those interested in the energy sector. With its robust business model, consistent dividend payments, and a positive future outlook, it is well-positioned to deliver value to its shareholders. Investors are encouraged to conduct thorough research and consider their investment strategies before making any decisions.

We invite readers to share their thoughts in the comments section below and encourage them to explore more articles on our site that can assist them in their investment journeys.

Thank you for reading! We hope to see you back here for more insights and updates on the stock market.

Lisa Marie Presley Children: A Deep Dive Into Her Legacy

Everything You Need To Know About Marathon Petroleum Stock

What Is The Dow Jones Industrial Average? A Comprehensive Guide