Understanding Stock Splits In 2024: What Investors Need To Know

Stock splits in 2024 are set to reshape the investment landscape, providing both opportunities and challenges for investors. As companies look to optimize their stock prices and enhance liquidity, stock splits become a pivotal strategy. Investors must understand the implications of these splits to navigate the stock market effectively.

In this article, we will delve into the concept of stock splits, the reasons behind them, and their potential impact on stock prices. We will also examine notable companies that are expected to implement stock splits in 2024 and what that means for investors. By the end of this article, you'll have a comprehensive understanding of stock splits and be well-equipped to make informed investment decisions.

Whether you're a seasoned investor or just starting, grasping the dynamics of stock splits is crucial. So, let's explore the world of stock splits in 2024 and discover how they can influence your investment strategy.

Table of Contents

- What is a Stock Split?

- Why Do Companies Split Their Stocks?

- Impact of Stock Splits on Stock Prices

- Notable Stock Splits in 2024

- Investor Strategies for Stock Splits

- Myths and Misconceptions About Stock Splits

- How to Analyze Stock Splits

- Conclusion

What is a Stock Split?

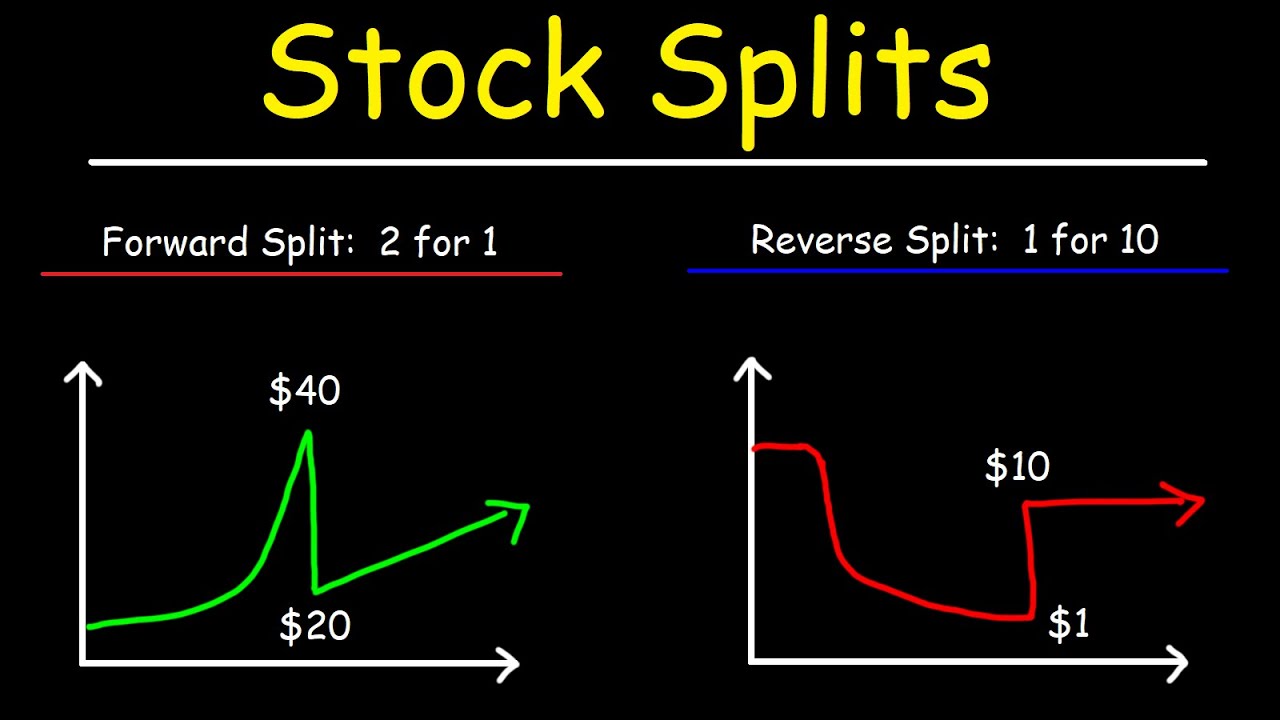

A stock split occurs when a company divides its existing shares into multiple new shares to boost liquidity. For example, in a 2-for-1 stock split, shareholders receive an additional share for every share they own, effectively doubling the number of shares outstanding while halving the stock price.

Stock splits are typically executed by companies when their stock price is perceived to be too high, making it less accessible to small investors. By lowering the share price, companies aim to attract more investors and improve trading volume.

It's important to note that a stock split does not change the overall market capitalization of the company; it simply redistributes the ownership of the company's equity among a larger number of shares.

Why Do Companies Split Their Stocks?

There are several reasons why companies opt for stock splits, including:

- Increasing Liquidity: A lower stock price can attract more buyers, enhancing trading activity and liquidity.

- Making Shares More Affordable: Stock splits can make shares more accessible to retail investors who may find high-priced stocks prohibitive.

- Enhancing Marketability: A lower share price can improve a company's image and make its shares more appealing to investors.

- Positioning for Growth: Companies may split their stocks in anticipation of future growth, signaling confidence in their business prospects.

Impact of Stock Splits on Stock Prices

The impact of stock splits on stock prices can vary significantly based on market conditions and investor sentiment. Generally, stock splits can lead to a temporary increase in stock prices due to heightened investor interest. However, it’s crucial to understand that a stock split does not inherently add value to the company; it merely changes the number of shares outstanding.

Investors should consider the overall performance of the company and market trends when evaluating the impact of stock splits. Historical data suggests that while some stocks experience a price increase post-split, others may not see significant changes in value.

Notable Stock Splits in 2024

As we look ahead to 2024, several companies are expected to announce stock splits. Here are a few notable examples:

- Company A: Anticipated a 3-for-1 stock split to increase liquidity and attract retail investors.

- Company B: Expected a 5-for-2 stock split to enhance marketability and position for growth.

- Company C: Preparing for a 2-for-1 stock split to make shares more affordable for a broader range of investors.

Investors should monitor these developments closely, as they can create opportunities for investment or require adjustments to existing portfolios.

Investor Strategies for Stock Splits

Investors can adopt several strategies when dealing with stock splits:

- Research the Company: Understand the company's fundamentals and growth prospects before investing.

- Watch for Timing: Pay attention to market conditions and potential catalysts that could influence stock performance post-split.

- Diversify Investments: Avoid overconcentration in a single stock, especially one undergoing a split.

- Consider Long-Term Goals: Stock splits may create short-term volatility; focus on long-term investment objectives.

Myths and Misconceptions About Stock Splits

There are several common myths regarding stock splits that investors should be aware of:

- Myth 1: Stock splits increase a company's value. Reality: A stock split does not change the intrinsic value of a company; it merely alters the number of shares outstanding.

- Myth 2: All companies that split their stocks will see share prices rise. Reality: While some stocks may experience price increases, others may not see significant changes.

- Myth 3: Stock splits are a sign of financial trouble. Reality: Companies may split stocks as a proactive measure to enhance liquidity and marketability.

How to Analyze Stock Splits

When analyzing stock splits, consider the following factors:

- Company Performance: Review the company's financial health, growth potential, and market position.

- Market Conditions: Assess the broader market environment and investor sentiment towards the industry.

- Historical Performance: Look at how similar companies have performed after previous stock splits.

By conducting thorough analysis, investors can make informed decisions regarding their investment strategies surrounding stock splits.

Conclusion

In conclusion, stock splits in 2024 present both opportunities and challenges for investors. Understanding the mechanics behind stock splits, their implications on stock prices, and the strategies to navigate them is crucial for making informed investment decisions. As we move forward, staying informed about notable stock splits and market trends will empower investors to capitalize on potential opportunities.

We encourage you to share your thoughts in the comments below, explore more articles on our site, and stay updated on the latest investment insights.

Thank you for reading, and we look forward to welcoming you back for more valuable content on investing and financial strategies!

Kingdom Business: Unlocking The Secrets To Success In Faith-Based Enterprises

Josephine Langford Movies: A Comprehensive Guide To Her Filmography

Ultimate Guide To Ranchero Sauce: A Flavorful Addition To Your Culinary Arsenal