Understanding HYG Stock: A Comprehensive Guide To High-Yield Bonds

HYG stock, which represents the iShares iBoxx $ High Yield Corporate Bond ETF, has become increasingly popular among investors seeking higher returns in today's low-interest-rate environment. As the financial landscape continues to evolve, understanding the intricacies of high-yield bonds and their associated risks is crucial for making informed investment decisions. This article will delve deep into the world of HYG stock, exploring its performance, risks, and investment strategies.

In this guide, we will cover everything you need to know about HYG stock, including its structure, historical performance, and how it fits into a diversified investment portfolio. Additionally, we will provide insights into the factors that influence high-yield bond markets and tips for effectively investing in HYG stock. Whether you are a seasoned investor or a newcomer to the world of finance, this article aims to equip you with the knowledge needed to navigate the complexities of high-yield bonds.

By the end of this article, you will have a clear understanding of HYG stock and be well-prepared to assess the potential benefits and risks associated with investing in high-yield bonds. Let’s get started on this investment journey!

Table of Contents

- What is HYG Stock?

- Biography of HYG Stock

- Performance of HYG Stock

- Risks Associated with HYG Stock

- Investment Strategies for HYG Stock

- Factors Influencing HYG Stock

- Tax Implications of Investing in HYG Stock

- Conclusion

What is HYG Stock?

HYG stock represents the iShares iBoxx $ High Yield Corporate Bond ETF, which is designed to track the performance of an index composed of U.S. dollar-denominated, high-yield corporate bonds. This ETF provides investors with exposure to a diversified portfolio of bonds that are considered to have a higher risk of default compared to investment-grade bonds. As a result, HYG stock typically offers higher yields, making it an attractive option for income-seeking investors.

Biography of HYG Stock

HYG was launched by BlackRock in April 2007 and has since become one of the largest and most widely traded high-yield bond ETFs in the market. Its primary goal is to provide investors with exposure to the U.S. high-yield bond market while offering liquidity and transparency.

Personal Data and Biodata

| Attribute | Details |

|---|---|

| Fund Name | iShares iBoxx $ High Yield Corporate Bond ETF |

| Launch Date | April 2007 |

| Issuer | BlackRock |

| Asset Class | High-Yield Bonds |

| Expense Ratio | 0.49% |

| Average Daily Volume | 5 million shares |

Performance of HYG Stock

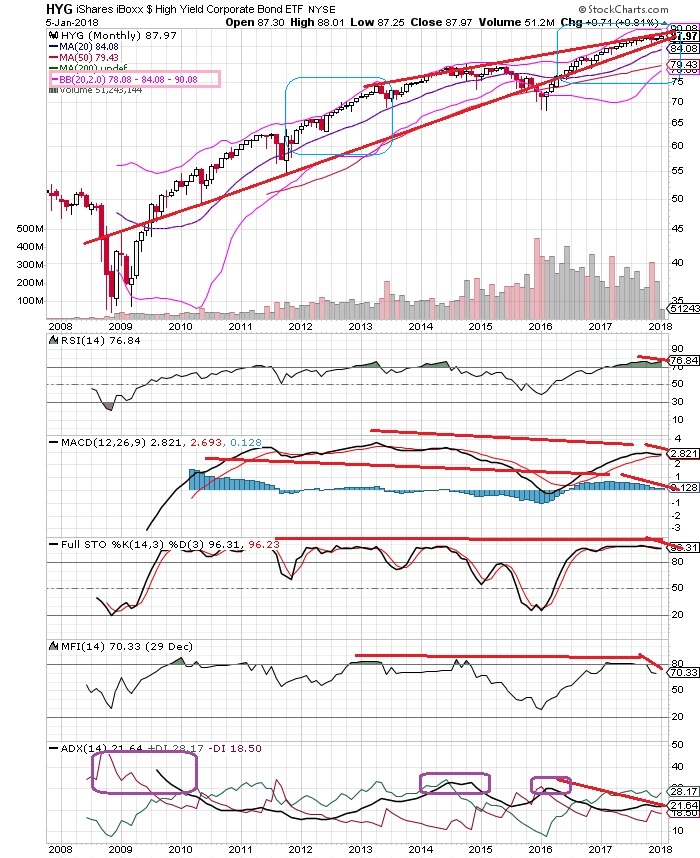

The performance of HYG stock is closely tied to the high-yield bond market. Over the years, HYG has demonstrated resilience during economic recoveries, often outperforming other bond categories. Historical data shows that during periods of economic expansion, high-yield bonds tend to perform well due to increased corporate earnings and reduced default rates.

However, it is essential to note that HYG stock can also be highly sensitive to economic downturns. In times of recession or financial instability, high-yield bonds often face significant selling pressure, which can lead to decreased prices and increased yields. Investors should carefully monitor economic indicators and market trends when considering HYG stock.

Risks Associated with HYG Stock

Investing in HYG stock comes with inherent risks that investors should be aware of. Some of the key risks include:

- Credit Risk: High-yield bonds are issued by companies with lower credit ratings, meaning there is a higher risk of default.

- Interest Rate Risk: Changes in interest rates can impact bond prices. When rates rise, bond prices typically fall.

- Market Risk: Economic downturns or market volatility can negatively affect the performance of high-yield bonds.

- Liquidity Risk: During times of market stress, it may become difficult to buy or sell high-yield bonds at desired prices.

Investment Strategies for HYG Stock

Investors looking to incorporate HYG stock into their portfolios should consider the following strategies:

- Diversification: Use HYG stock as part of a diversified portfolio to balance risk and enhance returns.

- Income Generation: Consider HYG stock for its potential to provide attractive income through dividends.

- Market Timing: Monitor economic indicators and market trends to make informed decisions about entry and exit points.

- Risk Management: Implement risk management strategies, such as stop-loss orders, to limit potential losses.

Factors Influencing HYG Stock

Several factors can impact HYG stock performance, including:

- Economic Conditions: Economic growth or contraction can influence corporate earnings and, consequently, the performance of high-yield bonds.

- Interest Rates: Changes in interest rates set by the Federal Reserve can affect bond prices and yields.

- Default Rates: An increase in corporate defaults can negatively impact the high-yield bond market and HYG stock.

- Credit Spreads: The difference between yields on high-yield bonds and investment-grade bonds can provide insights into market sentiment.

Tax Implications of Investing in HYG Stock

Investors should be aware of the tax implications associated with investing in HYG stock. The dividends received from high-yield bonds may be subject to ordinary income tax rates, which can be higher than capital gains tax rates. Additionally, capital gains taxes may apply when selling HYG stock at a profit. It is advisable to consult with a tax professional to understand the specific tax implications of investing in high-yield bonds.

Conclusion

In conclusion, HYG stock provides investors with an opportunity to access the high-yield bond market, offering the potential for higher returns in a low-interest-rate environment. However, investing in HYG stock also comes with risks that must be carefully considered. By understanding the performance factors, risks, and strategies associated with HYG stock, investors can make informed decisions that align with their financial goals.

We encourage you to share your thoughts on HYG stock in the comments below, and don’t forget to explore our other articles for more insights into the world of investing!

Thank you for reading, and we look forward to welcoming you back for more informative content!

How To Get Creases Out Of Leather: A Comprehensive Guide

Pannus Stomach: Understanding The Condition And Its Implications

Chiefs 2024 Schedule: A Comprehensive Look At The Upcoming Season