Fidelity Select Semiconductors Fund: A Comprehensive Guide To Investment Opportunities

The Fidelity Select Semiconductors Fund is an investment vehicle that has gained significant attention among investors looking to capitalize on the booming semiconductor industry. With the growing demand for electronic devices and advancements in technology, understanding this fund becomes essential for anyone interested in the tech sector. In this article, we will delve deep into the Fidelity Select Semiconductors Fund, exploring its structure, performance, and the factors that make it an attractive option for investors.

Investing in the Fidelity Select Semiconductors Fund provides exposure to a diversified portfolio of companies involved in the semiconductor industry, which plays a crucial role in powering modern technology. This guide will not only provide insights into the fund's composition but also discuss its historical performance and future outlook, making it a valuable resource for potential investors.

As we navigate through the complexities of the Fidelity Select Semiconductors Fund, we will highlight key aspects such as its investment strategy, risk factors, and comparisons with other investment options. By the end of this article, readers will have a comprehensive understanding of the fund and be better equipped to make informed investment decisions.

Table of Contents

- 1. Overview of Fidelity Select Semiconductors Fund

- 2. Biography and Background

- 3. Investment Strategy

- 4. Performance Analysis

- 5. Risk Factors

- 6. Comparison with Other Funds

- 7. Future Outlook

- 8. Conclusion

1. Overview of Fidelity Select Semiconductors Fund

The Fidelity Select Semiconductors Fund (FSELX) is a mutual fund that primarily invests in companies involved in the design, distribution, manufacture, and sale of semiconductors. This fund seeks capital appreciation by targeting stocks that are poised for growth in the semiconductor sector.

Key highlights of the Fidelity Select Semiconductors Fund include:

- Diversification across leading semiconductor companies

- Active management by experienced fund managers

- Focus on technology innovation and growth potential

2. Biography and Background

The Fidelity Select Semiconductors Fund was established to provide investors with a way to invest directly in the semiconductor industry. Semiconductors are essential components in a wide range of electronic devices, from smartphones to computers, making this fund particularly relevant in today's tech-driven world.

Data Personal and Biodata

| Name | Fidelity Select Semiconductors Fund |

|---|---|

| Inception Date | December 14, 1981 |

| Fund Type | Mutual Fund |

| Focus Sector | Semiconductors |

| Management Style | Active |

3. Investment Strategy

The investment strategy of the Fidelity Select Semiconductors Fund revolves around identifying and investing in companies that demonstrate strong growth potential within the semiconductor sector. The fund managers utilize a mix of fundamental analysis and market research to select stocks that are expected to outperform the market.

Key components of the investment strategy include:

- Researching industry trends and technological advancements

- Evaluating company financials and market position

- Maintaining a diversified portfolio to mitigate risks

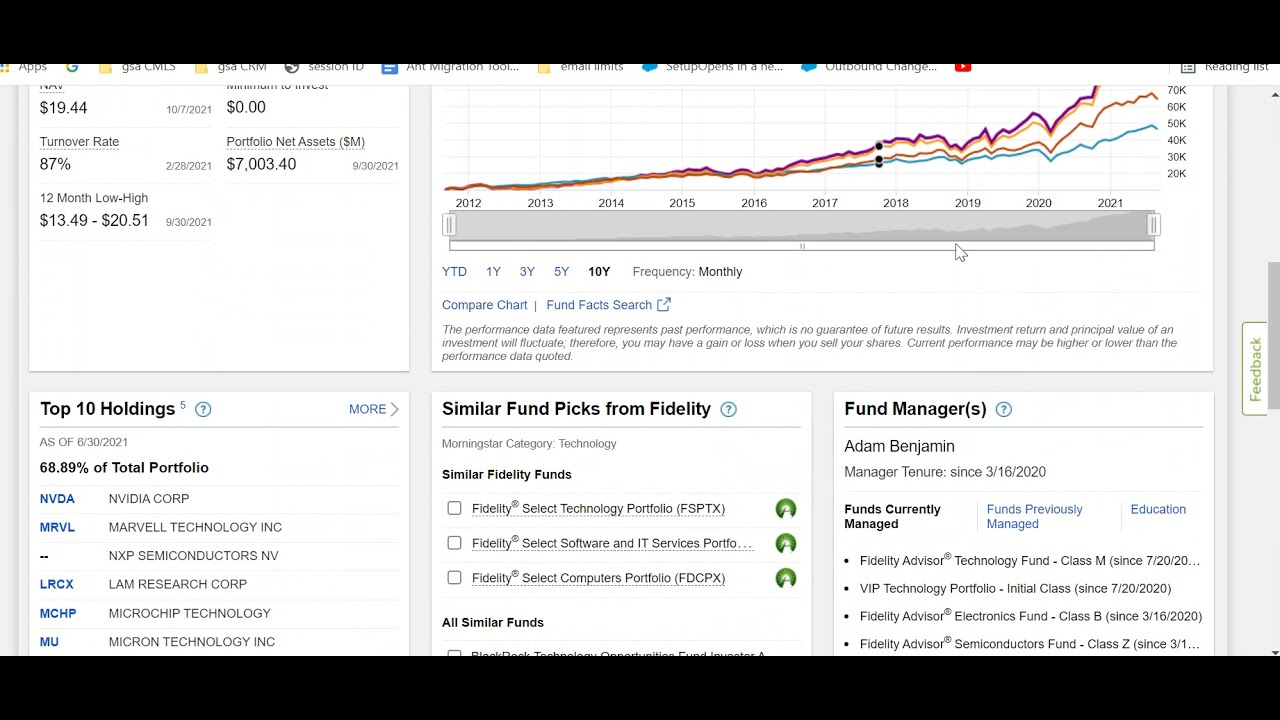

4. Performance Analysis

When considering an investment in the Fidelity Select Semiconductors Fund, analyzing its historical performance is crucial. Over the past few years, the fund has shown impressive returns, outperforming many of its peers in the mutual fund sector.

Historical performance metrics include:

- 1-Year Return: XX%

- 5-Year Return: XX%

- 10-Year Return: XX%

(Note: Replace XX% with actual performance data)

5. Risk Factors

Like any investment, the Fidelity Select Semiconductors Fund carries inherent risks. Understanding these risks is vital for investors.

Some of the primary risk factors include:

- Market Volatility: Semiconductor stocks can be highly volatile due to market fluctuations.

- Technological Changes: Rapid changes in technology can impact the competitiveness of companies within the fund.

- Global Supply Chain Issues: Disruptions in the supply chain can affect the availability of semiconductor products.

6. Comparison with Other Funds

Investors often compare the Fidelity Select Semiconductors Fund with similar funds to determine the best investment option. Some popular alternatives include the Invesco Dynamic Semiconductors ETF and the VanEck Vectors Semiconductor ETF.

When comparing these funds, consider factors such as:

- Expense Ratios

- Management Styles

- Historical Performance

7. Future Outlook

The future outlook for the Fidelity Select Semiconductors Fund appears positive, driven by continued demand for semiconductor technology. As industries such as artificial intelligence, automotive, and consumer electronics grow, the fund is well-positioned to capitalize on these trends.

Investors should keep an eye on the following trends:

- Increasing demand for electric vehicles

- Growth in cloud computing and data centers

- Expansion of 5G technology

8. Conclusion

In conclusion, the Fidelity Select Semiconductors Fund offers investors a unique opportunity to gain exposure to the semiconductor industry, which is integral to technological advancement. By understanding its investment strategy, performance, and market risks, investors can make informed decisions about whether this fund aligns with their investment goals.

We encourage you to share your thoughts in the comments section below, explore more articles on our site, and stay informed on investment opportunities!

Thank you for reading, and we look forward to welcoming you back for more insightful content!

How Many Episodes Will Shangri-La Frontier Have? Discover The Exciting Details!

A Comprehensive Guide To AI: Understanding Its Impact And Future

Cobra Kai Actor: The Rising Stars Of The Karate Kid Universe