Understanding Excel Stock: A Comprehensive Guide To Managing Your Investments

Excel Stock is an essential tool for investors looking to efficiently manage their portfolios and track stock performance. In today's fast-paced financial markets, having the right tools can make a significant difference in investment outcomes. With the rise of technology, Excel has become a go-to platform for many investors who want to analyze data, forecast trends, and make informed decisions. This article will dive deep into how to effectively use Excel for stock management, providing valuable insights that cater to both novice and experienced investors.

In this guide, we will explore various features of Excel that can enhance your investment strategy, including formulas, charts, and data analysis techniques. We will also discuss the importance of maintaining data integrity and how to source reliable data. By the end of this article, you will have a comprehensive understanding of how to leverage Excel to optimize your stock investments.

Whether you're looking to track your portfolio performance, analyze historical data, or create forecasts, this article will serve as a valuable resource. Join us as we navigate through the capabilities of Excel in stock management and discover best practices that can lead to better investment decisions.

Table of Contents

- What is Excel Stock?

- Setting Up Excel for Stock Management

- Key Features of Excel for Investors

- Data Sourcing and Integrity

- Analyzing Stock Data in Excel

- Creating Visuals and Charts

- Case Studies and Examples

- Conclusion

What is Excel Stock?

Excel Stock refers to the use of Microsoft Excel as a tool for managing and analyzing stock investments. It allows investors to input data regarding stock prices, dividends, and other financial metrics to track performance over time. Excel can also be used to create financial models, forecast future stock prices, and assess portfolio risk.

Importance of Excel in Stock Management

Excel offers several advantages for stock investors:

- Flexibility: Users can customize spreadsheets to suit their specific needs.

- Data Analysis: Excel provides powerful tools for analyzing large datasets.

- Visualization: Users can create charts and graphs to better understand stock performance.

- Cost-Effective: Excel is widely available and often included in office software packages.

Setting Up Excel for Stock Management

To effectively manage your investments using Excel, it is crucial to set up your spreadsheet correctly. Here are the steps to get started:

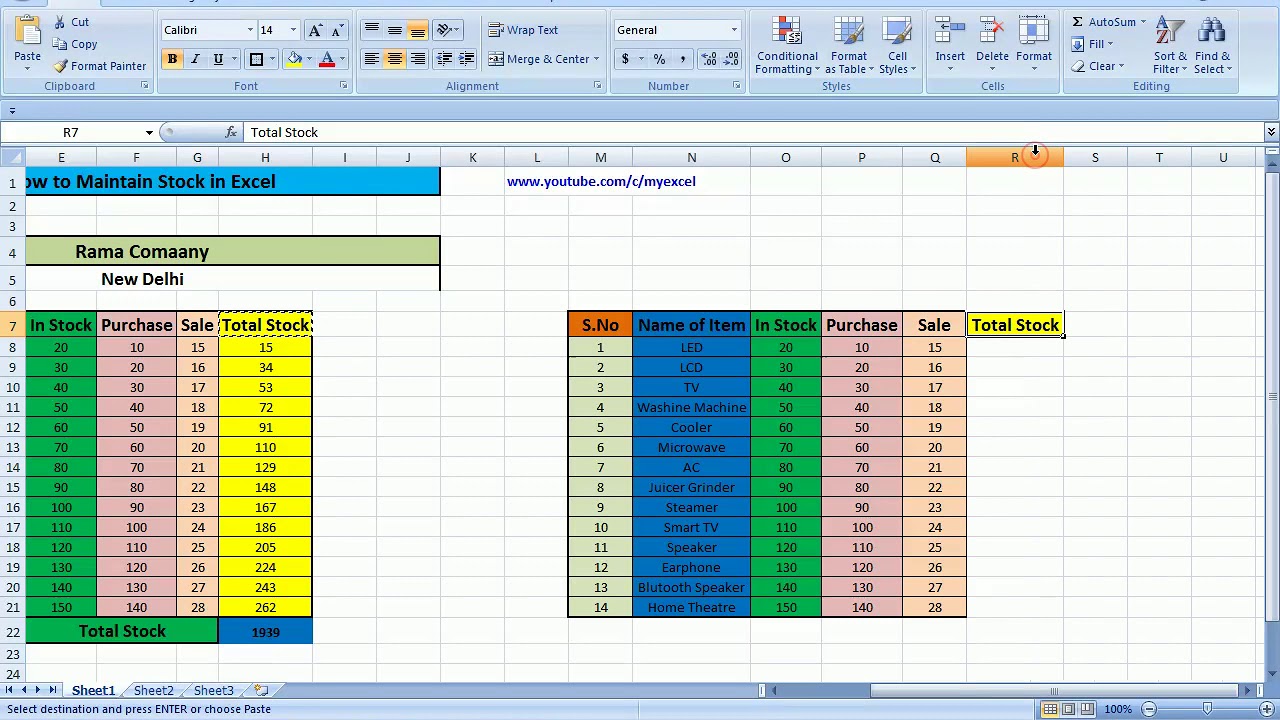

Creating a Stock Portfolio Spreadsheet

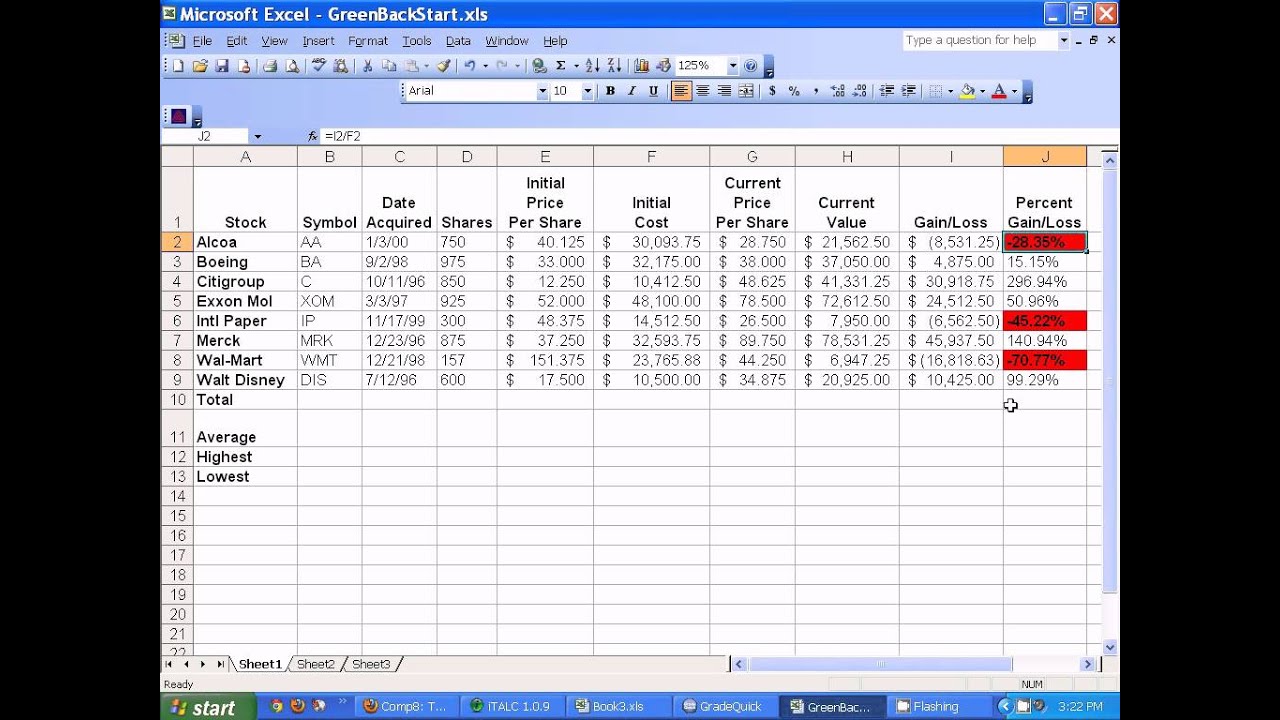

- Open a new Excel workbook and create appropriate columns such as Stock Ticker, Purchase Price, Current Price, Quantity, Total Investment, and Gain/Loss.

- Input your stock data into the respective columns.

- Use formulas to calculate your Total Investment and Gain/Loss. For example, the formula for Gain/Loss can be written as:

=(Current Price - Purchase Price) * Quantity.

Key Features of Excel for Investors

Excel is equipped with numerous features that can enhance your stock management experience. Here are some of the most useful ones:

Formulas and Functions

Excel has a variety of built-in functions that can be used for financial calculations, such as:

- AVERAGE: Calculate the average price of a stock over a period.

- SUM: Calculate the total investment across multiple stocks.

- IF: Create conditional statements to analyze data based on specific criteria.

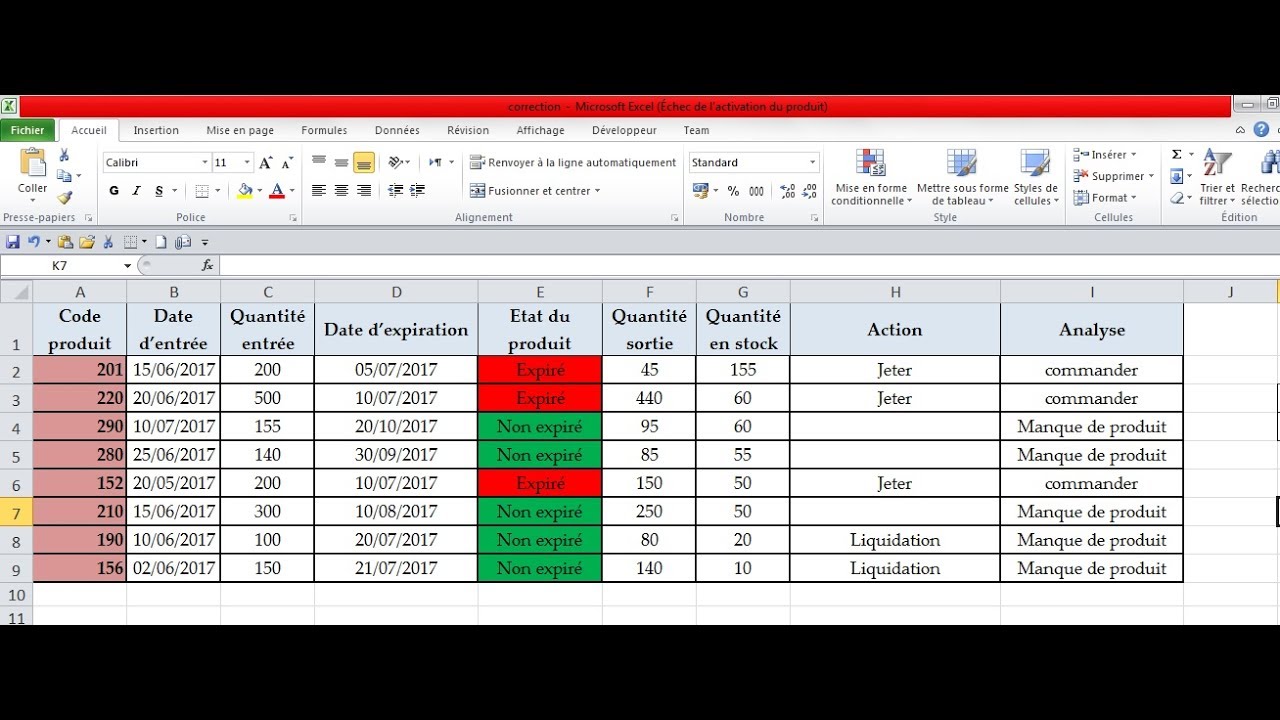

Data Validation and Formatting

Data validation helps ensure that the information entered into your spreadsheet is accurate. You can set rules for data entry to avoid errors, such as restricting entries to numerical values for stock prices.

Data Sourcing and Integrity

The quality of your analysis largely depends on the accuracy of the data you use. Here are some tips for sourcing reliable stock data:

Using Online Data Sources

Many websites provide free stock data that can be imported into Excel, such as:

Consider using Excel's built-in data connection features to automatically update stock prices from these sources.

Analyzing Stock Data in Excel

Once you have collected and organized your stock data, the next step is to analyze it for insights. Here are some analysis techniques you can employ:

Trend Analysis

Analyzing trends over time can help identify patterns in stock performance. Use Excel's charting features to visualize data trends.

Portfolio Diversification Analysis

Assess the diversification of your portfolio by calculating the correlation between different stocks. A diversified portfolio can reduce risk and enhance returns.

Creating Visuals and Charts

Visual representation of data can simplify complex information. Here are some chart types you might consider:

Common Chart Types for Stock Analysis

- Line Charts: Ideal for showing stock price movements over time.

- Bar Charts: Useful for comparing different stocks or categories.

- Pie Charts: Effective for illustrating portfolio allocation.

Case Studies and Examples

To illustrate the effectiveness of Excel in stock management, let’s explore a couple of practical examples:

Example 1: Tracking a Tech Stock Portfolio

A tech investor created a portfolio in Excel to track multiple tech stocks, utilizing formulas to calculate total gains and losses. They regularly updated the spreadsheet with real-time data from Yahoo Finance, allowing them to make data-driven decisions.

Example 2: Analyzing Historical Performance

An investor used Excel to analyze the historical performance of a specific stock over five years, creating line charts to visualize price changes, which helped in predicting future trends.

Conclusion

Excel Stock is an invaluable tool for anyone serious about managing their investments. By harnessing Excel's powerful features, you can track your portfolio, analyze stock performance, and make informed investment decisions. Remember to keep your data accurate and current, and don't hesitate to leverage online resources for reliable stock information.

We encourage you to implement the strategies discussed in this article and explore the capabilities of Excel for your stock management needs. If you found this article helpful, please leave a comment, share it with others, or check out our other articles for more insights!

Thank you for reading, and we hope to see you back here for more financial tips and resources!

Kate Beckinsale And Matt Rife: A Look At Their Relationship And More

Understanding The Trump Media Stock Chart: A Comprehensive Analysis

Purina Cat Food Recall 2024: What You Need To Know