How Much Can I Convert From Traditional IRA To Roth IRA?

Understanding the conversion process from a Traditional IRA to a Roth IRA is essential for anyone looking to optimize their retirement savings. This process can be a strategic move to minimize future tax burdens and maximize growth potential. In this article, we will explore the intricacies of IRA conversions, including the rules governing them, the tax implications, and the benefits of making such conversions. By the end of this article, you'll have a comprehensive understanding of how much you can convert from a Traditional IRA to a Roth IRA and the best practices for doing so.

As retirement approaches, many individuals begin to reconsider their investment strategies. One of the most significant decisions involves converting a Traditional IRA into a Roth IRA. This decision can have profound implications for your financial future, including how much tax you will owe upon withdrawal and how your investments will grow over time. In this article, we will discuss the maximum conversion amounts, the factors to consider, and how to approach this conversion strategically.

We will also delve into the benefits of Roth IRAs, including tax-free withdrawals and the absence of required minimum distributions (RMDs). With the right planning, converting to a Roth IRA can provide long-term financial benefits that align with your retirement goals. So, let’s explore how much you can convert from a Traditional IRA to a Roth IRA and the factors you need to be aware of to make informed decisions.

Table of Contents

- What is an IRA Conversion?

- Benefits of Converting to a Roth IRA

- Factors Affecting Conversion Amounts

- How to Convert Your IRA

- Tax Implications of Conversions

- Roth IRA Contribution Limits

- Strategic Considerations for Conversion

- Common Questions About IRA Conversions

What is an IRA Conversion?

An IRA conversion is the process of moving funds from a Traditional Individual Retirement Account (IRA) to a Roth IRA. This conversion allows you to pay taxes on the converted amount now, rather than when you withdraw funds in retirement. The idea is to enjoy tax-free growth and withdrawals in the future.

Types of IRA Accounts

- Traditional IRA: Contributions may be tax-deductible, and taxes are paid upon withdrawal.

- Roth IRA: Contributions are made with after-tax dollars, and qualified withdrawals are tax-free.

Benefits of Converting to a Roth IRA

There are several compelling reasons to consider converting your Traditional IRA to a Roth IRA, including:

- Tax-Free Withdrawals: Once you reach age 59½ and have held the account for at least five years, withdrawals are tax-free.

- No Required Minimum Distributions (RMDs): Unlike Traditional IRAs, Roth IRAs do not require withdrawals during the account holder’s lifetime.

- Tax Diversification: Having both Traditional and Roth accounts can provide flexibility in managing tax liabilities in retirement.

Factors Affecting Conversion Amounts

The amount you can convert from a Traditional IRA to a Roth IRA is not strictly limited; however, several factors can influence your decision:

- Annual Income: Your current income level can impact your tax bracket and the overall tax owed on the conversion.

- Tax Bracket Considerations: Converting a large amount in a high-income year may push you into a higher tax bracket.

- Future Income Projections: Anticipating future income can help determine the ideal conversion strategy.

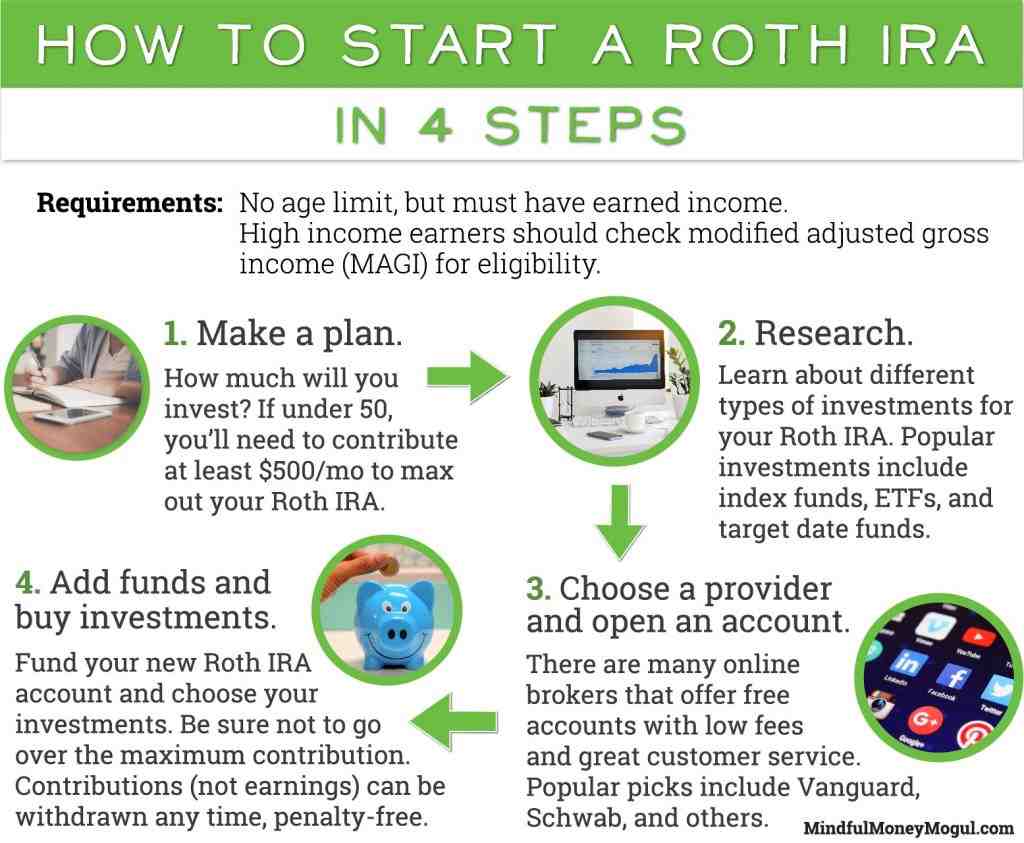

How to Convert Your IRA

Converting your Traditional IRA to a Roth IRA involves several steps:

- Evaluate Your Current Financial Situation: Assess your income, expenses, and tax implications.

- Determine Conversion Amount: Decide how much you want to convert based on your financial goals and tax considerations.

- Contact Your IRA Custodian: Initiate the conversion process through your financial institution.

- Complete the Tax Forms: Ensure you report the conversion on your tax return.

Tax Implications of Conversions

Tax implications are a critical consideration when converting your IRA:

- Taxable Income: The amount converted is added to your taxable income for the year.

- Potential Tax Bracket Increase: Consider how the conversion amount may affect your overall tax liability.

- State Taxes: Depending on your state, you may owe additional taxes on the converted amount.

Roth IRA Contribution Limits

While there are no limits on how much you can convert from a Traditional IRA, there are contribution limits for Roth IRAs:

- For 2023: The contribution limit is $6,500 for individuals under age 50 and $7,500 for those aged 50 and older.

- Income Limits: High earners may face restrictions on their ability to contribute directly to a Roth IRA.

Strategic Considerations for Conversion

Before proceeding with a conversion, consider the following strategies:

- Partial Conversions: Instead of converting the entire amount at once, consider partial conversions over multiple years to manage tax liabilities.

- Timing the Conversion: Evaluate market conditions and your income for optimal conversion timing.

- Consult a Financial Advisor: Seek professional guidance to navigate the complexities of IRA conversions.

Common Questions About IRA Conversions

Here are some frequently asked questions regarding IRA conversions:

- Can I convert any amount from my Traditional IRA? Yes, you can convert any amount, but consider the tax implications of large conversions.

- Will I owe taxes on the converted amount? Yes, the converted amount is taxable as ordinary income.

- Is there a deadline for conversions? You can convert your IRA at any time, but it's important to plan for tax implications in the current tax year.

Conclusion

Converting from a Traditional IRA to a Roth IRA can be a strategic move for your retirement planning. By understanding how much you can convert, the tax implications, and the benefits involved, you can make informed decisions that align with your financial goals. Remember to evaluate your current financial situation and consult with a financial advisor if necessary. If you found this article helpful, please leave a comment, share it with others, or explore more articles on our site.

Final Thoughts

Thank you for reading! We hope this article has provided valuable insights into IRA conversions. We invite you to return to our site for more informative content and resources related to personal finance and retirement planning.

How Did Rand Paul Make His Money?

Understanding Potential Hurricanes: Preparation And Safety Tips

Kayla Itsines: The Fitness Guru Transforming Lives