Stock Market Right Now: Trends, Insights, And Predictions

The stock market right now is experiencing significant fluctuations, leaving investors both excited and anxious. As we navigate through these uncertain economic times, it's crucial to understand the current trends and factors influencing market behavior. This article aims to provide a comprehensive overview of the stock market, offering insights and predictions to help investors make informed decisions.

The stock market serves as a barometer for economic health, reflecting investor sentiment and corporate performance. Presently, several factors are impacting the market dynamics, including inflation rates, interest rates, geopolitical tensions, and technological advancements. By examining these elements, we can gain a clearer picture of where the stock market is headed.

This article will delve into various aspects of the stock market, including recent trends, sector performances, and expert predictions. We will also explore investment strategies that can be employed in the current climate. Whether you’re a seasoned investor or just starting, understanding the stock market right now is essential for navigating your financial future.

Table of Contents

- Current Trends in the Stock Market

- Economic Factors Influencing the Market

- Sector Performance Analysis

- Effective Investment Strategies

- Expert Predictions for the Future

- Risk Management in Uncertain Times

- Case Studies of Successful Investments

- Conclusion and Call to Action

Current Trends in the Stock Market

The stock market right now is characterized by volatility, with several key trends emerging. Let’s explore these trends in detail:

1. Increased Volatility

The recent months have seen heightened volatility in the stock market. Major indices such as the S&P 500 and Dow Jones Industrial Average have experienced significant swings. This volatility can be attributed to various factors, including changing economic indicators and investor sentiment.

2. Rise of Technology Stocks

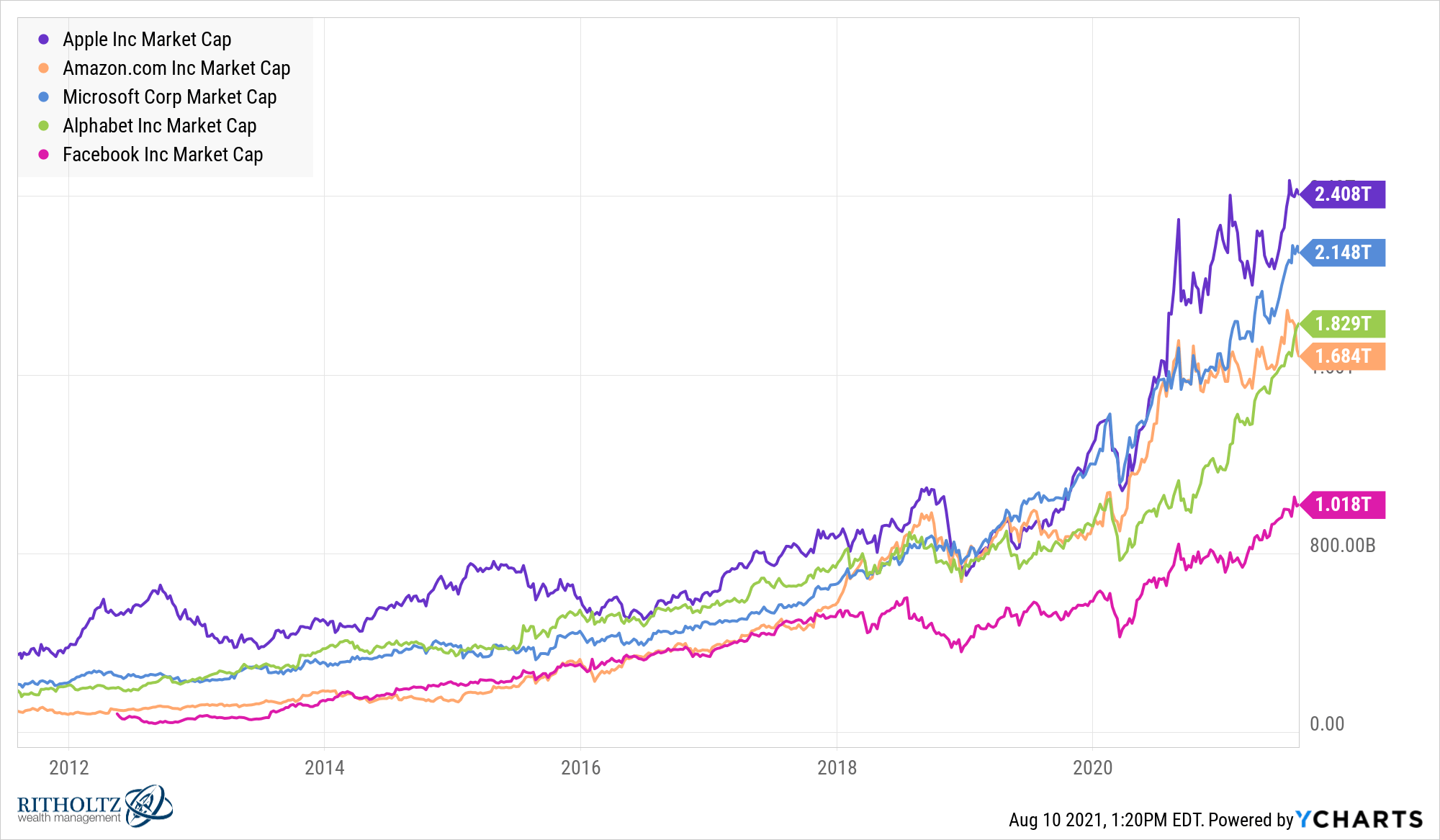

Technology stocks have been leading the charge in the stock market. Companies in sectors such as artificial intelligence, cloud computing, and cybersecurity have shown remarkable growth. This trend indicates a shift in investor focus towards technology and innovation.

3. Focus on ESG Investing

Environmental, Social, and Governance (ESG) factors are becoming increasingly important for investors. Companies that prioritize sustainability and social responsibility are gaining attention, which is reflected in their stock performance.

Economic Factors Influencing the Market

Understanding the economic landscape is crucial for grasping the stock market right now. Several key factors are currently influencing market conditions:

1. Inflation Rates

Inflation has been a hot topic in economic discussions. Rising prices can erode purchasing power, leading to cautious spending by consumers and businesses alike. Investors are closely monitoring inflation data to gauge its impact on interest rates and corporate earnings.

2. Interest Rates

The Federal Reserve's stance on interest rates is pivotal in shaping market sentiment. Any changes in interest rates can have a profound effect on borrowing costs and investment decisions. Currently, the Fed's policies are geared towards managing inflation without stifling economic growth.

3. Geopolitical Tensions

Geopolitical issues, such as trade disputes and international conflicts, can create uncertainty in the stock market. Investors are advised to stay informed about global events that may affect market stability.

Sector Performance Analysis

Different sectors of the stock market respond uniquely to economic changes. Here’s an analysis of how various sectors are performing right now:

1. Technology Sector

- Strong growth in sub-sectors like AI and cloud services.

- Continued investment in digital transformation by businesses.

2. Healthcare Sector

- Increased demand for healthcare services and innovations.

- Focus on biotech and pharmaceuticals, especially post-pandemic.

3. Consumer Discretionary Sector

- Shifts in consumer behavior towards online shopping.

- Impact of inflation on discretionary spending.

Effective Investment Strategies

In light of the current market conditions, it’s essential to adopt effective investment strategies:

1. Diversification

Diversifying your investment portfolio can help mitigate risk. Consider including a variety of asset classes, such as stocks, bonds, and real estate.

2. Long-Term Focus

While the stock market right now may seem volatile, maintaining a long-term investment perspective can yield significant returns. Avoid panic selling during downturns.

3. Regular Portfolio Review

Regularly reviewing your investment portfolio can help you stay aligned with your financial goals. Adjust your holdings as necessary based on market conditions and personal circumstances.

Expert Predictions for the Future

Financial experts and analysts have varying opinions on the future of the stock market. Here are some key predictions:

1. Continued Volatility

Experts predict that volatility will persist in the near term due to ongoing economic uncertainties. Investors should prepare for market fluctuations.

2. Tech Sector Resilience

The technology sector is expected to remain resilient, driven by ongoing innovation and consumer demand. Analysts foresee continued growth in key tech companies.

3. Interest Rate Adjustments

Future adjustments in interest rates will significantly influence the market. Investors should be vigilant about the Federal Reserve’s policy changes.

Risk Management in Uncertain Times

Effective risk management strategies are essential for navigating the stock market right now:

1. Set Clear Investment Goals

Establishing clear investment goals can guide your decision-making process and help you stay focused during market turbulence.

2. Stay Informed

Regularly updating yourself on market news and economic indicators can empower you to make informed investment choices.

3. Utilize Stop-Loss Orders

Implementing stop-loss orders can help protect your investments from significant losses during market downturns.

Case Studies of Successful Investments

Learning from successful investments can provide valuable insights. Here are a few case studies:

- Case Study 1: The Rise of Tesla - An analysis of how early investments in Tesla have yielded substantial returns.

- Case Study 2: Amazon's Growth - Understanding how Amazon has transformed the retail landscape and the resulting stock performance.

- Case Study 3: Biotech Boom - Exploring successful biotech companies and their impact on the healthcare sector.

Conclusion and Call to Action

In conclusion, understanding the stock market right now is essential for making informed investment decisions. By keeping an eye on current trends, economic factors, and expert predictions, investors can navigate this volatile landscape more effectively.

We encourage you to share your thoughts on the stock market in the comments below and to explore other articles on our site for more investment insights.

Sources

- Investopedia - Understanding Market Volatility

- The Wall Street Journal - Economic Indicators and Their Impact on the Stock Market

- Bloomberg - Current Trends in Technology Stocks

Thank you for reading! We look forward to seeing you again for more financial insights and updates.

Tommy Lloyd: A Rising Star In Kentucky Basketball

Understanding Spy Premarket: A Comprehensive Guide

Understanding StumbleUpon: The Evolution Of Online Content Discovery