Understanding NASDAQ: Meli - A Comprehensive Overview Of Mercado Libre

NASDAQ: Meli is the ticker symbol for Mercado Libre, the largest e-commerce and fintech platform in Latin America. With its extensive reach across various countries, Mercado Libre has emerged as a significant player in the global digital marketplace. In this article, we will delve deep into Mercado Libre’s operations, its growth trajectory, and the factors influencing its stock performance. This comprehensive guide aims to provide insights not just for investors but also for anyone interested in understanding the dynamics of e-commerce in Latin America.

With the rising popularity of online shopping and digital payments, Mercado Libre is positioned to capitalize on these trends. Whether you are considering investing in NASDAQ: Meli or simply want to learn more about the company, this article will serve as a valuable resource.

Table of Contents

- Biography of Mercado Libre

- Business Model of Mercado Libre

- Financial Performance

- Market Trends in Latin America

- Challenges Faced by Mercado Libre

- Future Potential of NASDAQ: Meli

- Investing Tips for NASDAQ: Meli

- Conclusion

Biography of Mercado Libre

Founded in 1999 by Marcos Galperin, Mercado Libre has grown from a startup to a leading e-commerce platform in Latin America. With operations in 18 countries, the company offers a wide range of products and services, including an online marketplace, payment solutions, and logistics. Below is a brief overview of the company's key data:

| Attribute | Details |

|---|---|

| Founded | 1999 |

| Founder | Marcos Galperin |

| Headquarters | Buenos Aires, Argentina |

| Market Capitalization | $N/A (as of October 2023) |

| Employees | Over 10,000 |

| Website | mercadolibre.com |

Business Model of Mercado Libre

Mercado Libre operates on a multi-faceted business model that includes various revenue streams:

- Marketplace Fees: The company charges sellers a fee for listing their products on the platform.

- Payment Processing: Through Mercado Pago, Mercado Libre earns revenue by processing payments for transactions made on its platform.

- Logistics Services: By offering shipping and logistics solutions, Mercado Libre enhances the buyer’s experience and generates additional income.

- Advertising: The platform provides advertising services to sellers to promote their products.

Innovative Features of the Platform

Mercado Libre continues to innovate by adding features that improve user experience:

- Mobile App: With a user-friendly mobile application, Mercado Libre facilitates seamless shopping.

- Customer Support: Enhanced customer service options ensure buyer and seller satisfaction.

- Integration with Social Media: The platform allows sellers to promote their products on social media, expanding their reach.

Financial Performance

Over the years, Mercado Libre has demonstrated robust financial growth:

- Revenue Growth: The company has consistently reported year-over-year revenue growth, driven by increased online shopping and payment transactions.

- Profit Margins: Improved operational efficiencies have led to better profit margins in recent years.

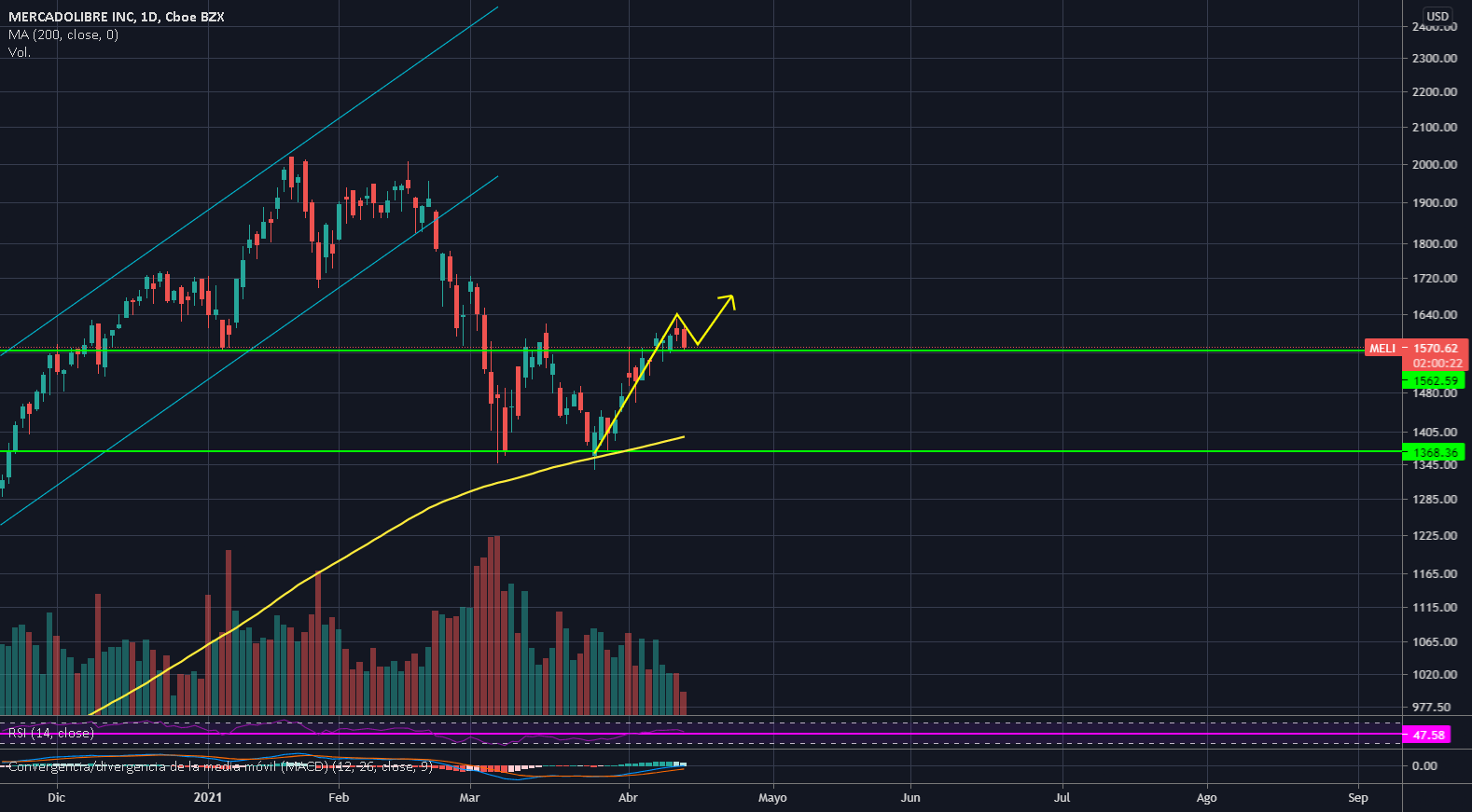

- Stock Performance: NASDAQ: Meli has shown a strong performance in the stock market, reflecting investor confidence.

Key Financial Metrics

Below are some key financial metrics for Mercado Libre:

| Metric | Value |

|---|---|

| Revenue (2022) | $N/A |

| Net Income (2022) | $N/A |

| Year-over-Year Growth | XX% |

Market Trends in Latin America

The e-commerce landscape in Latin America is evolving rapidly:

- Increased Internet Penetration: More people are accessing the internet, leading to a rise in online shopping.

- Mobile Commerce: A significant portion of transactions is now conducted via mobile devices.

- Shift in Consumer Behavior: Consumers are increasingly favoring online shopping over traditional retail.

Challenges Faced by Mercado Libre

Despite its success, Mercado Libre faces several challenges:

- Regulatory Issues: Different countries have varying regulations that can impact operations.

- Competition: The rise of local competitors and global giants poses a threat.

- Economic Conditions: Fluctuating economic conditions in Latin America can affect consumer spending.

Future Potential of NASDAQ: Meli

The future looks promising for Mercado Libre:

- Expansion Plans: The company aims to expand its services into more regions.

- Technological Advancements: Investing in technology will enhance the platform's capabilities.

- Partnerships: Collaborations with other companies can provide additional growth opportunities.

Investing Tips for NASDAQ: Meli

If you're considering investing in NASDAQ: Meli, here are some tips:

- Research: Conduct thorough research on the company and its market.

- Diversification: Diversify your portfolio to mitigate risks.

- Long-term Perspective: Consider a long-term investment approach to ride out market volatility.

Conclusion

In summary, NASDAQ: Meli represents a unique opportunity in the growing e-commerce market of Latin America. With a strong business model, impressive financial performance, and promising future potential, Mercado Libre stands out as a key player in the industry. As an investor, staying informed and conducting thorough research is essential for making informed decisions. We invite you to share your thoughts in the comments below and explore more articles on our site for further insights.

Closing Thoughts

Thank you for taking the time to read this comprehensive guide on NASDAQ: Meli. We hope you found the information valuable and informative. Please return to our site for more insights and updates on the latest trends in the financial world.

Exploring The Enigma Of The 100000000000000000000 Dollar 100 Dollar Bill

Unveiling The Life And Career Of Jennifer Williams

Top Data Analytics Companies: Transforming Data Into Insight