The Ultimate Guide To Largest Short Interest Stocks: What You Need To Know

Investing in the stock market can be a complex and challenging endeavor, especially when it comes to understanding short selling and short interest. Among the various investment strategies, short selling stands out due to its unique approach to profiting from a decline in stock prices. In this comprehensive article, we will delve into the largest short interest stocks currently in the market and explore what this means for investors. With the landscape of the stock market constantly changing, understanding which stocks have the largest short interest can provide valuable insights for traders and investors alike.

In this article, we aim to provide a thorough analysis of the largest short interest stocks, looking at key metrics, trends, and implications for both short sellers and long investors. The keyword "largest short interest stocks" will guide our exploration as we dissect this critical aspect of stock trading. Whether you are a seasoned investor or just starting out, having a solid grasp of short interest can be the key to making informed investment decisions.

We will cover various topics, including what short interest is, how it is calculated, why it matters, and the potential risks and rewards associated with investing in stocks with high short interest. By the end of this article, you will have a comprehensive understanding of the largest short interest stocks and how to leverage this information for your investment strategy.

Table of Contents

- What is Short Interest?

- How is Short Interest Calculated?

- Why Does Short Interest Matter?

- Top Stocks with High Short Interest

- Risks of Investing in Short Interest Stocks

- Strategies for Investing in Short Interest Stocks

- Case Studies of Short Squeeze

- Conclusion

What is Short Interest?

Short interest refers to the total number of shares that have been sold short but not yet covered or closed out. When investors sell short, they are betting that the price of a stock will decline. If the stock price drops, they can buy back the shares at a lower price, return them to the lender, and pocket the difference. Short interest serves as a gauge of market sentiment toward a particular stock.

How is Short Interest Calculated?

Short interest is typically expressed as a number of shares or as a percentage of the float (the total number of shares available for trading). The formula for calculating short interest is as follows:

- Short Interest = Total Shares Sold Short

- Short Interest Ratio = Short Interest / Average Daily Trading Volume

A higher short interest ratio indicates that it would take longer for short sellers to cover their positions, which could lead to increased volatility in the stock price.

Why Does Short Interest Matter?

Understanding short interest is crucial for several reasons:

- Market Sentiment: High short interest can indicate negative sentiment about a stock.

- Potential for Short Squeeze: When a heavily shorted stock begins to rise in price, short sellers may rush to cover their positions, leading to a further increase in the stock price.

- Investment Opportunities: Identifying stocks with high short interest can help investors spot potential buying opportunities.

Top Stocks with High Short Interest

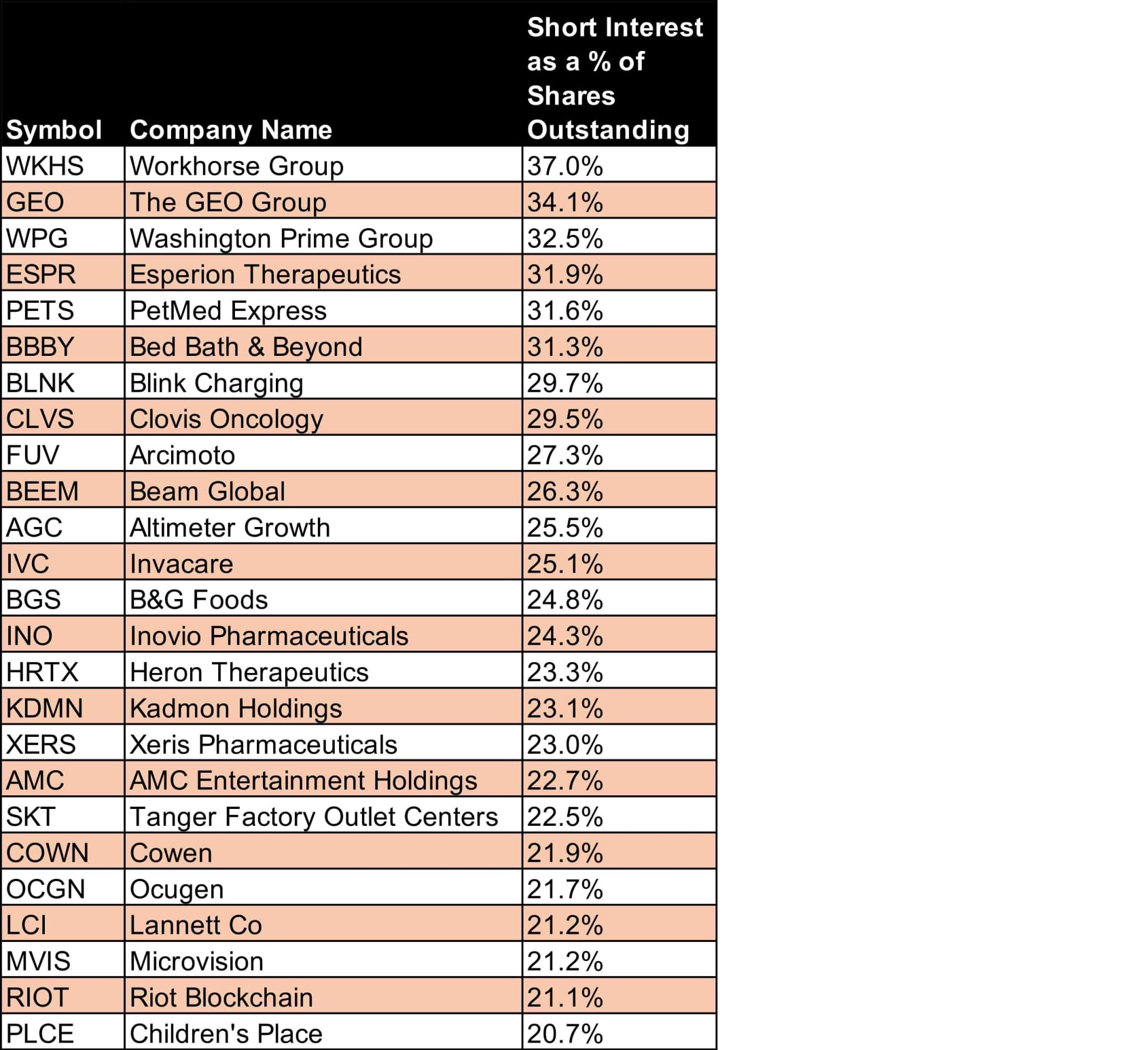

As of the latest data, here are some of the largest short interest stocks to watch:

| Stock Ticker | Company Name | Short Interest (%) | Market Cap (Billion $) |

|---|---|---|---|

| AMC | AMC Entertainment Holdings | 20.3% | 4.5 |

| GME | GameStop Corp. | 18.6% | 5.3 |

| BB | BlackBerry Limited | 15.4% | 3.0 |

Risks of Investing in Short Interest Stocks

While there can be opportunities in investing in stocks with high short interest, there are also significant risks:

- Volatility: Stocks with high short interest can experience sharp price movements.

- Short Squeeze Risk: A sudden price increase can lead to a short squeeze, causing significant losses for short sellers.

- Market Sentiment Changes: Negative sentiment can quickly shift, impacting stock prices dramatically.

Strategies for Investing in Short Interest Stocks

Investors can apply several strategies when considering stocks with high short interest:

- Monitor Price Trends: Keep an eye on price movements and trading volumes.

- Understand the Company Fundamentals: Assess the company's financial health and industry position.

- Set Risk Management Parameters: Use stop-loss orders to protect against significant losses.

Case Studies of Short Squeeze

Several notable cases of short squeezes have occurred in recent years, highlighting the potential volatility of stocks with high short interest. For example:

- GameStop (GME): The infamous short squeeze in early 2021 saw GME's stock price surge, leading to massive losses for short sellers.

- AMC Entertainment (AMC): Similar to GME, AMC's stock experienced dramatic price increases driven by retail investors.

Conclusion

In conclusion, understanding the largest short interest stocks is essential for investors looking to navigate the complexities of the stock market. By recognizing the implications of short interest, investors can make informed decisions and potentially capitalize on market movements. Whether you are interested in short selling or looking for long-term investments, being aware of short interest trends can enhance your investment strategy.

We encourage you to share your thoughts in the comments below, and don’t forget to subscribe to our newsletter for more insights and updates on stock market trends!

Thank you for reading, and we look forward to welcoming you back for more valuable investment content!

Kate Winslet Naked: A Deep Dive Into Her Iconic Roles And Impact On Cinema

What Meat Is Most Eaten In The World?

How To Spend Bill Gates' Money: A Guide To Philanthropy And Personal Finance