Leaked Credit Cards 2024: Understanding The Risks And Preventive Measures

In the digital age, the security of our financial information is more critical than ever, especially with the rise of leaked credit cards in 2024. As data breaches and cyberattacks become increasingly sophisticated, individuals and businesses must be vigilant about protecting their sensitive information. This article delves into the alarming trend of leaked credit cards, exploring its implications and offering actionable insights to safeguard against such threats.

As we navigate through this complex topic, we will examine the causes of credit card leaks, the impact on victims, and the necessary steps to take in case of a breach. With an estimated 60 million credit card numbers compromised in the last year alone, understanding how to protect oneself is paramount.

Join us as we unpack this pressing issue, offering expert advice and authoritative resources to help you stay one step ahead in the fight against financial fraud.

Table of Contents

- What Are Leaked Credit Cards?

- Causes of Leaked Credit Cards

- Impact of Leaked Credit Cards

- How to Protect Your Credit Card Information

- What to Do If Your Credit Card is Leaked

- Emerging Trends in Credit Card Security

- The Role of Technology in Preventing Leaks

- Conclusion

What Are Leaked Credit Cards?

Leaked credit cards refer to the unauthorized access and distribution of credit card information, including card numbers, expiration dates, and security codes. These leaks can occur due to various factors, including data breaches, phishing attacks, or insecure online platforms.

In 2024, the threat of leaked credit cards has escalated, with cybercriminals employing advanced techniques to infiltrate databases and steal sensitive information. Understanding the nature of these leaks is essential in developing effective countermeasures.

Types of Credit Card Leaks

- Data Breaches: Large-scale hacks targeting financial institutions or retailers.

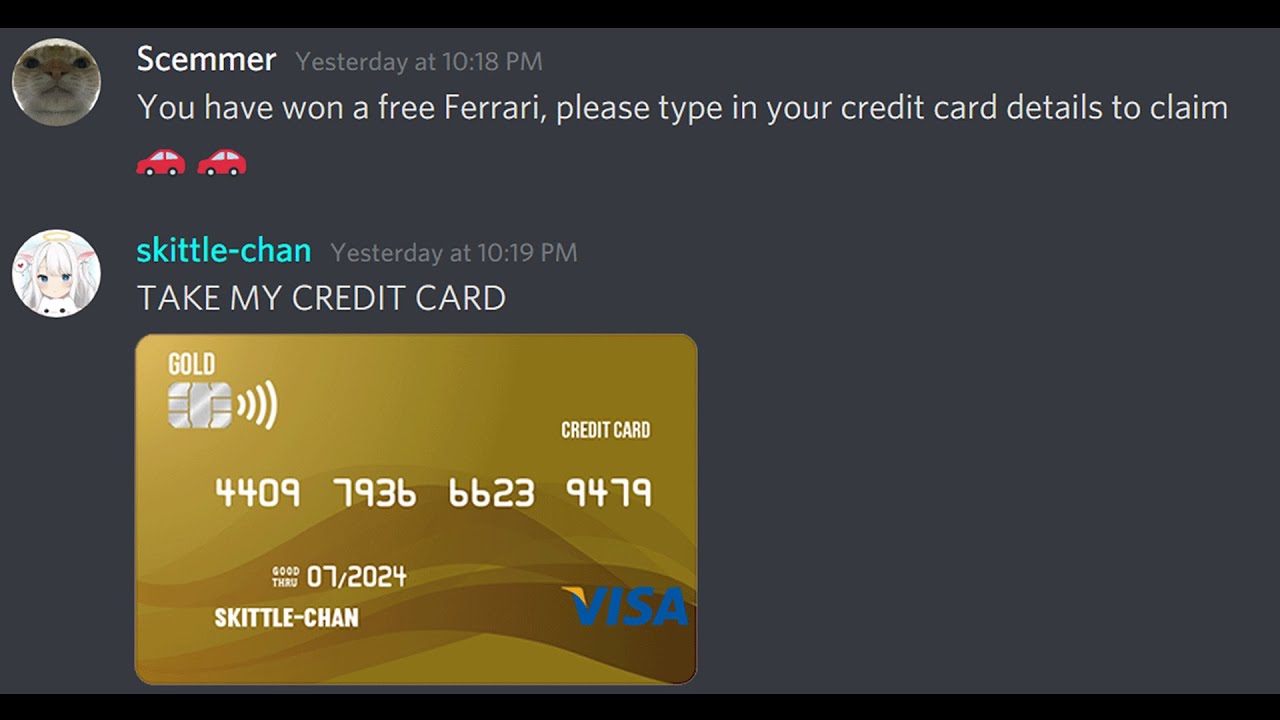

- Phishing Scams: Deceptive emails or websites designed to trick users into revealing their information.

- Malware Attacks: Software designed to infiltrate computers and steal stored credit card data.

Causes of Leaked Credit Cards

The causes of leaked credit cards are multi-faceted and often interconnected. Some of the primary causes include:

- Inadequate Security Measures: Many businesses fail to implement robust security protocols, making them vulnerable to attacks.

- Human Error: Employees may inadvertently expose sensitive data through negligence or lack of training.

- Outdated Technology: Using outdated software can leave systems open to exploitation.

- Increased Online Transactions: The surge in e-commerce has created more opportunities for cybercriminals.

According to a report by the Identity Theft Resource Center, data breaches increased by 17% in 2023, highlighting the urgent need for improved security measures.

Impact of Leaked Credit Cards

The consequences of leaked credit cards can be devastating for individuals and businesses alike. Some of the most significant impacts include:

- Financial Loss: Victims may face unauthorized charges, leading to potential financial ruin.

- Identity Theft: Stolen credit card information can be used to create fake identities.

- Reputation Damage: Businesses that suffer data breaches may lose customer trust and face legal repercussions.

Statistics show that the average cost of a data breach in 2023 was approximately $4.35 million, underscoring the urgent need for preventive measures.

How to Protect Your Credit Card Information

Protecting your credit card information requires proactive measures. Here are some effective strategies:

- Use Strong Passwords: Create complex passwords and change them regularly.

- Enable Two-Factor Authentication: Add an extra layer of security to your online accounts.

- Monitor Your Accounts: Regularly check your bank statements for unauthorized transactions.

- Utilize Virtual Credit Cards: Consider using virtual cards for online purchases to minimize exposure.

What to Do If Your Credit Card is Leaked

If you suspect that your credit card information has been compromised, take the following steps immediately:

- Contact Your Bank: Report the issue and freeze your account.

- Change Your Passwords: Update passwords for all accounts linked to your credit card.

- Monitor Your Credit Report: Keep an eye on your credit report for any unusual activity.

- File a Fraud Alert: Notify credit bureaus of potential fraud to protect your credit score.

Emerging Trends in Credit Card Security

As the landscape of cyber threats evolves, so do the security measures to combat them. Some emerging trends in credit card security include:

- Artificial Intelligence: AI is being utilized to detect and prevent fraudulent transactions in real-time.

- Blockchain Technology: This decentralized technology offers enhanced security for transactions.

- Biometric Authentication: Fingerprint and facial recognition technologies are becoming more prevalent.

These advancements represent a significant leap forward in protecting sensitive financial information.

The Role of Technology in Preventing Leaks

Technology plays a crucial role in preventing credit card leaks. Here are some key technologies being adopted:

- Encryption: Encrypting sensitive data ensures that even if it is intercepted, it remains unreadable.

- Firewalls: Firewalls protect networks from unauthorized access.

- Regular Software Updates: Keeping systems updated reduces vulnerabilities.

Investing in these technologies can significantly reduce the risk of credit card leaks.

Conclusion

In conclusion, the rise of leaked credit cards in 2024 presents significant challenges for individuals and businesses alike. By understanding the causes, impacts, and preventive measures, we can better protect ourselves from financial fraud.

We encourage readers to take proactive steps to safeguard their credit card information and stay informed about emerging threats. If you found this article helpful, consider leaving a comment or sharing it with others to raise awareness about this critical issue.

Thank you for reading, and we invite you to explore more articles on our site to stay informed and empowered.

Joy Marie Palm-Miller: The Journey Of An Inspiring Entrepreneur

Sondra Blust: The Rise Of An OnlyFans Star