Monthly Car Payment Calculator: Your Ultimate Guide To Managing Auto Financing

Are you looking to purchase a vehicle but feeling overwhelmed by the financial aspects? A monthly car payment calculator can be your best friend in this journey. This tool allows you to estimate your monthly payments based on the price of the car, your down payment, interest rate, and loan term. Understanding how to use this calculator effectively can help you make informed decisions and find a car that fits your budget.

In this comprehensive guide, we will explore everything you need to know about using a monthly car payment calculator. From understanding the key factors that influence your payments to tips on getting the best financing options, we aim to equip you with the knowledge needed to navigate the auto financing landscape successfully.

Whether you are a first-time car buyer or looking to upgrade your current vehicle, knowing how to calculate your monthly payments can save you money and stress in the long run. Let’s dive in!

Table of Contents

- What is a Monthly Car Payment Calculator?

- How Does It Work?

- Key Factors Affecting Monthly Payments

- Benefits of Using a Calculator

- How to Use a Monthly Car Payment Calculator

- Tips for Getting the Best Financing

- Common Mistakes to Avoid

- Conclusion

What is a Monthly Car Payment Calculator?

A monthly car payment calculator is a financial tool designed to help potential car buyers estimate their monthly payments based on various factors. This online calculator allows users to input details such as the car price, down payment, interest rate, and loan term to produce an estimated monthly payment amount.

By using this calculator, buyers can gain a clearer picture of what their budget allows and make more informed purchasing decisions. It can also be beneficial for comparing different financing options and understanding the overall cost of the vehicle over time.

How Does It Work?

The functionality of a monthly car payment calculator is quite straightforward. Here’s how it typically works:

- Input Car Price: Enter the total cost of the vehicle you wish to purchase.

- Enter Down Payment: Specify the amount you plan to pay upfront. A higher down payment will lower your monthly payments.

- Interest Rate: Input the annual percentage rate (APR) you expect to receive from your lender.

- Loan Term: Select the length of the loan, usually expressed in months (e.g., 36, 48, 60 months).

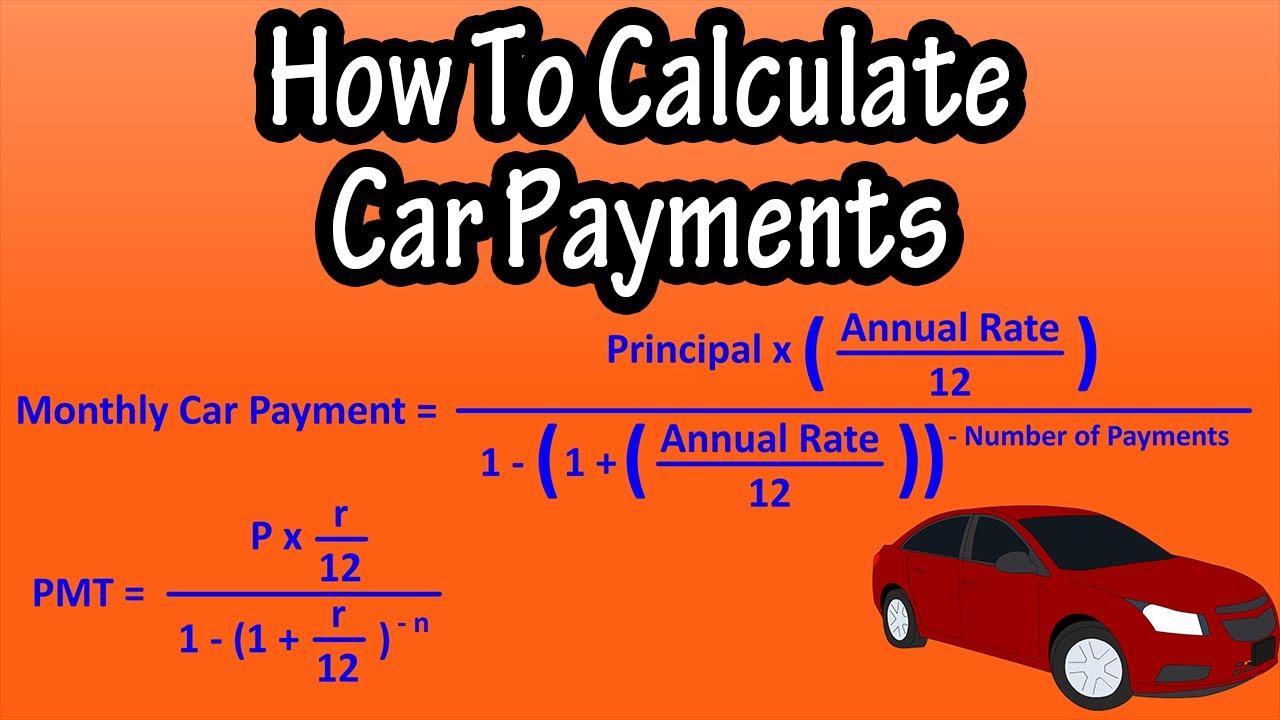

Once you input these values, the calculator will utilize a standard formula to estimate your monthly payment. The formula usually looks something like this:

Monthly Payment = [P * r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- P: Loan principal (car price - down payment)

- r: Monthly interest rate (annual rate / 12)

- n: Total number of payments (loan term in months)

Key Factors Affecting Monthly Payments

When using a monthly car payment calculator, it’s essential to understand the key factors that can influence your monthly payment:

1. Car Price

The total cost of the vehicle is the most significant factor affecting your monthly payment. Higher-priced vehicles will naturally result in higher payments unless offset by a larger down payment.

2. Down Payment

A substantial down payment reduces the principal amount financed, thereby lowering monthly payments. Aim for at least 20% of the car's price if possible.

3. Interest Rate

The interest rate you receive is influenced by your credit score, the lender’s policies, and current market conditions. A lower interest rate means lower monthly payments.

4. Loan Term

Longer loan terms result in smaller monthly payments, but they can also lead to paying more interest over the life of the loan. Consider the balance between affordability and total cost.

Benefits of Using a Calculator

Using a monthly car payment calculator comes with several advantages:

- Budget Planning: Helps you establish a budget for your car purchase and stick to it.

- Informed Decisions: Allows for comparisons between different vehicles and financing options.

- Focus on Affordability: Encourages you to consider what you can realistically afford each month.

- Time-Saving: Quickly provides estimates without the need for complex calculations.

How to Use a Monthly Car Payment Calculator

Using a monthly car payment calculator is easy. Follow these steps for optimal results:

- Visit a reputable online calculator (many are available on dealership websites or financial institutions).

- Input the car price and down payment.

- Enter the estimated interest rate.

- Select your preferred loan term.

- Click “Calculate” to view your estimated monthly payment.

- Adjust the variables to see how changes affect your monthly payment.

Tips for Getting the Best Financing

To secure the most favorable financing for your vehicle, consider these tips:

- Shop Around: Compare offers from multiple lenders to find the best interest rates.

- Improve Your Credit Score: Work on boosting your credit score before applying for a loan.

- Negotiate: Don’t hesitate to negotiate financing terms with your dealer.

- Consider Shorter Loan Terms: A shorter loan term may offer lower interest rates and overall savings.

Common Mistakes to Avoid

To make the most out of your vehicle financing process, avoid these common pitfalls:

- Ignoring Total Costs: Focus on monthly payments without considering total loan costs can lead to financial strain.

- Overestimating Your Budget: Be realistic about your financial situation and avoid overcommitting.

- Skipping the Research: Failing to research the vehicle’s value can result in overpaying.

- Neglecting Other Fees: Be aware of additional fees such as taxes, registration, and insurance.

Conclusion

Utilizing a monthly car payment calculator is a vital step in the car buying process. It enables you to estimate your payments, understand your budget, and make informed financing decisions. Remember to consider all factors that influence your payments, and take the time to shop around for the best financing options.

We encourage you to leave a comment below sharing your experiences with car financing or any questions you may have. Additionally, feel free to share this article with friends or family who might find it useful!

Thank you for reading, and we hope to see you back soon for more valuable insights and tips!

Anyone But You Streaming: A Comprehensive Guide To The Latest Romantic Comedy

Tia And Tamera Mowry: A Comprehensive Look At The Iconic Twin Sisters

QuantumScape: The Future Of Battery Technology