Understanding ENB Stock: A Comprehensive Guide To Enbridge Inc.

ENB stock, representing shares of Enbridge Inc., has been a focal point for investors interested in the energy sector. As a major North American energy infrastructure company, Enbridge plays a vital role in the transportation of crude oil and natural gas. The significance of understanding ENB stock lies in its potential for investment growth, dividends, and the overall health of the energy market.

In this article, we will delve into the history, performance, and future outlook of ENB stock. We will also explore how external factors such as market trends, regulatory changes, and global energy demands impact the stock's performance. By the end of this guide, you will have a comprehensive understanding of ENB stock and its investment potential.

Whether you are a seasoned investor or a newcomer to the stock market, grasping the nuances of ENB stock is essential for making informed investment decisions. Let’s navigate through the various aspects of Enbridge and its stock to help you understand its value in the energy landscape.

Table of Contents

- 1. Biography of Enbridge Inc.

- 2. Key Data and Statistics

- 3. Performance of ENB Stock

- 4. Dividends and Returns

- 5. Market Factors Influencing ENB Stock

- 6. Investment Strategy for ENB Stock

- 7. Future Outlook for ENB Stock

- 8. Conclusion

1. Biography of Enbridge Inc.

Founded in 1949, Enbridge Inc. has transformed into one of the largest energy infrastructure companies in North America. The company operates the longest crude oil and liquids transportation system in the world, with significant operations in both the United States and Canada. Enbridge is also a leader in natural gas distribution and renewable energy projects.

Key Milestones in Enbridge's History

- 1949: Enbridge was established in Calgary, Alberta.

- 1998: Enbridge acquired the Interprovincial Pipe Line System.

- 2017: Enbridge completed the merger with Spectra Energy, expanding its reach in natural gas.

- 2020: Enbridge committed to reaching net-zero emissions by 2050.

2. Key Data and Statistics

Before investing in ENB stock, it is essential to analyze its key data and statistics. Below is a summary of the most relevant financial information:

| Data Point | Value |

|---|---|

| Market Capitalization | $85 billion |

| Dividend Yield | 6.7% |

| P/E Ratio | 20.5 |

| 52-Week High | $55.00 |

| 52-Week Low | $39.00 |

3. Performance of ENB Stock

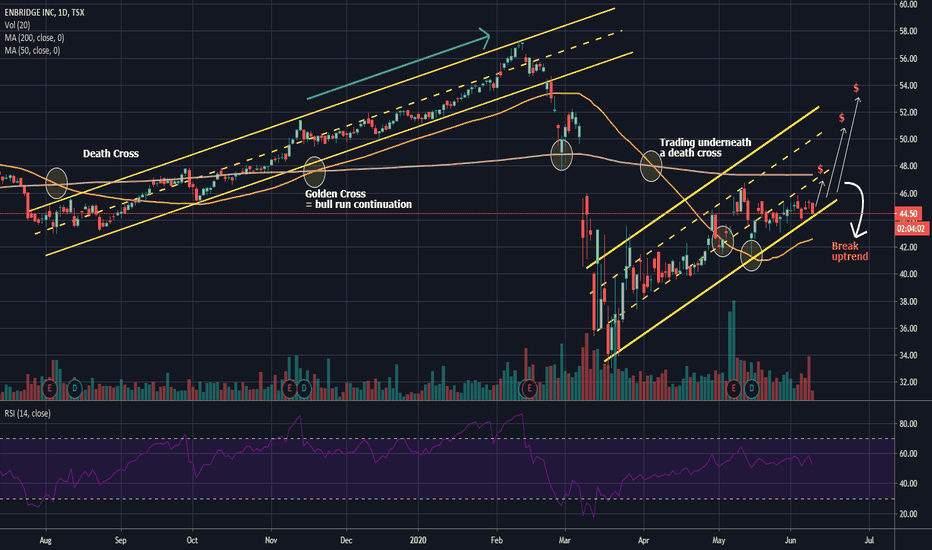

ENB stock has shown a resilient performance over the years, driven by its strong fundamentals and operational efficiency. The stock is often viewed as a stable investment due to its consistent dividend payments and strategic growth initiatives.

Historical Stock Performance

Over the past five years, ENB stock has experienced fluctuations typical of the energy sector. However, its long-term trend has been upward, supported by the company’s ongoing investments in infrastructure and renewable energy.

4. Dividends and Returns

One of the most appealing aspects of ENB stock is its robust dividend policy. Enbridge has a history of paying dividends consistently, making it an attractive option for income-focused investors.

Dividend History

- Enbridge has increased its dividend for 26 consecutive years.

- The company aims to grow dividends by 5-7% annually.

- Dividend payments are made quarterly, providing regular income to shareholders.

5. Market Factors Influencing ENB Stock

Several external factors can influence the performance of ENB stock. Understanding these factors is crucial for making informed investment decisions.

Key Influencing Factors

- **Global Oil Prices:** Fluctuations in crude oil prices directly impact Enbridge’s revenue.

- **Regulatory Environment:** Changes in energy regulations can affect operational capabilities.

- **Economic Conditions:** Economic growth or recession can influence energy demand.

- **Technological Advances:** Innovations in energy technology can create new opportunities for growth.

6. Investment Strategy for ENB Stock

Investing in ENB stock can be a strategic choice, especially for those looking for stable returns. Here are some strategies to consider:

Strategic Approaches

- **Long-Term Investment:** Consider holding ENB stock for the long term to benefit from dividend growth.

- **Diversification:** Include ENB stock in a diversified portfolio to mitigate risks.

- **Regular Monitoring:** Keep an eye on market trends and company performance to make timely decisions.

7. Future Outlook for ENB Stock

The future outlook for ENB stock appears promising, with the company focusing on sustainability and renewable energy projects. Enbridge's commitment to reducing carbon emissions and investing in green energy sources aligns with global trends towards decarbonization.

Predictions for Growth

- Analysts predict steady growth in revenue driven by infrastructure projects.

- The demand for natural gas and renewable energy is expected to rise, benefiting Enbridge.

- Strategic acquisitions could enhance market position and revenue streams.

8. Conclusion

In conclusion, ENB stock offers a compelling investment opportunity for those interested in the energy sector. With its strong dividend history, solid performance, and strategic outlook, Enbridge Inc. stands out as a reliable choice for investors. As always, it is essential to conduct thorough research and consider market conditions before making investment decisions.

We encourage you to leave your comments or questions below, share this article with fellow investors, and explore more insightful articles on our website.

Thank you for taking the time to learn about ENB stock. We hope you found this guide informative and valuable for your investment journey.

Understanding MSFT Dividend: A Comprehensive Guide For Investors

All About Viking Football: History, Achievements, And Future Prospects

Is Ray Liotta Dead? A Comprehensive Look At The Life And Legacy Of The Iconic Actor