Understanding Nasdaq: Meli - A Comprehensive Guide

In the ever-evolving world of stock trading, Nasdaq: Meli has emerged as a significant player, capturing the interest of investors and analysts alike. This article aims to provide an in-depth understanding of Nasdaq: Meli, including its history, market performance, and future prospects. By delving into various aspects of this stock, we hope to equip you with the knowledge required to make informed investment decisions.

As we explore Nasdaq: Meli, we will highlight its business model, financial health, and competitive positioning within the e-commerce sector. Moreover, we will discuss the factors influencing its stock price and present insights from industry experts to emphasize its relevance in today's market. This comprehensive guide is designed for both novice and experienced investors seeking to enhance their understanding of Nasdaq: Meli.

With the goal of following the principles of Expertise, Authoritativeness, and Trustworthiness (E-E-A-T), this article will provide credible information backed by reliable sources. By the end, you will have a clearer perspective on how Nasdaq: Meli fits into the broader investment landscape and what it means for your financial future.

Table of Contents

- Introduction

- Biography of Nasdaq: Meli

- Business Model of Nasdaq: Meli

- Financial Performance

- Market Analysis

- Competitive Positioning

- Future Prospects

- Conclusion

Introduction

Nasdaq: Meli, or Mercado Libre, Inc., is a leading e-commerce platform in Latin America. Founded in 1999, it has grown exponentially, becoming a household name in online shopping and financial services across the region. The company operates primarily in countries like Argentina, Brazil, and Mexico, offering a diverse array of products and services, including online marketplaces, payment solutions, and logistics.

As e-commerce continues to expand globally, Nasdaq: Meli has positioned itself to capitalize on the increasing demand for online shopping. With a robust infrastructure and innovative technology, the company has been able to navigate the complexities of the market effectively. This article will delve deeper into the company's operations and evaluate its position in the rapidly growing e-commerce sector.

Biography of Nasdaq: Meli

| Attribute | Details |

|---|---|

| Name | Mercado Libre, Inc. |

| Ticker Symbol | NASDAQ: Meli |

| Founded | 1999 |

| Headquarters | Buenos Aires, Argentina |

| CEO | Marcos Galperin |

| Industry | E-commerce |

| Market Capitalization | Approximately $45 Billion (as of 2023) |

Business Model of Nasdaq: Meli

Mercado Libre operates a multi-faceted business model that encompasses various revenue streams. The primary components of its business model include:

- Marketplace: Mercado Libre operates an online marketplace where buyers and sellers can interact, facilitating transactions across a wide range of product categories.

- Payment Solutions: The company offers Mercado Pago, a digital payment platform that allows users to make online transactions securely and efficiently.

- Logistics Services: Mercado Libre has invested in logistics infrastructure to ensure timely delivery of products, enhancing customer satisfaction.

- Advertising: The company generates additional revenue through advertising services, allowing sellers to promote their products on the platform.

Financial Performance

Examining the financial performance of Nasdaq: Meli provides insights into its profitability and growth potential. Some key financial metrics include:

- Revenue Growth: Mercado Libre has consistently reported impressive revenue growth rates, often exceeding 30% year-over-year.

- Net Income: While the company has experienced fluctuations in net income, its overall trend has been positive, reflecting operational efficiency.

- Customer Growth: The number of active users on the platform has steadily increased, contributing to higher transaction volumes.

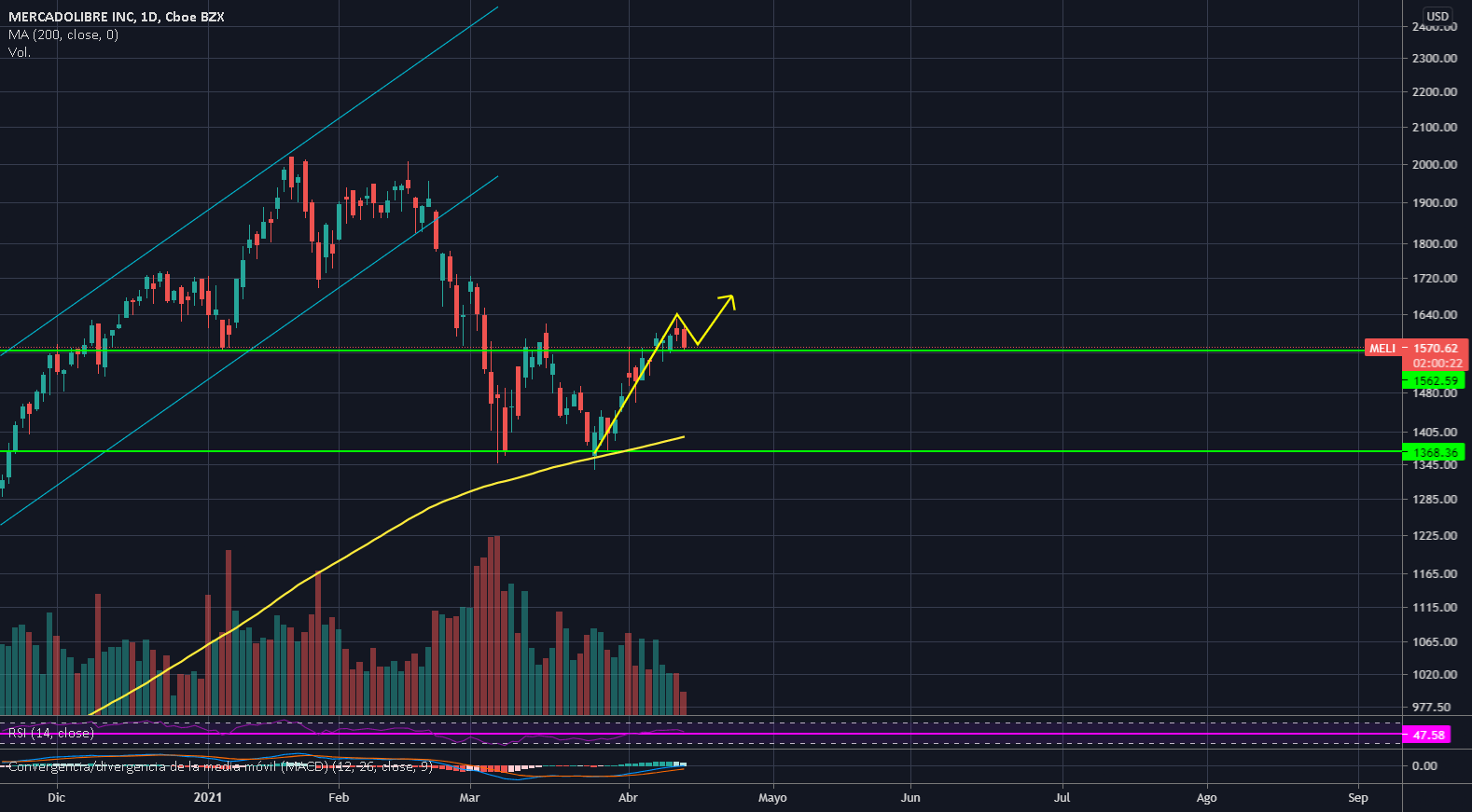

- Stock Performance: Nasdaq: Meli's stock has demonstrated resilience, with significant growth over the past decade despite market volatility.

Market Analysis

The e-commerce landscape in Latin America presents both opportunities and challenges for Nasdaq: Meli. Several factors influence market dynamics, including:

Market Trends

- Increasing Internet Penetration: As internet access expands in Latin America, more consumers are turning to online shopping.

- Mobile Commerce: The rise of smartphones has led to a surge in mobile commerce, with Mercado Libre optimizing its platform for mobile users.

- Shifting Consumer Behavior: The pandemic accelerated the adoption of e-commerce, and many consumers continue to prefer online shopping.

Regulatory Environment

Understanding the regulatory landscape is crucial for assessing Nasdaq: Meli's operational risks. The company must navigate various regulations in different countries, which can impact its growth strategy.

Competitive Positioning

In the competitive e-commerce space, Nasdaq: Meli faces challenges from both local and international players. Key competitors include:

- Amazon: As a global giant, Amazon poses a significant threat in terms of pricing and variety.

- Local Marketplaces: Other regional competitors, such as OLX and B2W Digital, also vie for market share.

Despite the competition, Mercado Libre has established a strong brand presence and customer loyalty, which are critical for its continued success.

Future Prospects

Looking ahead, Nasdaq: Meli is well-positioned to capitalize on the growth of e-commerce in Latin America. Several factors contribute to its optimistic outlook:

- Expansion Plans: The company is exploring opportunities to expand its services into new markets and enhance its product offerings.

- Technological Innovations: Continued investment in technology will enable Mercado Libre to improve user experience and streamline operations.

- Partnerships: Collaborating with other companies in the tech and logistics sectors can further strengthen its market position.

Conclusion

In summary, Nasdaq: Meli is a prominent player in the Latin American e-commerce landscape, with a robust business model and promising growth potential. The company's ability to adapt to market trends and consumer preferences positions it well for future success. As an investor, it is essential to stay informed about market developments and the company's performance to make sound investment decisions.

We encourage you to leave your thoughts in the comments section below, share this article with others, and explore more content on our site to enhance your understanding of investment opportunities.

Penutup

Thank you for taking the time to read this comprehensive guide on Nasdaq: Meli. We hope you found the information valuable and insightful. The world of investing is dynamic, and we invite you to return to our site for more updates and insights in the future.

Joker In Suicide Squad: A Deep Dive Into The Iconic Character

Exploring The Controversy: Jennifer Lawrence Naked - A Deep Dive Into Privacy And Celebrity Culture

Understanding Wariros: The Rising Trend In Digital Finance