TurboTax Free: A Comprehensive Guide To Filing Your Taxes For Free

TurboTax Free is an invaluable resource for individuals seeking to file their taxes without incurring any costs. In today’s financial landscape, understanding how to navigate tax filing is essential, especially with the various options available, including TurboTax Free. This article will provide a detailed overview of TurboTax Free, exploring its features, eligibility requirements, and tips for maximizing your tax refund while ensuring compliance with tax regulations.

As tax season approaches, many individuals find themselves looking for ways to minimize expenses while ensuring they are filing accurately. TurboTax Free offers a user-friendly platform that allows users to file simple tax returns without paying for premium services. Whether you're a student, a recent graduate, or someone with straightforward tax needs, TurboTax Free can be a great option to consider.

This guide will delve into the ins and outs of TurboTax Free, including how to get started, the benefits it offers, and common questions users have. By the end of this article, you’ll have a comprehensive understanding of TurboTax Free and how you can leverage it to file your taxes efficiently and accurately.

Table of Contents

- What is TurboTax Free?

- Eligibility Requirements for TurboTax Free

- Key Features of TurboTax Free

- Step-by-Step Guide to Using TurboTax Free

- Common Questions About TurboTax Free

- Tips for Maximizing Your Refund with TurboTax Free

- Pros and Cons of Using TurboTax Free

- Conclusion

What is TurboTax Free?

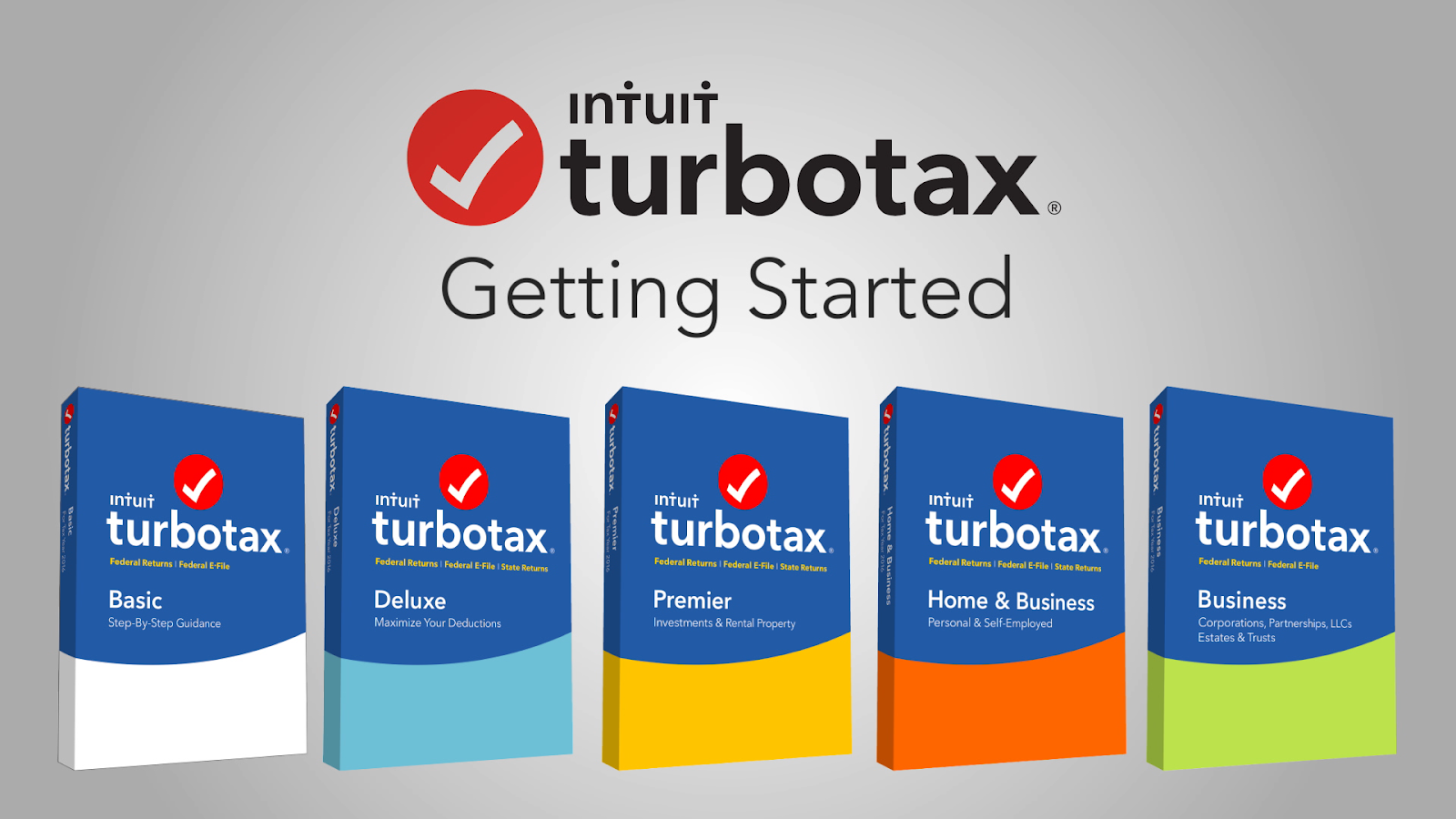

TurboTax Free is a tax filing option provided by Intuit, designed specifically for individuals with simple tax situations. This service allows users to file their federal tax returns at no cost, making it an attractive choice for those who meet the eligibility criteria. TurboTax Free is particularly well-suited for individuals who are filing their taxes for the first time or those who have straightforward income sources, such as wages from employment or interest from bank accounts.

Overview of TurboTax Free

TurboTax Free is part of a broader suite of TurboTax products, which cater to a variety of tax situations. The free version is limited to basic tax returns, but it provides users with access to essential features, including:

- Step-by-step guidance throughout the filing process

- Free federal tax filing

- Access to the TurboTax mobile app for on-the-go filing

- Real-time refund tracking

- Simple interface that is easy to navigate

Eligibility Requirements for TurboTax Free

To take advantage of TurboTax Free, users must meet specific eligibility requirements. These criteria are designed to ensure that the service is beneficial for those with straightforward tax situations. Here are the primary requirements:

- Filing status must be single or married filing jointly.

- Adjusted Gross Income (AGI) must be $39,000 or less for single filers and $64,000 or less for married couples.

- Users should only report income from wages, salaries, tips, and limited interest or dividend income.

- Those claiming the Earned Income Tax Credit (EITC) or the American Opportunity Tax Credit (AOTC) are generally eligible.

Key Features of TurboTax Free

TurboTax Free is packed with features that streamline the tax filing process. Understanding these features can help users maximize their experience:

- User-Friendly Interface: The platform is designed to be intuitive, making it easy for users to navigate through the tax filing process.

- Step-by-Step Guidance: TurboTax Free provides users with guided prompts that simplify complex tax topics, ensuring accuracy and compliance.

- Mobile Access: The TurboTax app allows users to file taxes from their smartphones or tablets, offering flexibility for users on the go.

- Real-Time Refund Tracking: Users can track the status of their refunds in real-time, providing peace of mind as they await their tax returns.

Step-by-Step Guide to Using TurboTax Free

Filing your taxes using TurboTax Free can be a straightforward process if you follow these steps:

- Create an Account: Visit the TurboTax website and create a free account using your email address.

- Answer Questions: TurboTax will prompt you with a series of questions to determine your eligibility and gather necessary information.

- Input Income Information: Enter your income details, including W-2 forms and any other relevant income documentation.

- Claim Deductions and Credits: TurboTax will guide you through available deductions and credits based on your circumstances.

- Review and File: Once you’ve completed your return, review all information for accuracy before submitting.

Common Questions About TurboTax Free

Many users have questions about TurboTax Free. Here are answers to some of the most common inquiries:

Is TurboTax Free really free?

Yes, TurboTax Free allows users to file their federal tax returns without any fees, as long as they meet the eligibility requirements.

What if I have more complex tax needs?

If your tax situation is more complex, you may need to consider other TurboTax products, such as TurboTax Deluxe or Premier, which offer additional features and support for more complicated tax scenarios.

Tips for Maximizing Your Refund with TurboTax Free

To ensure you get the most out of your TurboTax Free experience, consider the following tips:

- Gather all necessary documents before you start, including W-2s, 1099s, and any other income statements.

- Take advantage of all eligible deductions and credits, such as the Earned Income Tax Credit or education credits.

- Review your return carefully to ensure no errors that could delay your refund.

Pros and Cons of Using TurboTax Free

Like any tax filing option, TurboTax Free has its advantages and disadvantages. Here’s a breakdown:

Pros:

- Completely free for eligible users

- User-friendly interface

- Step-by-step guidance throughout the filing process

Cons:

- Limited to simple tax returns

- Additional fees for more complex situations or state filing

Conclusion

TurboTax Free is an excellent option for individuals looking to file their taxes without incurring costs, provided they meet the eligibility requirements. With its user-friendly interface, step-by-step guidance, and mobile access, TurboTax Free makes tax filing accessible to many. By following the tips outlined in this article, you can maximize your refund and ensure compliance with tax regulations. If you have any questions or want to share your experiences, feel free to leave a comment below or share this article with others who may benefit from it.

Final Thoughts

As tax season approaches, consider utilizing TurboTax Free for your filing needs. With the right information and preparation, you can navigate the tax process with confidence and ease. We encourage you to explore the platform and see how it can work for you. Thank you for reading, and we hope to see you again soon!

Ammika Harris: A Glimpse Into The Life Of Chris Brown’s Partner

Kaitlin Doubleday: A Comprehensive Look At The Actress And Her Career

Understanding NYSE NU: A Comprehensive Guide To New York Stock Exchange's Nu Holdings Ltd.