Understanding Stock Splits In 2024: A Comprehensive Guide

As we move into 2024, stock splits have become a hot topic among investors and analysts alike. Stock splits are corporate actions that affect the shares of a company, often leading to increased liquidity and a more manageable share price. In this article, we will delve deep into the concept of stock splits, their implications, and what investors should know to navigate this financial strategy effectively.

The financial landscape is ever-evolving, and stock splits can significantly influence market dynamics. They can make shares more accessible to a broader range of investors, potentially driving demand and therefore, impacting stock prices. However, understanding the mechanics and rationale behind stock splits is crucial for making informed investment decisions. This article aims to clarify what stock splits entail, their benefits and drawbacks, and the notable stock splits to watch in 2024.

Whether you are a seasoned investor or a novice looking to understand the stock market better, this guide will provide you with valuable insights into stock splits. By the end of this article, you will have a solid understanding of how stock splits work, the reasons companies implement them, and how they can affect your investment portfolio.

Table of Contents

- What Are Stock Splits?

- Types of Stock Splits

- Reasons for Stock Splits

- Impact on Shareholders

- Notable Stock Splits in 2024

- How to Invest in Splitting Stocks

- Considerations for Investors

- Conclusion

What Are Stock Splits?

Stock splits occur when a company divides its existing shares into multiple new shares to increase the number of shares outstanding. This is typically done in a specific ratio, such as a 2-for-1 or 3-for-1 split. For instance, in a 2-for-1 stock split, a shareholder who owns one share will now have two shares, but the overall value of their investment remains the same.

**Key Points to Note:**

- Stock splits do not change the overall market capitalization of the company.

- The price per share decreases proportionally based on the split ratio.

- Shareholders end up with more shares, but their total investment value remains unchanged.

Types of Stock Splits

There are primarily two types of stock splits that companies may choose to implement:

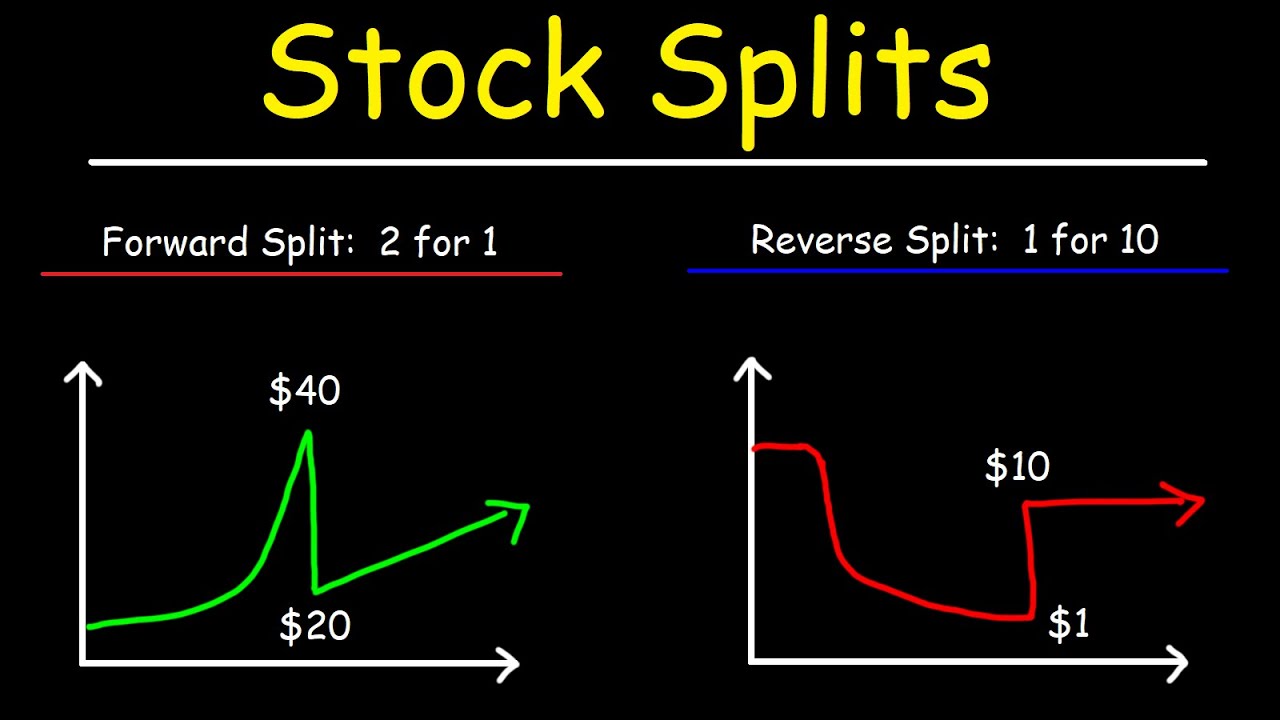

Forward Stock Split

A forward stock split increases the number of shares and typically reduces the price per share. Companies might choose a forward split to make their shares more affordable and boost liquidity.

Reverse Stock Split

A reverse stock split consolidates the number of existing shares into fewer ones, effectively increasing the share price. Companies may pursue a reverse split to avoid delisting from stock exchanges or to improve their market image.

Reasons for Stock Splits

Companies opt for stock splits for various strategic reasons, including:

- Improving Liquidity: Lower share prices can attract more investors, increasing trading volume.

- Making Shares More Affordable: A lower price per share can make it easier for retail investors to buy shares.

- Enhancing Market Perception: A company may want to maintain a certain stock price range to convey stability and growth potential.

Impact on Shareholders

For existing shareholders, the immediate impact of a stock split is neutral in terms of total value. However, the psychological effects can lead to increased investor interest and potential price appreciation post-split. Here are some considerations:

- **Increased Visibility:** More shares available can lead to higher trading volumes and increased visibility on the market.

- **Potential for Price Growth:** If the split generates positive market sentiment, the stock price may rise over time.

Notable Stock Splits in 2024

As we look ahead to 2024, several companies are expected to announce stock splits. Keeping an eye on these announcements can be vital for investors:

- Company A: Anticipated 5-for-1 split.

- Company B: Possible 3-for-2 split.

- Company C: Expected reverse split to maintain listing.

How to Invest in Splitting Stocks

Investing in stocks that are about to split requires careful analysis and strategy:

- **Research the Company:** Understand the company's financial health and growth potential.

- **Monitor Market Trends:** Pay attention to industry trends and how similar companies have performed post-split.

- **Set Investment Goals:** Determine your investment horizon and risk tolerance before buying into splitting stocks.

Considerations for Investors

Before making investment decisions regarding stock splits, consider the following:

- **Market Sentiment:** Stock splits can influence investor perception; monitor public sentiment.

- **Long-term vs. Short-term:** Assess whether you are looking for long-term growth or short-term gains.

- **Diversification:** Don’t put all your eggs in one basket; diversify your portfolio to mitigate risks.

Conclusion

In summary, stock splits are a significant corporate action that can influence market dynamics and investor behavior. As we enter 2024, understanding the mechanics of stock splits, their implications, and the upcoming splits can empower investors to make informed decisions. We encourage you to share your thoughts in the comments below or explore more articles on our site to deepen your investment knowledge.

Thank you for reading, and we hope to see you back for more insightful financial content!

Taylor Swift Doll: A Comprehensive Guide To Collecting And Understanding This Iconic Merchandise

Price Of Costco Stock Today: An In-Depth Analysis And Insights

Lacey Evans: The Rising Star Of Professional Wrestling