Understanding HYG Stock: A Comprehensive Guide To High Yield Corporate Bonds

HYG stock is a popular investment choice among those looking to diversify their portfolios with high-yield corporate bonds. As investors seek higher returns in a low-interest-rate environment, understanding the intricacies of HYG stock becomes essential. This article delves into the details of HYG stock, its performance, and its place in the investment landscape.

The iShares iBoxx $ High Yield Corporate Bond ETF, commonly referred to as HYG, provides exposure to a broad range of high-yield corporate bonds. These bonds are typically issued by companies with lower credit ratings, which means they offer higher yields to compensate investors for the increased risk. In this article, we will explore the fundamentals of HYG stock, its historical performance, and the factors influencing its value.

In addition to providing insights into HYG stock, we will also discuss its risks and benefits, making it a valuable resource for both novice and seasoned investors. Whether you're considering adding HYG stock to your investment portfolio or simply seeking to understand it better, this comprehensive guide will equip you with the knowledge you need.

Table of Contents

- What is HYG Stock?

- HYG Stock Biography

- HYG Stock Data

- Performance of HYG Stock

- Risks and Benefits of HYG Stock

- Investing in HYG Stock

- Market Factors Influencing HYG Stock

- Conclusion

What is HYG Stock?

HYG stock represents shares in the iShares iBoxx $ High Yield Corporate Bond ETF, which is designed to track the performance of the iBoxx $ Liquid High Yield Index. This index consists of U.S. dollar-denominated, high-yield corporate bonds issued by companies that are considered to be below investment grade.

Investors are attracted to HYG stock because it offers exposure to a diversified portfolio of high-yield bonds, which can provide attractive returns compared to traditional fixed-income investments. However, it is essential to understand the risks associated with investing in high-yield bonds, including credit risk, interest rate risk, and liquidity risk.

HYG Stock Biography

The HYG ETF was launched on April 4, 2007, by BlackRock, one of the world's leading asset management firms. Since its inception, HYG has grown significantly in assets under management, becoming one of the most popular high-yield bond ETFs on the market. The fund aims to provide investors with a cost-effective way to gain exposure to the high-yield corporate bond market.

Key Facts about HYG Stock:

| Attribute | Details |

|---|---|

| Fund Manager | BlackRock |

| Inception Date | April 4, 2007 |

| Expense Ratio | 0.49% |

| Assets Under Management | Over $15 billion |

Performance of HYG Stock

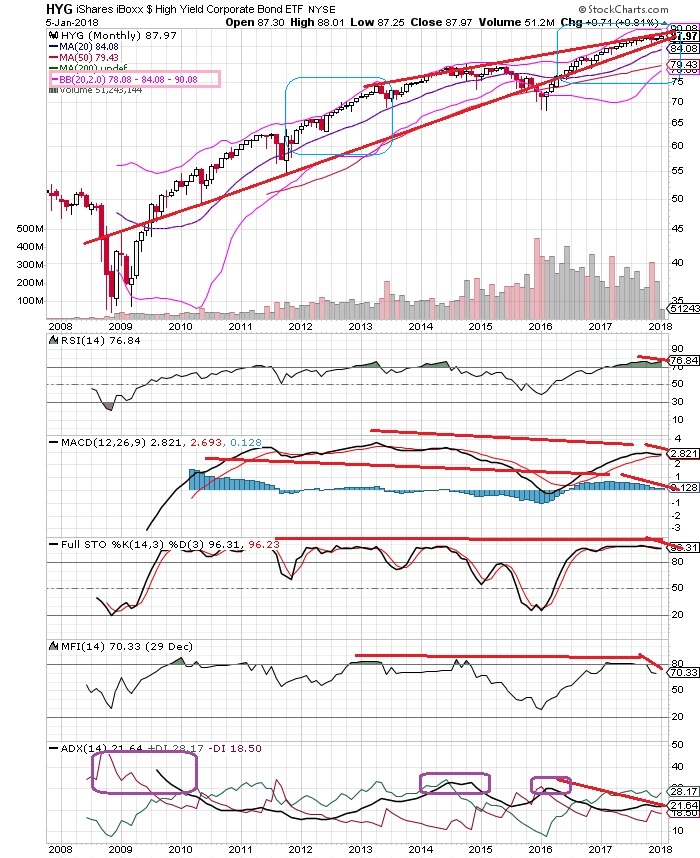

The performance of HYG stock can be influenced by various factors, including changes in interest rates, credit spreads, and overall market conditions. Historically, HYG has provided attractive yields, but it is crucial to analyze its performance in the context of broader market trends.

Historical Performance:

- In 2020, HYG experienced volatility due to the COVID-19 pandemic, with a significant drop in value followed by a recovery.

- The average annual return of HYG over the past decade has been approximately 5-6%, depending on market conditions.

- HYG's yield has typically ranged from 4% to 7%, making it an appealing option for income-seeking investors.

Risks and Benefits of HYG Stock

Before investing in HYG stock, it is essential to weigh the risks and benefits associated with high-yield corporate bonds.

Benefits:

- High Yields: HYG stock offers higher yields compared to investment-grade bonds, making it attractive for income-focused investors.

- Diversification: The ETF provides exposure to a diversified portfolio of bonds, reducing individual bond risk.

- Liquidity: As an ETF, HYG stock can be bought and sold throughout the trading day, providing liquidity to investors.

Risks:

- Credit Risk: The underlying bonds may be issued by companies with lower credit ratings, increasing the risk of default.

- Interest Rate Risk: Rising interest rates can lead to a decline in bond prices, impacting the value of HYG stock.

- Market Volatility: HYG stock can be affected by market sentiment and economic conditions, leading to price fluctuations.

Investing in HYG Stock

Investing in HYG stock can be a suitable option for those looking to enhance their portfolio's yield. However, it is essential to consider individual investment goals and risk tolerance before making a decision.

Tips for Investing in HYG Stock:

- Assess your risk tolerance and investment objectives before investing in high-yield bonds.

- Consider using HYG stock as a part of a diversified portfolio to mitigate risk.

- Stay informed about market trends and economic indicators that may impact the performance of high-yield bonds.

Market Factors Influencing HYG Stock

Several market factors can influence the performance of HYG stock. Understanding these factors can help investors make informed decisions.

- Interest Rates: Changes in interest rates can significantly affect the bond market. Rising rates typically lead to lower bond prices.

- Economic Conditions: The overall health of the economy plays a crucial role in the performance of high-yield corporate bonds.

- Credit Spreads: The difference between yields on high-yield bonds and investment-grade bonds can impact HYG stock's performance.

Conclusion

In summary, HYG stock is an attractive option for investors seeking high yields through exposure to high-yield corporate bonds. While it offers several benefits, including diversification and liquidity, it is essential to consider the associated risks. By understanding the fundamentals of HYG stock and the factors influencing its performance, investors can make informed decisions that align with their financial goals.

We encourage you to leave your thoughts in the comments below or share this article with others interested in investing in HYG stock. For more insightful articles, feel free to explore our website.

Final Thoughts

Thank you for reading this comprehensive guide on HYG stock. We hope you found it informative and helpful in your investment journey. Remember, staying informed is key to successful investing, and we look forward to having you back for more valuable insights.

Understanding CAG: The Stock Performance And Market Insights Of Conagra Brands

Meghan Markle's Father Thomas Markle Wants To Meet His Grandchildren

Dean Wade Stats: A Comprehensive Analysis Of His Basketball Career