Understanding Adani Enterprises Share Price: A Comprehensive Guide

Adani Enterprises share price has been a topic of considerable interest among investors and market analysts. As a leading player in various sectors, including energy, resources, logistics, agribusiness, real estate, financial services, and defense, Adani Enterprises is pivotal in shaping the Indian economy. This article delves into the intricacies of Adani Enterprises’ share price, exploring its historical performance, current trends, and future outlook.

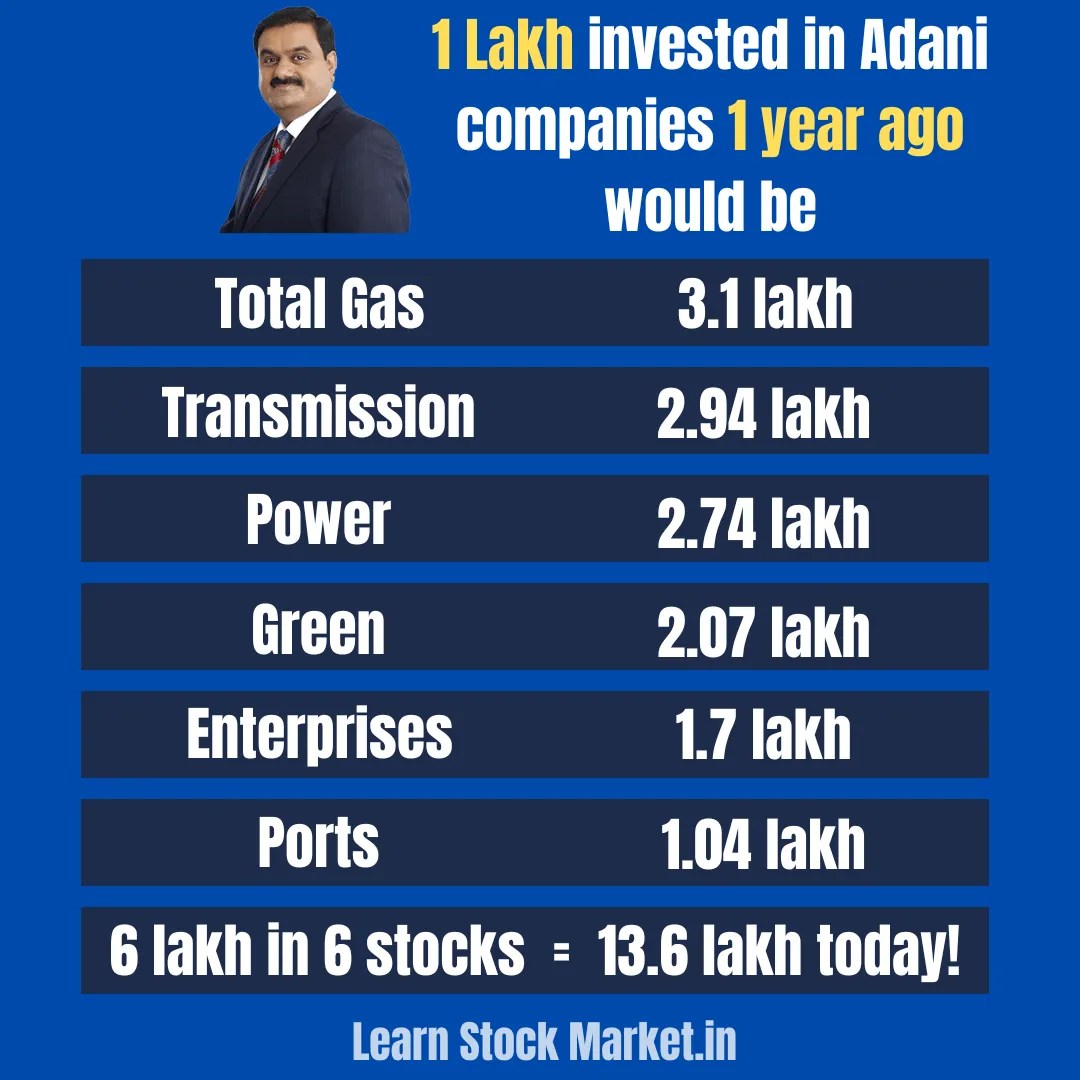

In recent years, the stock has shown significant volatility, prompting both seasoned investors and new traders to seek clarity on its movements. With the rise of the Adani Group as a formidable conglomerate, understanding the factors influencing the share price of Adani Enterprises is crucial for making informed investment decisions. This guide aims to provide a detailed analysis of the share price, backed by data and expert insights.

This comprehensive article will cover a range of topics, including the company's background, market performance, expert opinions, and future forecasts. By the end of this article, readers will have a clearer understanding of how to navigate the Adani Enterprises share price landscape.

Table of Contents

- 1. Company Overview

- 2. Historical Share Price Trends

- 3. Current Market Performance

- 4. Factors Influencing Share Price

- 5. Expert Analysis

- 6. Future Predictions

- 7. Investment Considerations

- 8. Conclusion

1. Company Overview

Adani Enterprises Limited, part of the Adani Group, is a diversified multinational company based in India. Founded in 1988 by Gautam Adani, the company initially focused on trading commodities and has since expanded into various sectors. As of now, Adani Enterprises is involved in:

- Energy generation and transmission

- Mining and resources

- Logistics and transportation

- Agribusiness

- Real estate development

- Defense manufacturing

With a mission to create sustainable solutions and drive economic growth, Adani Enterprises has become one of the largest players in the Indian market. The company is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), providing investors with ample opportunities to engage with its shares.

Company Data and Profile

| Detail | Information |

|---|---|

| Founded | 1988 |

| Founder | Gautam Adani |

| Headquarters | Ahmedabad, India |

| Stock Symbol | ADANIENT |

| Industry | Conglomerate |

2. Historical Share Price Trends

To understand the current share price of Adani Enterprises, it is essential to look at its historical performance. The stock has seen significant fluctuations over the years, influenced by various internal and external factors. Below are some critical historical insights:

- In 2020, the share price saw a remarkable increase, driven by robust earnings and positive market sentiment.

- The stock peaked in early 2021, reaching an all-time high, primarily due to the growing interest in renewable energy ventures.

- Post-2021, the share price experienced volatility, with occasional dips linked to market corrections and regulatory scrutiny.

Investors should consider these historical trends when evaluating the potential future performance of Adani Enterprises shares.

3. Current Market Performance

As of the latest trading sessions, the share price of Adani Enterprises has shown signs of recovery after a period of decline. The stock is closely monitored by investors due to its performance on major exchanges:

- Current share price: [Insert current price]

- Market capitalization: [Insert market cap]

- 52-week high: [Insert high]

- 52-week low: [Insert low]

This performance is indicative of the company's resilience and the market's confidence in its growth trajectory.

4. Factors Influencing Share Price

The share price of Adani Enterprises is influenced by various factors, including:

4.1 Economic Indicators

Macroeconomic factors such as GDP growth, inflation rates, and currency fluctuations can significantly impact share prices. A growing economy typically boosts investor confidence, leading to higher share prices.

4.2 Industry Trends

The performance of the sectors in which Adani Enterprises operates can also affect its share price. For instance, developments in renewable energy and logistics can have a direct impact on the company's valuation.

4.3 Regulatory Environment

Changes in government policies, regulations, and environmental laws can influence the operations and profitability of Adani Enterprises, thereby affecting its share price.

5. Expert Analysis

Market analysts and financial experts often provide insights into the future performance of Adani Enterprises shares. Here are some key takeaways from recent analyses:

- Analysts suggest that the company's diversification strategy is a significant strength, allowing it to mitigate risks associated with market fluctuations.

- Investment in renewable energy projects is expected to drive long-term growth, making the stock a favorable option for sustainable investors.

- However, analysts also caution about potential risks related to regulatory scrutiny and market volatility.

6. Future Predictions

Predicting the future share price of Adani Enterprises requires careful consideration of various factors. Current trends suggest that:

- Analysts forecast moderate growth in the coming years, driven by the company's investments in green energy.

- Short-term fluctuations are likely due to market volatility, but long-term prospects remain positive.

Investors are encouraged to keep abreast of market trends and news related to the company to make informed decisions.

7. Investment Considerations

Investing in Adani Enterprises shares can be an attractive option, but it is essential to consider the following:

- Assess your risk tolerance: Given the volatility in the stock price, investors should evaluate their risk appetite.

- Stay informed: Regularly review market news, company announcements, and economic indicators that may impact share prices.

- Diversify your portfolio: To mitigate risks, consider diversifying your investments across different sectors.

8. Conclusion

In conclusion, understanding the Adani Enterprises share price is crucial for investors looking to navigate the complexities of the stock market. By analyzing historical trends, current performance, and expert insights, investors can make more informed decisions. While the share price has experienced fluctuations, the company's diverse portfolio and focus on sustainable growth present promising opportunities for the future.

We encourage you to share your thoughts in the comments below and explore more articles on our site for further insights into investment strategies and market analysis.

Penutup

Thank you for taking the time to read this comprehensive guide on Adani Enterprises share price. We hope you found it informative and engaging. Be sure to return to our site for more articles and updates that can help enhance your investment knowledge and strategies.

Understanding Bronny James And The Heart Attack Concerns

Kevin McCall: The Multifaceted Artist And Influencer

Luke Combs: The Kind Of Love We Make - A Deep Dive Into His Heartfelt Ballad