Understanding Reverse Stock Split: An In-Depth Guide

In the world of finance and investing, the term "reverse stock split" often raises questions among investors and market participants. This financial maneuver can have significant implications for a company's stock price and investor perception. In this article, we will explore what a reverse stock split is, how it works, and its potential effects on investors and the market. We will also discuss the reasons companies opt for this strategy and provide insights into when it may be beneficial or detrimental.

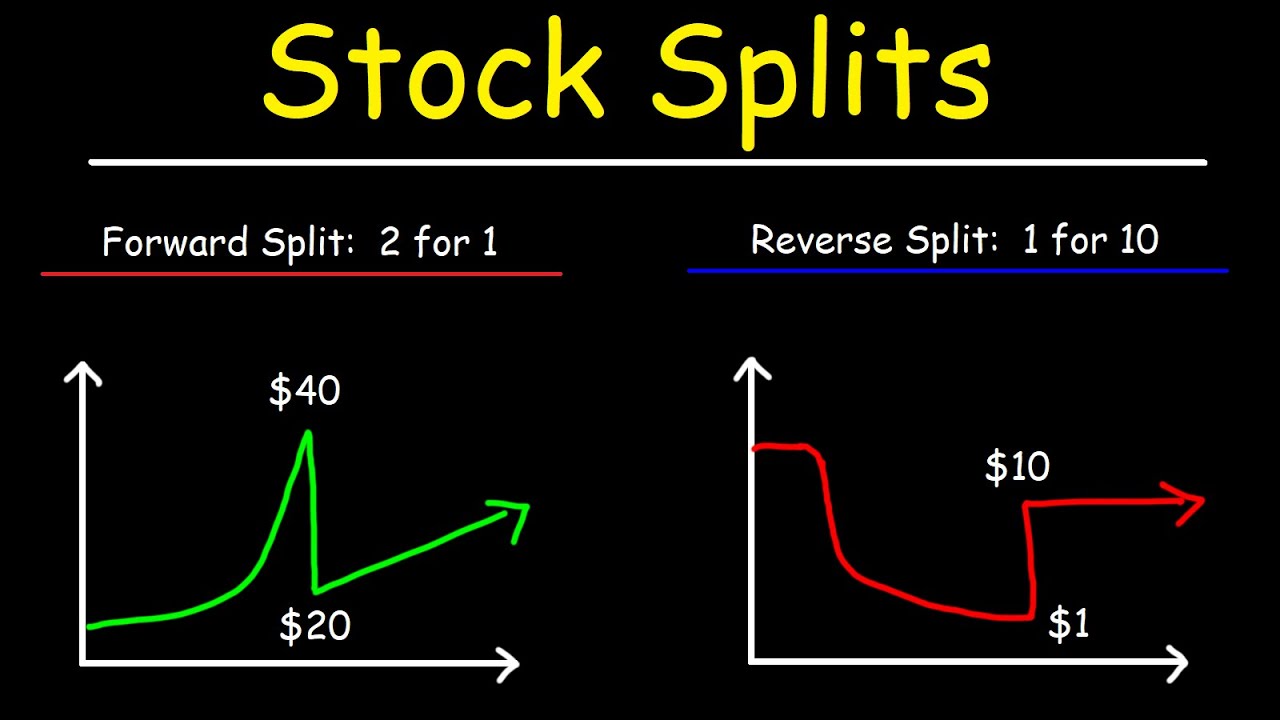

A reverse stock split occurs when a company reduces the number of its outstanding shares, leading to an increase in the share price. For example, in a 1-for-10 reverse stock split, every ten shares owned by shareholders are consolidated into one share. While the total market value of the company remains the same, the share price increases proportionally. This article will delve into the nuances of reverse stock splits, offering expert insights and data to help you understand this financial concept better.

Whether you are an experienced investor or just starting, understanding reverse stock splits is crucial for making informed decisions in your investment journey. We will provide an overview of the mechanics behind this practice, its impact on shareholder value, and real-world examples to illustrate its effects.

Table of Contents

- What is Reverse Stock Split?

- Mechanics of Reverse Stock Split

- Reasons for Reverse Stock Split

- Impact on Shareholders

- Real-World Examples of Reverse Stock Splits

- Pros and Cons of Reverse Stock Splits

- Investor Considerations

- Conclusion

What is Reverse Stock Split?

A reverse stock split is a corporate action that consolidates the number of existing shares of a company into fewer shares. This is typically done to increase the trading price of the shares. For example, if a company has 1,000,000 shares outstanding at $1 per share, a 1-for-10 reverse stock split would result in 100,000 shares outstanding at $10 per share.

Key Characteristics

- The overall market capitalization remains unchanged.

- Shareholder ownership is proportionally adjusted.

- Companies often pursue reverse stock splits to comply with stock exchange listing requirements.

Mechanics of Reverse Stock Split

The mechanics of a reverse stock split are relatively straightforward. Here’s how it typically works:

- The company announces the reverse stock split ratio (e.g., 1-for-5).

- On the effective date, shareholders receive new shares based on the split ratio.

- Old shares are replaced by new shares in the shareholder's account.

- The company's total outstanding shares decrease, while the share price increases proportionately.

For example, if you owned 100 shares of a company at $2 per share before a 1-for-5 reverse stock split, you would own 20 shares at $10 per share after the split.

Reasons for Reverse Stock Split

Companies undertake reverse stock splits for several reasons, including:

- Improve Stock Price: A higher stock price can make a company more attractive to institutional investors.

- Maintain Exchange Listing: Stock exchanges often have minimum price requirements, and reverse splits can help companies meet these thresholds.

- Enhance Perception: A higher stock price may improve the company's perception in the marketplace.

Impact on Shareholders

The impact of a reverse stock split on shareholders can vary widely. Here are some potential effects:

- Value Preservation: The market capitalization remains unchanged, meaning shareholders do not lose value immediately.

- Market Sentiment: Reverse splits can signal financial distress, potentially leading to negative sentiment among investors.

- Liquidity Changes: The reduced number of shares can affect the stock's liquidity.

Real-World Examples of Reverse Stock Splits

Several notable companies have conducted reverse stock splits. Here are a few examples to illustrate:

1. Citigroup Inc.

Citigroup executed a 1-for-10 reverse stock split in 2011 to boost its stock price after facing significant declines during the financial crisis.

2. Nasdaq-listed Companies

Many companies on the Nasdaq exchange have opted for reverse splits to maintain compliance with listing requirements when their share prices fell below the minimum threshold.

Pros and Cons of Reverse Stock Splits

Like any financial decision, reverse stock splits come with their advantages and disadvantages:

Pros

- Improves stock price, potentially attracting more investors.

- Helps maintain compliance with stock exchange listing rules.

- Can enhance the company's market reputation.

Cons

- May signal financial distress to investors.

- Could lead to decreased liquidity and trading volume.

- Shareholder confusion and dissatisfaction.

Investor Considerations

Investors should consider several factors when evaluating a reverse stock split:

- Assess the company's overall financial health and motives behind the split.

- Monitor market reactions and sentiment post-split.

- Determine long-term potential versus short-term volatility.

Conclusion

In summary, a reverse stock split is a financial strategy that can have far-reaching effects on a company's stock price and investor perception. While it can help companies meet exchange listing requirements and attract institutional investors, it can also signal financial distress. Understanding the mechanics and implications of reverse stock splits is essential for making informed investment decisions. If you found this article helpful, feel free to leave a comment, share it with others, or explore related articles on our site.

We hope this article has provided you with valuable insights into reverse stock splits. Stay informed, and we look forward to welcoming you back for more financial knowledge!

Texas Rangers Vs Dodgers Match Player Stats: A Comprehensive Analysis

Best Penny Stocks 2024: Your Comprehensive Guide To Investing Wisely

Understanding Federal Retirees And Survivor Benefits: A Comprehensive Guide