Current 30 Year Fixed Mortgage Rates: What Homebuyers Need To Know

Understanding the current 30 year fixed mortgage rates is crucial for homebuyers looking to make informed decisions in today’s real estate market. With fluctuating interest rates and economic factors influencing the housing market, it's essential to stay updated on the latest trends in mortgage rates. This article aims to provide a comprehensive overview of current 30 year fixed mortgage rates, how they are determined, and what homebuyers can expect in the near future.

The mortgage landscape can be overwhelming, especially for first-time homebuyers. A 30 year fixed mortgage is one of the most popular options available, offering stability in monthly payments over an extended period. As interest rates change, understanding their implications can significantly affect a buyer's purchasing power and overall financial strategy.

In this article, we will delve into the current rates, explore the factors affecting mortgage rates, and provide insights on how to navigate the mortgage process. Whether you are a seasoned buyer or a first-time homeowner, this guide will equip you with the knowledge needed to make informed decisions regarding your mortgage options.

Table of Contents

- Current 30 Year Fixed Mortgage Rates

- Factors Affecting Mortgage Rates

- Historical Trends in Mortgage Rates

- How to Get the Best 30 Year Fixed Rate

- The Mortgage Application Process

- Understanding Points and Fees

- Benefits of a 30 Year Fixed Mortgage

- Conclusion

Current 30 Year Fixed Mortgage Rates

As of October 2023, the average 30 year fixed mortgage rate is approximately 7.03%, a slight increase from the previous month. These rates can vary based on several factors, including the lender, the borrower's credit score, and market conditions. Here are some current rates from leading mortgage lenders:

- Lender A: 6.95%

- Lender B: 7.10%

- Lender C: 7.05%

It’s important to note that these rates are averages and can fluctuate daily based on economic indicators and lender policies.

Factors Affecting Mortgage Rates

Several key factors influence mortgage rates, including:

- Inflation: As inflation rises, so do interest rates, as lenders need to compensate for the decreased purchasing power of money over time.

- Economic Growth: A growing economy typically leads to higher interest rates, as increased demand for loans pushes rates up.

- Federal Reserve Policies: The Federal Reserve's decisions regarding interest rates can have a significant impact on mortgage rates.

- Housing Market Conditions: Supply and demand dynamics in the housing market can influence mortgage rates as well.

Understanding Credit Scores

Your credit score plays a vital role in determining your mortgage rate. Generally, a higher credit score can lead to lower interest rates. Lenders often categorize credit scores as follows:

- Excellent: 740 and above

- Good: 700 - 739

- Fair: 620 - 699

- Poor: Below 620

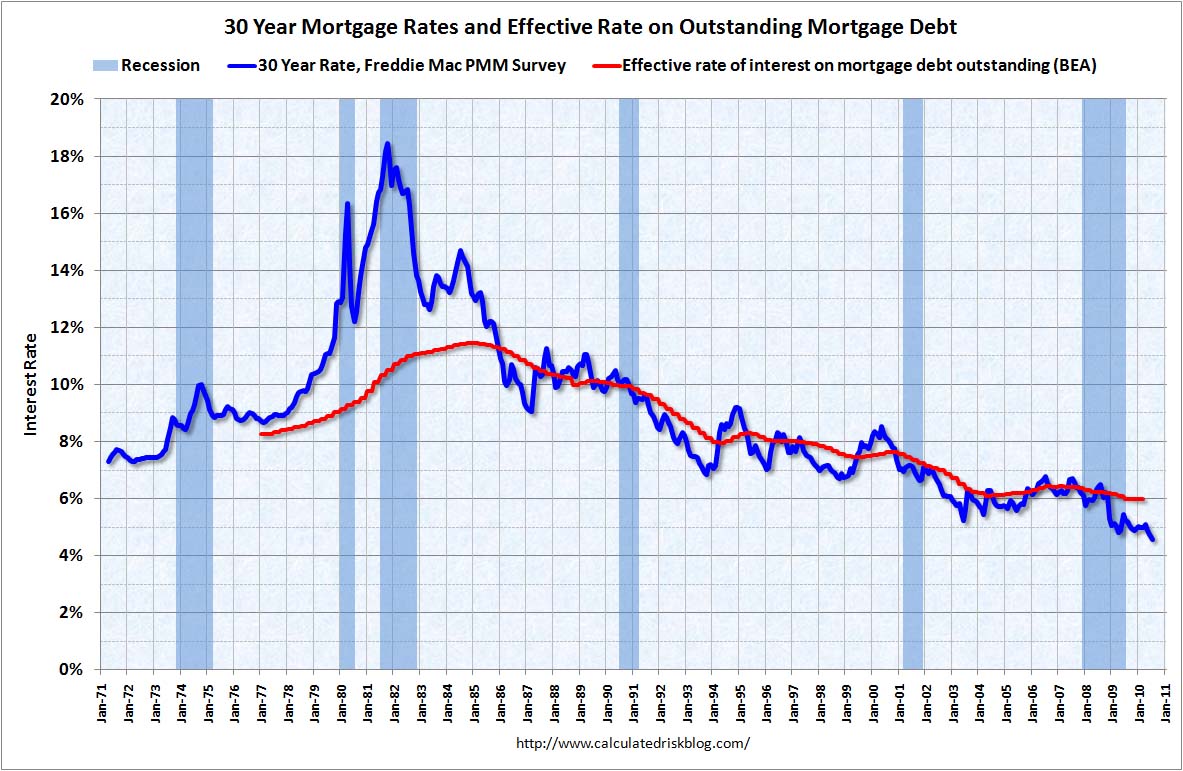

Historical Trends in Mortgage Rates

To fully understand current mortgage rates, it’s beneficial to look at historical trends. Over the past decade, mortgage rates have seen significant fluctuations:

- In 2012, the average rate was around 3.66%.

- By 2018, rates had risen to approximately 4.54%.

- In 2020, due to the COVID-19 pandemic, rates dropped to historic lows, reaching around 2.65%.

As of 2023, rates have begun to rise again, prompting potential homebuyers to reassess their purchasing strategies.

How to Get the Best 30 Year Fixed Rate

Securing the best mortgage rate requires careful planning and preparation. Here are some tips to help you achieve that:

- Improve Your Credit Score: Pay down debts, make payments on time, and check your credit report for errors.

- Shop Around: Get quotes from multiple lenders to compare rates and terms.

- Consider Points: Buying points can lower your interest rate, but ensure it makes financial sense for your situation.

- Lock in Your Rate: If you find a favorable rate, consider locking it in to protect against future increases.

The Mortgage Application Process

The mortgage application process can be complex, but understanding the steps can simplify your experience:

- Pre-Approval: Gather necessary documents and apply for pre-approval with a lender.

- House Hunting: Start looking for a home within your budget.

- Formal Application: Once you find a home, complete the formal mortgage application.

- Underwriting: The lender will review your application and assess your financial situation.

- Closing: Finalize the loan and complete all necessary paperwork.

Understanding Points and Fees

When obtaining a mortgage, you may encounter various points and fees:

- Origination Fees: Charged by lenders for processing the loan.

- Discount Points: Payments made to reduce the interest rate on the mortgage.

- Closing Costs: Fees associated with finalizing the mortgage, including appraisal and title fees.

Benefits of a 30 Year Fixed Mortgage

The 30 year fixed mortgage offers several advantages:

- Predictability: Fixed monthly payments make budgeting easier.

- Lower Monthly Payments: Compared to shorter-term loans, monthly payments are typically lower.

- Longer Time Frame: A longer repayment period allows for more flexibility in finances.

Conclusion

In conclusion, understanding current 30 year fixed mortgage rates is essential for anyone looking to purchase a home. By staying informed about the factors that influence these rates and knowing how to navigate the mortgage process, homebuyers can make better financial decisions. We encourage you to leave a comment, share this article with others, and explore additional resources on our site for more information on home buying.

Thank you for reading, and we hope to see you back for more insights on the housing market and mortgage trends!

Idris Elba Cyberpunk Wiki: Exploring The Multi-talented Star's Role In The Cyberpunk Universe

Brandon Cooks: A Comprehensive Look At His Career And Impact In The NFL

Knicks Vs Hornets: A Comprehensive Analysis Of Their Rivalry