The Stock Price: Understanding Its Fluctuations And Impacts

The stock price is a vital indicator of a company's financial health and investor sentiment. Understanding what affects stock prices can empower investors to make informed decisions. In this article, we will explore the intricacies of stock prices, including factors that influence them, their implications for investors, and strategies to navigate the stock market effectively.

With the growing complexity of financial markets, it is crucial to have a clear understanding of stock prices. This knowledge not only helps in making informed investment choices but also in grasping the broader economic landscape. As we delve deeper into this topic, we will cover essential concepts, strategies, and tools that can aid in analyzing stock prices effectively.

Table of Contents

- 1. What is a Stock Price?

- 2. Factors Influencing Stock Prices

- 3. The Role of Market Sentiment

- 4. Analyzing Stock Price Trends

- 5. The Impact of Economic Indicators

- 6. Strategies for Investing in Stocks

- 7. Tools for Stock Price Analysis

- 8. Conclusion and Next Steps

1. What is a Stock Price?

A stock price represents the value of a company's shares in the stock market. It is determined by supply and demand dynamics and reflects the market's perception of the company's future profitability. When demand for a stock exceeds its supply, the stock price rises; conversely, when supply exceeds demand, the price falls.

1.1 The Importance of Stock Prices

Stock prices are crucial for several reasons:

- They provide a measure of a company's market value.

- Investors use stock prices to assess investment opportunities.

- Stock prices influence company decisions, such as mergers and acquisitions.

2. Factors Influencing Stock Prices

Several factors can influence the fluctuations in stock prices, including:

- Company Performance: Earnings reports, revenue growth, and profit margins directly impact stock prices.

- Market Conditions: Overall market trends and economic conditions can lead to significant changes in stock prices.

- Industry Trends: Changes in industry dynamics, such as competition and regulation, can also affect stock prices.

2.1 External Factors

External factors, such as geopolitical events, natural disasters, or changes in government policy, can also have a profound impact on stock prices. For example, a trade war may lead to increased costs for companies, subsequently affecting their stock prices.

3. The Role of Market Sentiment

Market sentiment refers to the overall attitude of investors toward a particular stock or the stock market as a whole. Positive sentiment can drive stock prices higher, while negative sentiment can lead to declines.

3.1 Psychological Factors

Psychological factors such as fear and greed can significantly influence market sentiment and, consequently, stock prices. Understanding these emotions can help investors make better decisions.

4. Analyzing Stock Price Trends

Investors often analyze stock price trends to identify potential investment opportunities. This involves examining historical price movements and patterns to forecast future price behavior.

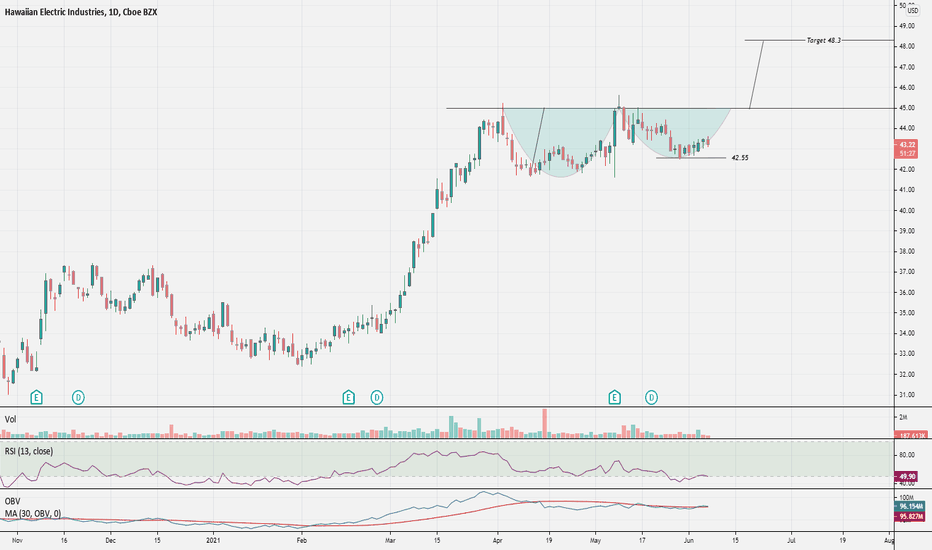

4.1 Technical Analysis

Technical analysis uses historical price data and trading volume to predict future price movements. By analyzing charts and indicators, investors can make informed decisions about buying or selling stocks.

5. The Impact of Economic Indicators

Economic indicators, such as GDP growth, unemployment rates, and inflation, can significantly affect stock prices. Investors closely monitor these indicators to gauge the overall economic health and make strategic investment decisions.

5.1 Interest Rates

Interest rates play a crucial role in stock prices. When interest rates rise, borrowing costs increase, which can lead to reduced consumer spending and lower corporate profits, negatively affecting stock prices.

6. Strategies for Investing in Stocks

There are various strategies investors can employ when investing in stocks:

- Value Investing: This strategy involves buying undervalued stocks with strong fundamentals.

- Growth Investing: Investors focus on stocks expected to grow at an above-average rate compared to their industry.

- Dividend Investing: This approach targets stocks that provide regular dividend payments to investors.

6.1 Diversification

Diversifying a stock portfolio can reduce risk by spreading investments across various sectors and asset classes. This strategy helps protect against significant losses in any single investment.

7. Tools for Stock Price Analysis

Investors can utilize various tools and resources for stock price analysis:

- Stock Screeners: These tools help investors filter stocks based on specific criteria, such as market capitalization or dividend yield.

- Financial News Websites: Reliable financial news platforms provide real-time updates and analysis.

- Investment Apps: Mobile apps allow investors to track stocks and manage their portfolios conveniently.

7.1 Utilizing Online Resources

Many online resources, such as forums and blogs, can provide valuable insights into stock market trends and investor sentiment. Engaging with these platforms can enhance understanding and decision-making.

8. Conclusion and Next Steps

In summary, understanding the dynamics of the stock price is essential for successful investing. By considering various factors, including market sentiment, economic indicators, and company performance, investors can make more informed decisions. As you continue your investment journey, consider implementing the strategies discussed in this article.

We encourage you to leave your thoughts in the comments below, share this article with fellow investors, and explore more content on our site to enhance your financial literacy.

Thank you for reading! We hope to see you back here for more insightful articles on the world of finance.

How Many US Athletes Participate In The Olympics 2024?

Top Artificial Intelligence Stocks To Buy: A Comprehensive Guide For Investors

The Dollar In Mexico: Understanding Its Impact And Importance

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/52d86652-ba2b-43fe-a8fc-523af1fa6e47.jpg)