Exploring NVDA Quote: Understanding Nvidia's Stock Performance And Market Influence

If you're looking for insights into the NVDA quote, you’ve landed in the right place. Nvidia Corporation, a leading player in the technology sector, particularly in graphics processing units (GPUs), has garnered significant attention from investors and analysts alike. As the demand for high-performance computing grows, understanding Nvidia's stock performance and what drives its valuation is crucial for potential investors.

In this article, we'll delve deep into the NVDA quote, examining its historical performance, current market trends, and future outlook. We'll also explore the factors that influence Nvidia's stock price and provide you with valuable resources to stay updated on this dynamic company's performance. Whether you're an experienced investor or just starting, this comprehensive guide will equip you with the knowledge you need.

With the rapid evolution of technology and the increasing significance of artificial intelligence, Nvidia stands at the forefront of these trends. Therefore, comprehending the NVDA quote is not just about stock prices; it’s about understanding the broader implications of Nvidia's innovations on the market and economy.

Table of Contents

- Nvidia: A Brief Biography

- NVDA Stock Performance Over the Years

- Factors Influencing the NVDA Quote

- Future Outlook for Nvidia

- Investing in NVDA: Pros and Cons

- Resources for Tracking NVDA Quote

- Conclusion

- Frequently Asked Questions

Nvidia: A Brief Biography

Nvidia Corporation, founded in 1993, has established itself as a leader in GPU manufacturing. The company originally focused on the gaming market but has expanded its applications into data centers, artificial intelligence, and autonomous vehicles. Here’s a quick overview of Nvidia:

| Detail | Information |

|---|---|

| Name | Nvidia Corporation |

| Founded | 1993 |

| Headquarters | Santa Clara, California, USA |

| CEO | Jensen Huang |

| Industry | Technology, Semiconductors |

| Stock Symbol | NVDA |

NVDA Stock Performance Over the Years

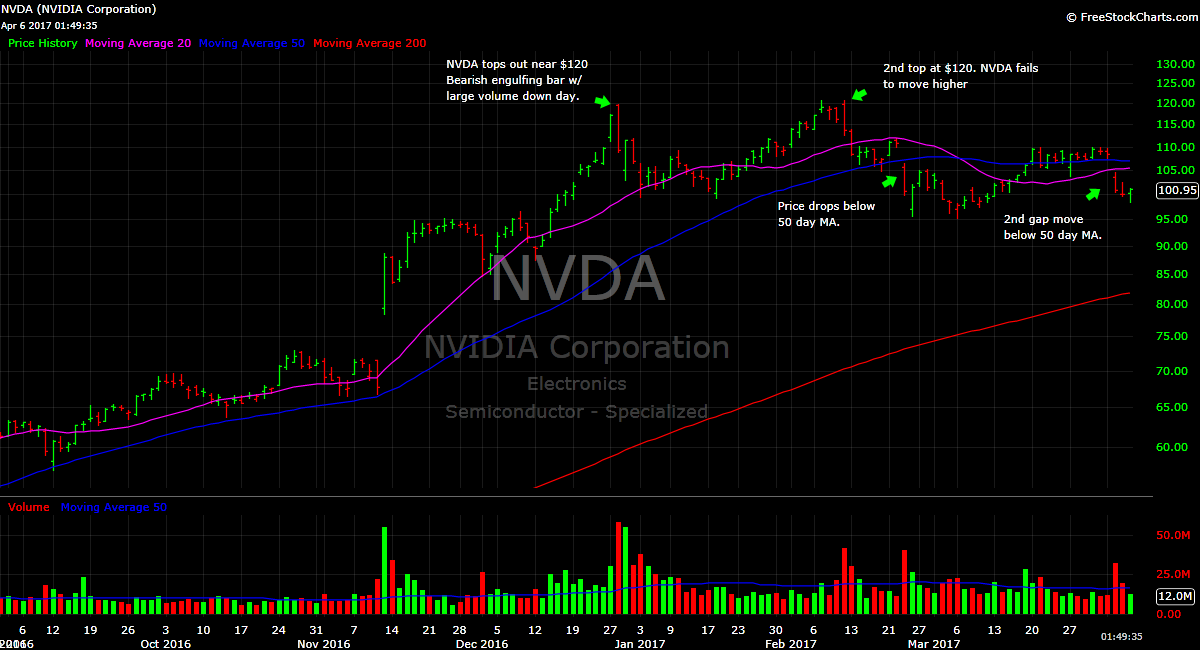

When analyzing the NVDA quote, it's essential to consider its performance over time. Nvidia's stock has seen substantial growth since its IPO in 1999. Below are some key historical milestones:

- Initial Public Offering (IPO): $12 per share in 1999.

- Significant Growth (2016-2021): Nvidia's stock price surged from around $30 to over $700, driven by the demand for GPUs in gaming and AI.

- Market Volatility (2022-Present): Like many tech stocks, Nvidia experienced fluctuations due to market corrections, but it has shown resilience.

Factors Influencing the NVDA Quote

Several factors play a crucial role in determining the NVDA quote:

1. Market Demand for GPUs

The demand for high-performance GPUs in gaming, data centers, and artificial intelligence applications significantly influences Nvidia's stock price. As industries increasingly rely on AI, Nvidia's role becomes even more critical.

2. Financial Performance

Nvidia's quarterly earnings reports provide insights into its financial health. Strong revenue growth and profitability can lead to positive sentiment around the NVDA quote.

3. Competitive Landscape

The technology sector's competitive nature means that Nvidia must constantly innovate to maintain its market position. Competitors like AMD and Intel also impact Nvidia's stock performance.

4. Macroeconomic Factors

Broader economic conditions, such as inflation rates and consumer spending, can influence investor sentiment and impact the NVDA quote.

Future Outlook for Nvidia

As we look ahead, several trends suggest a positive outlook for Nvidia:

- Growth in AI: Nvidia is poised to benefit from the increasing adoption of AI technologies across various sectors.

- Expansion into New Markets: The company is exploring opportunities in autonomous vehicles and healthcare, which could lead to new revenue streams.

- Innovation in Gaming: With the gaming industry continually evolving, Nvidia's focus on enhancing gaming experiences positions it favorably.

Investing in NVDA: Pros and Cons

Investing in Nvidia has its advantages and disadvantages. Here are some points to consider:

Pros:

- Strong historical performance and growth potential.

- Leadership in high-demand sectors like gaming and AI.

- Innovative product pipeline.

Cons:

- Market volatility can lead to significant price fluctuations.

- Competition from other semiconductor companies.

- Dependence on specific markets may pose risks.

Resources for Tracking NVDA Quote

To stay updated on the NVDA quote, consider utilizing the following resources:

Conclusion

In summary, the NVDA quote is a reflection of Nvidia's robust business model, innovative capabilities, and the growing demand for high-performance technology. Understanding the various factors that influence its stock performance is essential for making informed investment decisions.

We encourage you to follow Nvidia's developments closely, whether you're considering investing or simply interested in the technology sector's evolution. Leave your thoughts or questions in the comments below, and don't forget to share this article with fellow investors!

Frequently Asked Questions

1. What is the current NVDA quote?

You can find the latest NVDA quote on financial news websites like Nasdaq or Yahoo Finance.

2. Is Nvidia a good investment?

While Nvidia has shown strong growth potential, it's important to evaluate your investment goals and market conditions before investing.

3. How often does Nvidia report earnings?

Nvidia typically reports its earnings quarterly. Keep an eye on their investor relations page for dates and details.

AAPL Premarket: Understanding Apple Inc.'s Stock Movements Before Market Open

Liverpool: A Comprehensive Guide To The City, Its Culture, And Football Legacy

Matilda De Angelis: Rising Star Of Italian Cinema