Understanding IBKR: A Comprehensive Guide To Interactive Brokers

In the world of online trading and investment platforms, IBKR stands out as one of the most reputable names. Interactive Brokers, often abbreviated as IBKR, provides a wide range of services tailored for both individual and institutional investors. This article delves into the intricacies of IBKR, its features, advantages, and how it compares to other brokerage firms.

The rise of digital trading has transformed the way investors engage with the financial markets. With competitive pricing and advanced trading tools, IBKR has garnered a significant user base, making it a key player in the brokerage industry. This guide aims to provide a thorough understanding of IBKR, examining its offerings, fee structures, and user experience.

Whether you are a seasoned trader or a newcomer to the world of investments, understanding the fundamentals of IBKR can empower you to make informed decisions. Let’s dive deeper into what makes Interactive Brokers a preferred choice for many and explore its unique features, benefits, and challenges in the ever-evolving landscape of online trading.

Table of Contents

- What is IBKR?

- Biographical Overview of IBKR

- Key Features of IBKR

- Advantages of Using IBKR

- Disadvantages of IBKR

- Comparing IBKR with Other Brokerages

- User Experience and Support

- Conclusion

What is IBKR?

Interactive Brokers (IBKR) is a global brokerage firm that provides trading and investment services to a diverse clientele. Founded in 1978 by Thomas Peterffy, IBKR has grown to become a leading online trading platform, known for its advanced technology and competitive pricing.

IBKR offers a comprehensive suite of financial products, including stocks, options, futures, forex, and fixed income securities. The firm caters to both retail and institutional investors, providing access to over 135 markets worldwide.

Biographical Overview of IBKR

Here is a brief overview of Interactive Brokers:

| Data Point | Details |

|---|---|

| Founded | 1978 |

| Founder | Thomas Peterffy |

| Headquarters | Greenwich, Connecticut, USA |

| Market Access | 135+ markets worldwide |

| Securities Offered | Stocks, Options, Futures, Forex, Fixed Income |

Key Features of IBKR

IBKR is known for its robust trading platform and a variety of features designed for both novices and experienced traders. Some of the key features include:

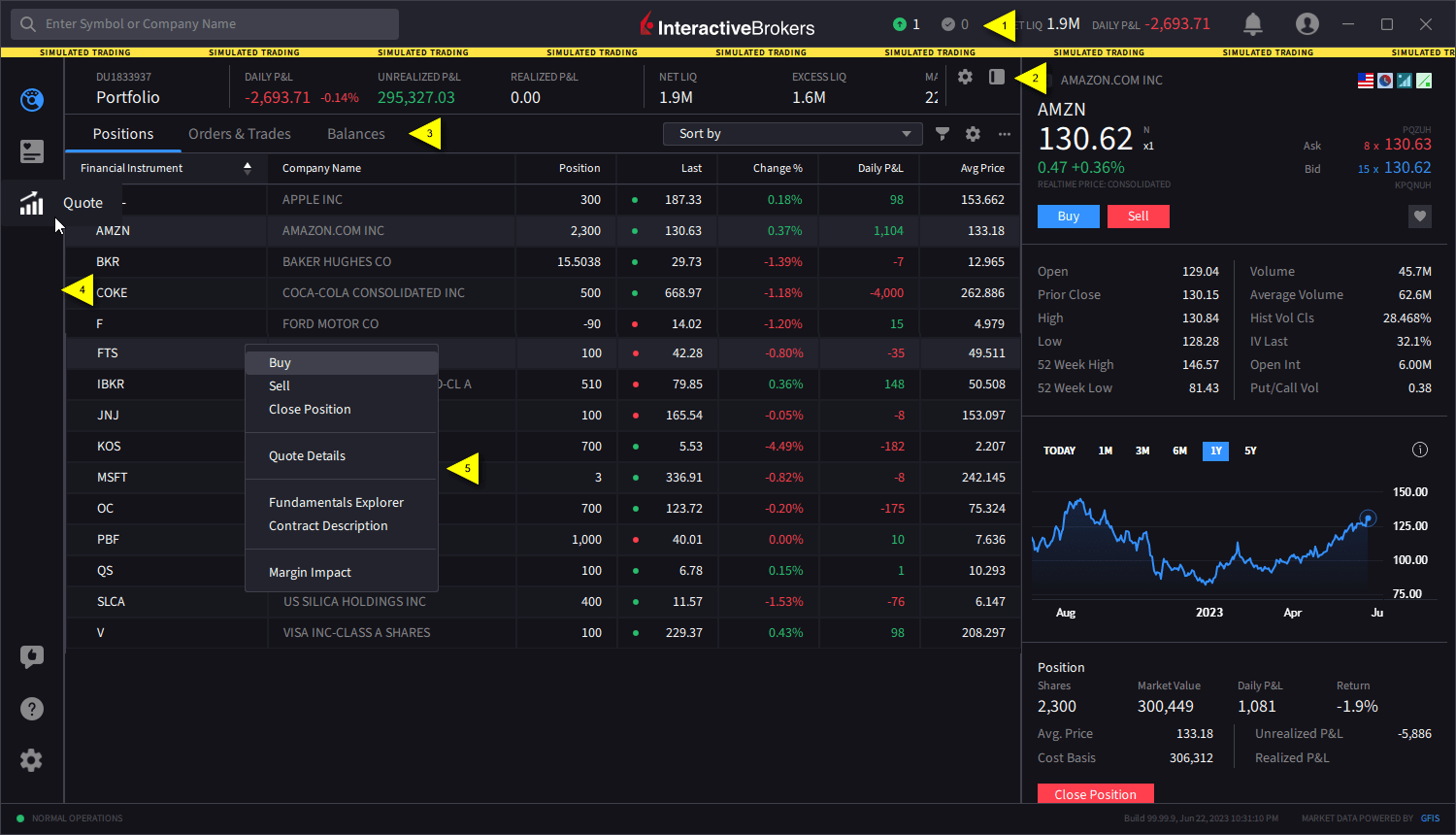

- Advanced Trading Tools: IBKR provides a suite of advanced trading tools, including the Trader Workstation (TWS), which offers real-time data, customizable charts, and technical analysis.

- Low Commission Rates: One of the major attractions of IBKR is its low commission structure, making it a cost-effective choice for active traders.

- Access to Global Markets: Traders can access a wide range of international markets, allowing for greater diversification of investment portfolios.

- Research and Analysis: IBKR offers extensive research reports, analytical tools, and market insights to help traders make informed decisions.

Advantages of Using IBKR

There are several advantages to using Interactive Brokers, including:

- Cost Efficiency: With competitive commissions and low margin rates, IBKR appeals to cost-conscious investors.

- Wide Range of Investment Options: The platform provides access to various asset classes, facilitating diversified investment strategies.

- Regulatory Compliance: IBKR is regulated by multiple financial authorities, ensuring a high level of security and trust for its users.

- Education and Resources: The platform offers numerous educational resources, webinars, and tutorials to help users improve their trading skills.

Disadvantages of IBKR

While IBKR offers many benefits, there are also some disadvantages to consider:

- Complexity: The advanced features and tools may be overwhelming for beginner traders.

- Account Minimums: IBKR may have higher minimum deposit requirements compared to other brokerage firms.

- Limited Customer Service: Some users report that customer service can be slow to respond, which can be frustrating during urgent situations.

Comparing IBKR with Other Brokerages

When choosing a brokerage firm, it is essential to compare different options. Here’s how IBKR stacks up against some of its competitors:

- IBKR vs. E*TRADE: While both offer robust trading platforms, E*TRADE is often seen as more user-friendly for beginners.

- IBKR vs. Schwab: Charles Schwab has a more extensive network of physical branches, making it a better choice for investors who prefer in-person services.

- IBKR vs. Robinhood: Robinhood offers commission-free trading but lacks the extensive tools and options available on IBKR.

User Experience and Support

Interactive Brokers has made strides in improving user experience, offering a sleek interface and comprehensive educational resources. However, the complexity of the platform may pose challenges for new users.

Customer support is available through various channels, including phone, email, and live chat. While many users find the support helpful, some have reported longer wait times during peak periods.

Conclusion

In summary, IBKR offers a powerful trading platform with a wide array of features that cater to both novice and experienced traders. Its competitive pricing, access to global markets, and advanced trading tools make it a strong contender in the brokerage industry.

If you are considering IBKR for your investment needs, take the time to explore its offerings and evaluate whether it aligns with your trading style and goals. Don’t hesitate to leave a comment or share your experiences with IBKR, and check out other articles on our site for more insights into the world of trading.

Thank you for reading! We hope to see you again soon for more informative content on trading and investment.

Cort: The Comprehensive Guide To Understanding This Essential Tool

Cah Stock: A Comprehensive Guide To Understanding And Investing

Walker Hayes Concert KC: A Night To Remember