The Ultimate Guide To XBI: Understanding Its Impact And Benefits

XBI is an essential term in the realm of finance and investment, particularly for those interested in biotechnology and pharmaceutical sectors. This article aims to provide a comprehensive understanding of XBI, its significance in the market, and how it affects investors and the health sector. As the world becomes increasingly reliant on biotechnology for health solutions, understanding XBI will empower investors to make informed decisions.

The biotechnology industry has witnessed exponential growth in recent years, driven by advancements in technology and a greater focus on healthcare solutions. XBI, an ETF that tracks the performance of biotechnology stocks, has become a popular choice among investors looking to tap into this thriving market. In this guide, we'll explore the intricacies of XBI, its components, performance metrics, and strategies for investing in it.

Whether you are a seasoned investor or a newcomer to the world of biotechnology, this article will equip you with the knowledge needed to navigate the complexities of XBI. We'll delve into essential aspects such as its history, performance analysis, and how it compares to other investment vehicles. Get ready to unlock the potential of XBI and its importance in your investment portfolio.

Table of Contents

- What is XBI?

- Overview of the Biotechnology Industry

- Performance Analysis of XBI

- Strategies for Investing in XBI

- Key Components of XBI

- Risks and Benefits of XBI Investment

- Future Outlook for XBI

- Conclusion

What is XBI?

XBI, or the SPDR S&P Biotech ETF, is an exchange-traded fund designed to track the performance of the S&P Biotechnology Select Industry Index. Established in 2006, XBI provides investors with exposure to the biotechnology sector by holding a diversified portfolio of biotechnology stocks.

This ETF is particularly appealing to investors who want to capitalize on the growth potential of biotechnology without having to pick individual stocks. XBI's structure allows for a relatively low-cost entry point into a sector known for its volatility and rapid growth.

Key Features of XBI

- Diversification: XBI holds a broad range of biotech stocks, reducing the impact of individual stock volatility.

- Liquidity: Being an ETF, XBI can be bought and sold throughout the trading day at market prices.

- Cost-Effective: Typically, ETFs have lower expense ratios compared to mutual funds.

Overview of the Biotechnology Industry

The biotechnology industry encompasses a wide range of applications in healthcare, agriculture, industrial processes, and environmental management. This sector is primarily focused on the development of drugs, therapies, and diagnostic tools using biological systems and organisms.

Recent advancements in genetic research, personalized medicine, and biomanufacturing have fueled the growth of biotechnology. As a result, companies within this sector have become critical players in addressing global health challenges, such as pandemics and chronic illnesses.

Key Trends in Biotechnology

- Increased investment in research and development (R&D)

- Growing demand for personalized medicine

- Advancements in gene editing technologies, such as CRISPR

- Expansion of telehealth services

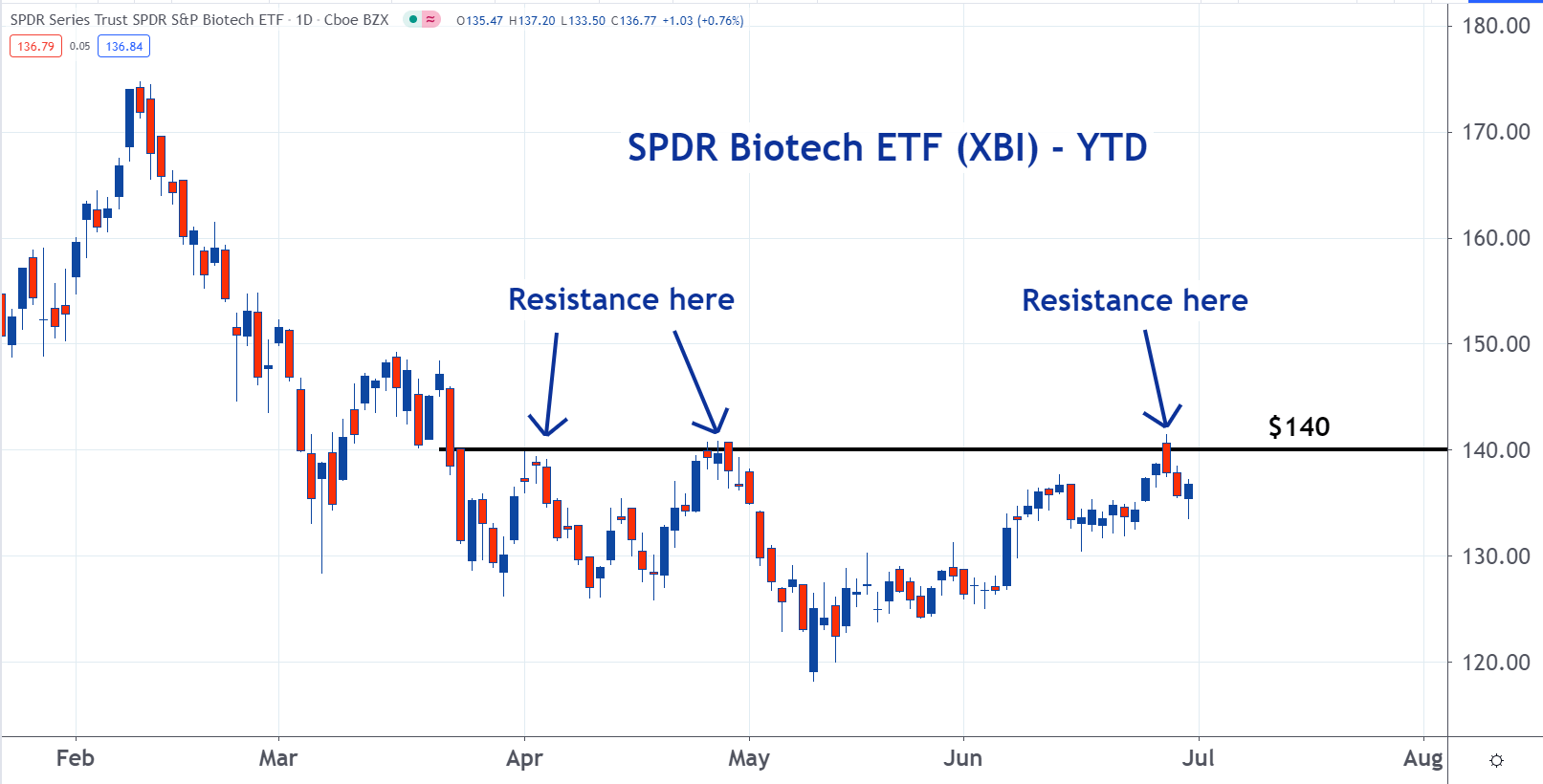

Performance Analysis of XBI

Evaluating the performance of XBI involves analyzing historical data, market trends, and key performance metrics. Historically, XBI has shown significant growth, often outperforming traditional indices such as the S&P 500.

One of the critical metrics to consider is the fund's annualized return, which reflects the average yearly return over a specific period. Investors should also look at the volatility of XBI compared to other investment options, as biotech stocks can experience sharp price fluctuations based on market sentiment and scientific breakthroughs.

Recent Performance Trends

In 2022, XBI experienced a surge in value due to increased interest in biotech stocks following the COVID-19 pandemic. However, the performance can vary significantly based on market conditions and investor sentiment.

Strategies for Investing in XBI

Investing in XBI can be approached in several ways, depending on an investor's risk tolerance and investment goals. Here are some strategies to consider:

Long-Term Investment

For investors looking to hold XBI for the long term, it is essential to focus on the overall growth potential of the biotechnology sector. This strategy involves buying and holding shares of XBI during market fluctuations.

Short-Term Trading

Short-term traders may take advantage of volatility by buying and selling XBI based on market trends and news. This approach requires a keen understanding of market dynamics and timely execution.

Key Components of XBI

XBI comprises a diverse range of biotechnology companies, from large-cap firms to smaller, emerging biotech stocks. The fund typically includes companies involved in drug development, diagnostics, and therapeutics.

Top Holdings in XBI

- Amgen Inc. (AMGN)

- Biogen Inc. (BIIB)

- Regeneron Pharmaceuticals Inc. (REGN)

- Vertex Pharmaceuticals Inc. (VRTX)

Risks and Benefits of XBI Investment

Like any investment, XBI comes with its own set of risks and benefits. Understanding these factors is crucial for making informed investment decisions.

Benefits

- Exposure to a high-growth sector

- Diversification reduces risk associated with individual stocks

- Liquidity allows for easy buying and selling

Risks

- High volatility can lead to significant losses

- Market sentiment can greatly affect stock prices

- Regulatory changes may impact biotech firms

Future Outlook for XBI

The future outlook for XBI appears promising, given the ongoing advancements in biotechnology and healthcare. As the demand for innovative treatments and therapies continues to rise, XBI is well-positioned to benefit from this trend.

Investors should keep an eye on developments in the biotech sector, regulatory changes, and emerging technologies that could impact the performance of XBI in the coming years.

Conclusion

In conclusion, XBI represents a valuable opportunity for investors seeking to capitalize on the growth potential of the biotechnology sector. With its diversified portfolio and strong historical performance, XBI can be a key component of a well-rounded investment strategy.

As you consider investing in XBI, remember to assess your risk tolerance and investment goals. Whether you choose a long-term or short-term approach, staying informed about market trends and company developments is crucial for success in this dynamic sector. We encourage you to leave comments below, share this article with fellow investors, or explore more resources on our site.

Thank you for reading, and we hope to see you back for more insightful content on investing and finance.

How Many Episodes Are In Season 4 Of Attack On Titan Part Two?

Understanding Target Corporation: A Comprehensive Overview

Salma Hayek: A Journey Through The Life And Career Of A Hollywood Icon