ZG Stock: A Comprehensive Guide To Understanding Its Performance And Future Outlook

Investing in stocks requires a deep understanding of the market dynamics and the specific stocks you are interested in. In this article, we will explore ZG stock, its historical performance, current trends, and future outlook. With a focus on critical data and expert insights, we aim to provide you with a well-rounded understanding of ZG stock. Whether you are a seasoned investor or a beginner, this guide will equip you with the knowledge to make informed investment decisions.

The stock market can be volatile and unpredictable, but having access to accurate information can help mitigate risks. ZG stock, associated with Zillow Group, Inc., has garnered attention due to its unique business model and significant market presence. This article will delve into various aspects of ZG stock, including its historical performance, recent news, and expert opinions, allowing you to better understand its potential as an investment.

As we navigate through the complexities of ZG stock, we will also touch upon key performance indicators, market trends, and the impact of economic factors on its valuation. By the end of this article, you will have a clearer picture of ZG stock’s investment potential, along with actionable insights to guide your decisions.

Table of Contents

- 1. Overview of ZG Stock

- 2. Historical Performance of ZG Stock

- 3. Key Metrics and Financials

- 4. Recent News and Events

- 5. Expert Opinions and Market Analysis

- 6. Future Outlook for ZG Stock

- 7. How to Invest in ZG Stock

- 8. Conclusion

1. Overview of ZG Stock

ZG stock represents shares of Zillow Group, Inc., a leading online real estate marketplace. Founded in 2006, Zillow has transformed the way people buy, sell, and rent homes by providing comprehensive listings and valuable market insights. As a publicly traded company, ZG stock is available on the NASDAQ exchange under the ticker symbol 'ZG'.

With a mission to empower consumers with data and technology, Zillow has expanded its services to include mortgage lending and home insurance, further diversifying its revenue streams. Understanding the core business model of Zillow is crucial for assessing the potential of ZG stock.

Key Business Segments of Zillow

- Real Estate Marketplace: Connecting buyers, sellers, and renters.

- Zillow Offers: Instant buying and selling of homes.

- Mortgage Services: Facilitating home loans and financing.

- Rental Services: Offering rental listings and management solutions.

2. Historical Performance of ZG Stock

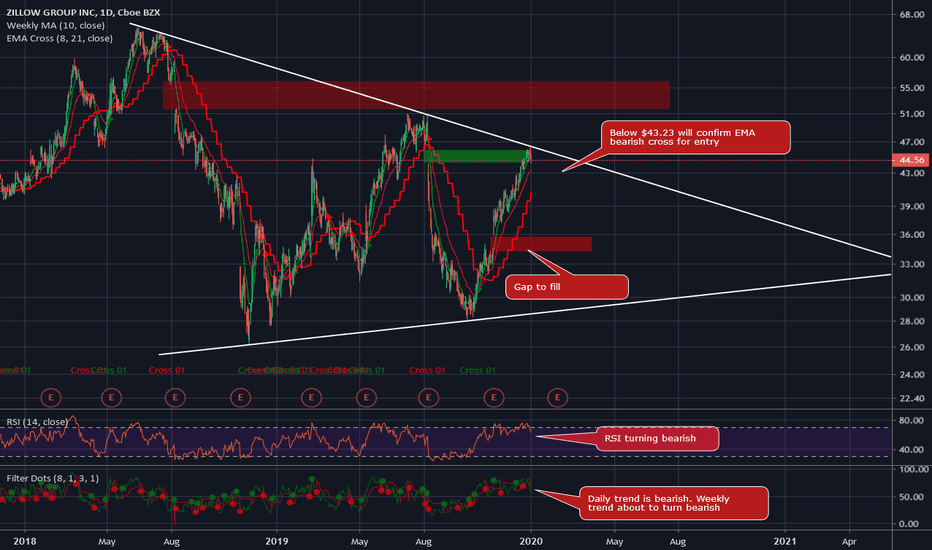

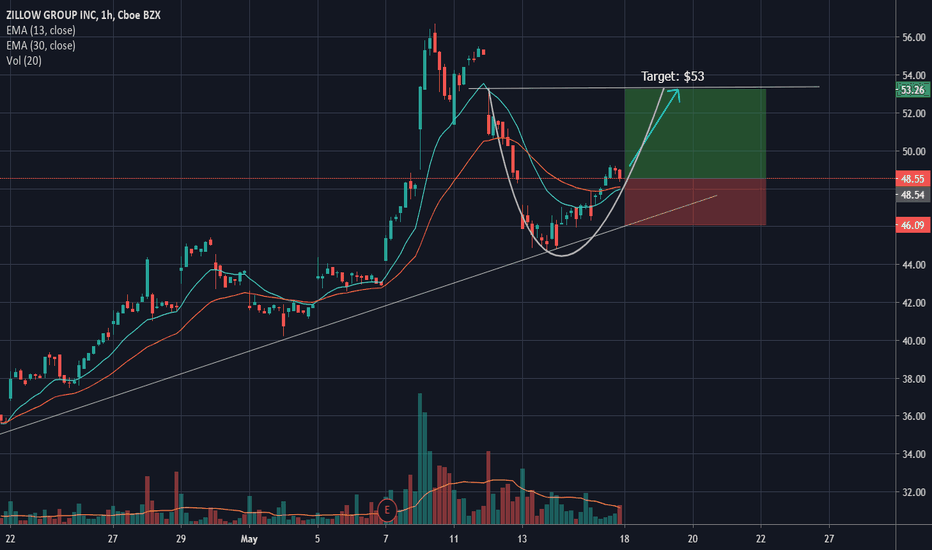

To gauge the investment potential of ZG stock, it is essential to analyze its historical performance. Since its IPO in 2011, the stock has experienced significant fluctuations influenced by various market factors and company developments.

Stock Price Trends

Over the years, ZG stock has seen periods of rapid growth and corrections. Notable milestones include:

- IPO Price: $20 per share in 2011

- Peak Price: Reached approximately $200 per share in early 2021

- Recent Performance: Experienced volatility amid changing housing market dynamics.

Investors should remain vigilant about market trends and company performance to make informed decisions about ZG stock.

3. Key Metrics and Financials

Understanding key financial metrics is vital for evaluating ZG stock's performance. Investors should consider the following indicators:

Revenue Growth

Zillow has shown consistent revenue growth over the years, driven by its expanding service offerings and user base. Recent financial reports indicate:

- 2021 Revenue: $3.9 billion

- Q2 2022 Revenue: $1.3 billion, reflecting a year-over-year increase.

Profitability Ratios

Profitability ratios provide insight into the company's financial health:

- Gross Margin: Approximately 35%

- Net Income: Fluctuated based on market conditions and investment strategies.

4. Recent News and Events

Staying informed about recent developments is crucial for assessing ZG stock's potential. Key events influencing the stock include:

Market Trends

The real estate market has experienced shifts due to changing consumer preferences and economic conditions. Recent trends include:

- Increased demand for remote work-friendly homes.

- Rising interest rates impacting mortgage affordability.

Company Initiatives

Zillow has launched several initiatives to enhance its platform, including:

- Improved user experience on the website and mobile app.

- Expansion of Zillow Offers to increase market share.

5. Expert Opinions and Market Analysis

Expert analysis and insights from industry professionals can provide valuable context for ZG stock. Analysts have mixed opinions on the stock's future performance based on various factors:

Positive Outlook

Some experts believe that Zillow's innovative approach and market leadership position will drive long-term growth, citing:

- Strong brand recognition and consumer trust.

- Diverse revenue streams mitigating risks.

Concerns and Risks

Conversely, analysts express concerns about:

- Market volatility and its impact on housing demand.

- Potential regulatory challenges in the real estate sector.

6. Future Outlook for ZG Stock

Looking ahead, the outlook for ZG stock will depend on several factors, including:

Market Conditions

The real estate market's trajectory will significantly impact Zillow's performance. Key considerations include:

- Interest rates and their effect on mortgage applications.

- Overall economic recovery and consumer confidence.

Company Strategy

Zillow's ability to adapt its business model and leverage technology will be critical in navigating future challenges. Investors should monitor:

- Innovations in technology and data analytics.

- Strategic partnerships to enhance service offerings.

7. How to Invest in ZG Stock

If you are considering investing in ZG stock, here are steps to guide you:

Research and Analysis

Conduct thorough research on Zillow's business model, financials, and market conditions. Utilize reputable financial news sources and analyst reports to gain insights.

Choose an Investment Platform

Select a reputable brokerage platform that allows you to buy and sell ZG stock. Consider factors such as fees, user experience, and available tools for analysis.

Diversify Your Portfolio

To mitigate risks, consider diversifying your investment portfolio by including different asset classes and sectors.

8. Conclusion

In summary, ZG stock represents an intriguing investment opportunity given Zillow's strong market position and innovative approach. However, potential investors should remain aware of the risks associated with market volatility and economic fluctuations. By staying informed and conducting thorough research, you can make well-informed decisions regarding ZG stock.

We encourage you to share your thoughts on ZG stock in the comments below, and don’t forget to check out our other articles for more insights on stock market trends and investment strategies!

9. Final Words

Thank you for reading our comprehensive guide on ZG stock. We hope this article has provided you with valuable information and insights. Stay tuned for more updates and analysis in the world of investing!

Patrick Bet-David Net Worth: An In-Depth Analysis

The Fascinating World Of Cruz: An In-Depth Exploration

Understanding Pickem: A Comprehensive Guide To Fantasy Sports