Understanding USDRUB: The Dynamics Of The US Dollar To Russian Ruble Exchange Rate

USDRUB is a critical currency pair that reflects the economic relationship between the United States and Russia. This exchange rate is not only a measure of currency value but also a barometer of geopolitical stability and economic health between these two nations. With the increasing globalization and interdependence of economies, understanding the intricacies of USDRUB is essential for investors, traders, and anyone interested in international finance.

The fluctuations in the USDRUB can be attributed to various factors including monetary policy changes, economic indicators, and geopolitical events. This article will explore the factors affecting the US Dollar to Russian Ruble exchange rate, its historical performance, and what the future may hold for this significant currency pair. By gaining insights into USDRUB, readers can make informed decisions regarding investments, trading strategies, and understanding market trends.

In this comprehensive guide, we will delve into the key elements that drive the USDRUB exchange rate. From economic fundamentals to market sentiment, we will cover it all. Whether you are a seasoned trader or a newcomer to the world of currency trading, this article aims to provide valuable insights and expert analysis on the USDRUB currency pair.

Table of Contents

- 1. What is USDRUB?

- 2. Historical Performance of USDRUB

- 3. Factors Affecting USDRUB Exchange Rate

- 4. Economic Indicators Impacting USDRUB

- 5. Geopolitical Influences on USDRUB

- 6. Trading Strategies for USDRUB

- 7. Future Outlook for USDRUB

- 8. Conclusion and Call to Action

1. What is USDRUB?

USDRUB is the abbreviation for the exchange rate between the United States Dollar (USD) and the Russian Ruble (RUB). This currency pair indicates how many Russian Rubles are required to purchase one US Dollar. The exchange rate is influenced by a multitude of factors including economic performance, interest rates, and political stability.

2. Historical Performance of USDRUB

The historical performance of USDRUB provides valuable insights into its volatility and trends over time. Understanding its past can help investors and traders predict future movements.

2.1. Major Historical Events

- The collapse of the Soviet Union in 1991 led to significant changes in the Russian economy and currency.

- The 1998 Russian financial crisis resulted in a sharp depreciation of the Ruble.

- Sanctions imposed on Russia in recent years have also impacted the USDRUB exchange rate.

2.2. Long-Term Trends

Over the past two decades, USDRUB has experienced periods of both stability and volatility, influenced by global economic conditions and domestic policies in Russia and the USA.

3. Factors Affecting USDRUB Exchange Rate

Numerous factors influence the USDRUB exchange rate, including:

- Interest Rate Differentials: Differences in interest rates set by the Federal Reserve and the Bank of Russia.

- Inflation Rates: Inflation impacts purchasing power and currency value.

- Economic Data Releases: Key economic indicators such as GDP growth, employment rates, and manufacturing output can sway market perceptions.

4. Economic Indicators Impacting USDRUB

Several economic indicators play a crucial role in determining the USDRUB exchange rate. These indicators provide insight into the economic health of both countries.

4.1. GDP Growth

Gross Domestic Product (GDP) growth is a primary indicator of economic performance. A strong GDP growth rate in the US typically strengthens the USD against the RUB.

4.2. Employment Data

Employment statistics, particularly the unemployment rate, are vital indicators of economic stability and growth potential.

5. Geopolitical Influences on USDRUB

Geopolitical events can create significant fluctuations in the USDRUB exchange rate. Factors such as diplomatic relations, military conflicts, and international sanctions can lead to rapid changes in currency value.

- Sanctions on Russia have historically led to a weaker Ruble.

- Trade policies and agreements can also impact currency strength.

6. Trading Strategies for USDRUB

Understanding the dynamics of USDRUB is essential for developing effective trading strategies. Here are some strategies traders might consider:

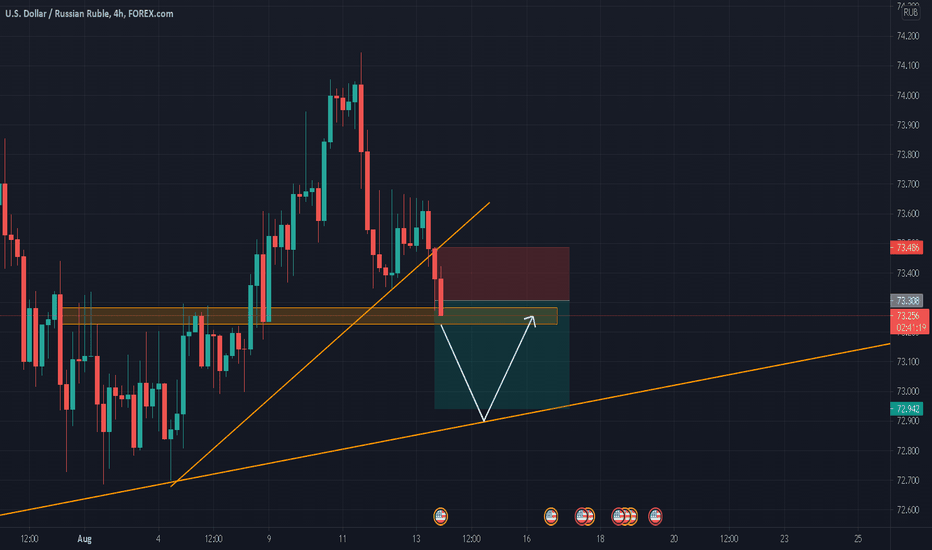

- Technical Analysis: Utilizing charts and historical data to predict future movements.

- Fundamental Analysis: Evaluating economic indicators and news events to inform trading decisions.

- Risk Management: Implementing stop-loss orders to mitigate potential losses.

7. Future Outlook for USDRUB

The future of the USDRUB exchange rate is uncertain and subject to various influences. Analysts often consider economic forecasts, political stability, and global market trends when predicting future movements in the currency pair.

8. Conclusion and Call to Action

In conclusion, understanding the USDRUB exchange rate is crucial for anyone involved in international finance. By staying informed about the factors influencing this currency pair, investors and traders can make more informed decisions. We encourage readers to stay updated on economic news, engage in discussions, and share this article with others interested in currency trading.

For further insights, feel free to leave your comments or explore more articles on our website. We strive to provide the most relevant and insightful content for our readers.

Thank you for reading, and we hope to see you back for more engaging discussions on currency trading and international finance.

Mila Kunis: The Rise Of A Hollywood Star

Exploring The Fascinating World Of Roman Gods

Understanding DRs Stock: A Comprehensive Guide To Depository Receipts