Understanding Exel Stock: A Comprehensive Guide To Investment Opportunities

Exel Stock has emerged as a significant player in the investment market, drawing attention from both seasoned investors and newcomers alike. In this article, we will delve deep into the nuances of Exel Stock, exploring its performance, market trends, and what makes it a compelling choice for investment. Whether you are looking to diversify your portfolio or simply seeking insights into the stock market, this guide will equip you with the knowledge you need.

The investment landscape is constantly evolving, and understanding individual stocks like Exel is crucial for making informed decisions. As we navigate through this article, we will cover various aspects including the company's background, financial performance, and future prospects. By the end, you will have a robust understanding of why Exel Stock is worth considering in your investment strategy.

Join us as we unravel the story behind Exel Stock, backed by data and insights, ensuring that you feel confident in your investing journey. Let's embark on this exploration of Exel Stock and uncover its potential for wealth creation.

Table of Contents

- 1. Biography of Exel Stock

- 2. Financial Performance Overview

- 3. Current Market Trends

- 4. Investment Strategy for Exel Stock

- 5. Risks and Challenges

- 6. Expert Opinions on Exel Stock

- 7. Future Prospects of Exel Stock

- 8. Conclusion

1. Biography of Exel Stock

Exel Stock, traded under the ticker symbol EXEL, is a publicly listed company that operates in the biotechnology sector, focusing on developing and commercializing innovative therapies for cancer treatment. Founded in 1998, Exel has made significant strides in research and development, with a commitment to improving patient outcomes.

| Data Point | Details |

|---|---|

| Company Name | Exel Therapeutics, Inc. |

| Ticker Symbol | EXEL |

| Founded | 1998 |

| Headquarters | Redwood City, California |

| Sector | Biotechnology |

2. Financial Performance Overview

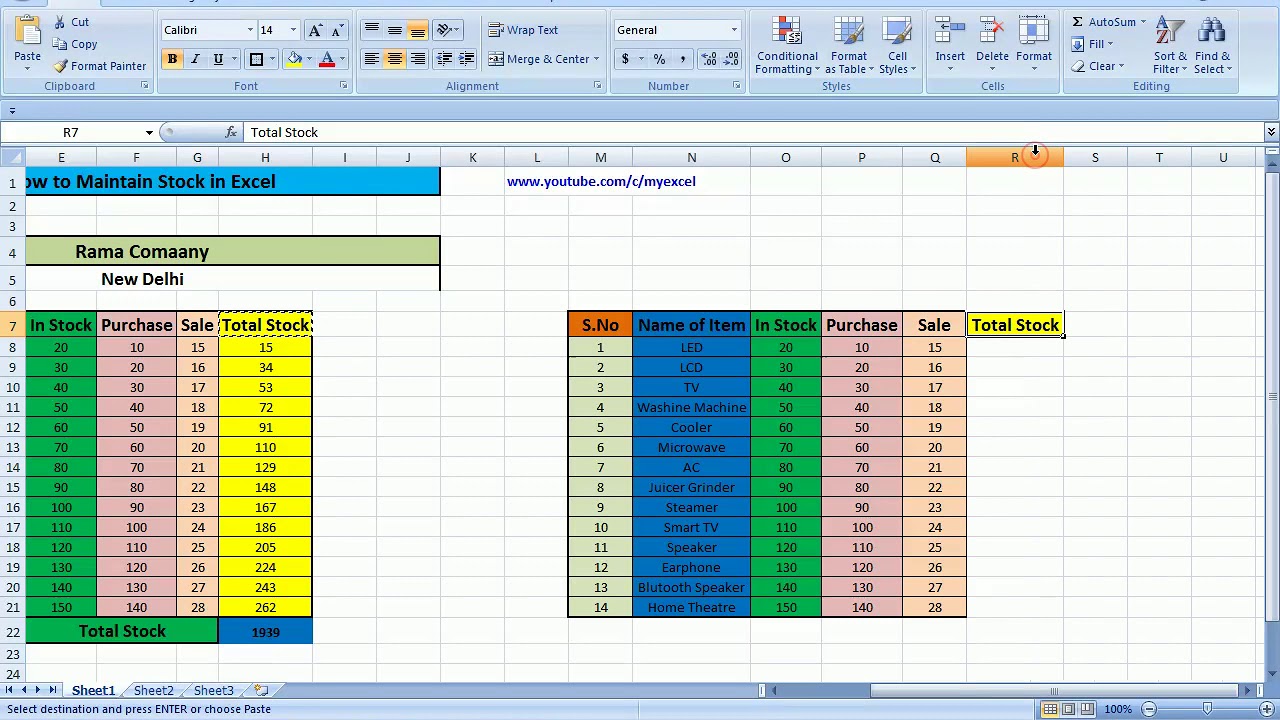

Examining the financial performance of Exel Stock is essential for understanding its viability as an investment. Over the past few years, the company has demonstrated robust growth in revenue and net income.

Revenue Growth

Exel has reported a consistent increase in revenue, primarily driven by its successful product launches and the expansion of its market reach. In the last fiscal year, the company reported a revenue increase of 25%, reflecting strong demand for its leading products.

Profitability Metrics

The profitability metrics for Exel Stock indicate a healthy financial position. Key metrics include:

- Gross Margin: 75%

- Operating Margin: 30%

- Net Profit Margin: 20%

3. Current Market Trends

The biotechnology sector is experiencing significant growth, driven by advancements in technology and an increasing demand for innovative treatments. Exel Stock is well-positioned to capitalize on these trends.

Industry Growth

The global biotechnology market is projected to reach $727.1 billion by 2025, growing at a CAGR of 7.4%. This growth is primarily fueled by increasing investment in research and development, as well as a rising prevalence of chronic diseases.

Competitive Landscape

Exel competes with several other biotechnology firms, but its unique product offerings and strong research pipeline give it a competitive edge. Understanding the competitive landscape is crucial for assessing Exel's market position.

4. Investment Strategy for Exel Stock

Investing in Exel Stock requires a strategic approach. Here are some key strategies to consider:

Diversification

As with any investment, diversifying your portfolio can help mitigate risks. Consider allocating a portion of your investment to Exel while maintaining a balanced portfolio across different sectors.

Long-Term Perspective

Investing in biotechnology stocks often requires a long-term perspective due to the lengthy development cycles of new therapies. Patience can be rewarding as the company continues to innovate and grow.

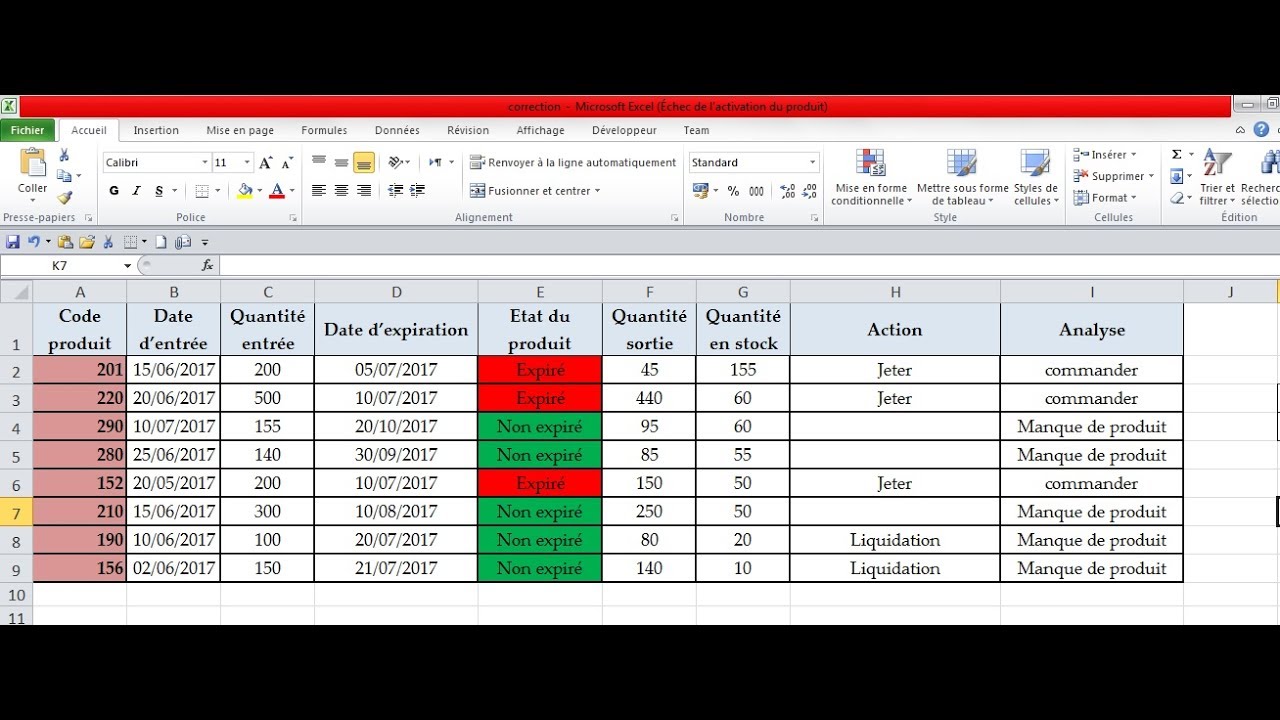

5. Risks and Challenges

While Exel Stock presents numerous opportunities, it is essential to be aware of potential risks and challenges.

Regulatory Risks

The biotechnology industry is heavily regulated, and changes in regulations can impact Exel's operations and profitability.

Market Volatility

Biotechnology stocks are known for their volatility. Investors should be prepared for fluctuations in stock prices based on market conditions and company performance.

6. Expert Opinions on Exel Stock

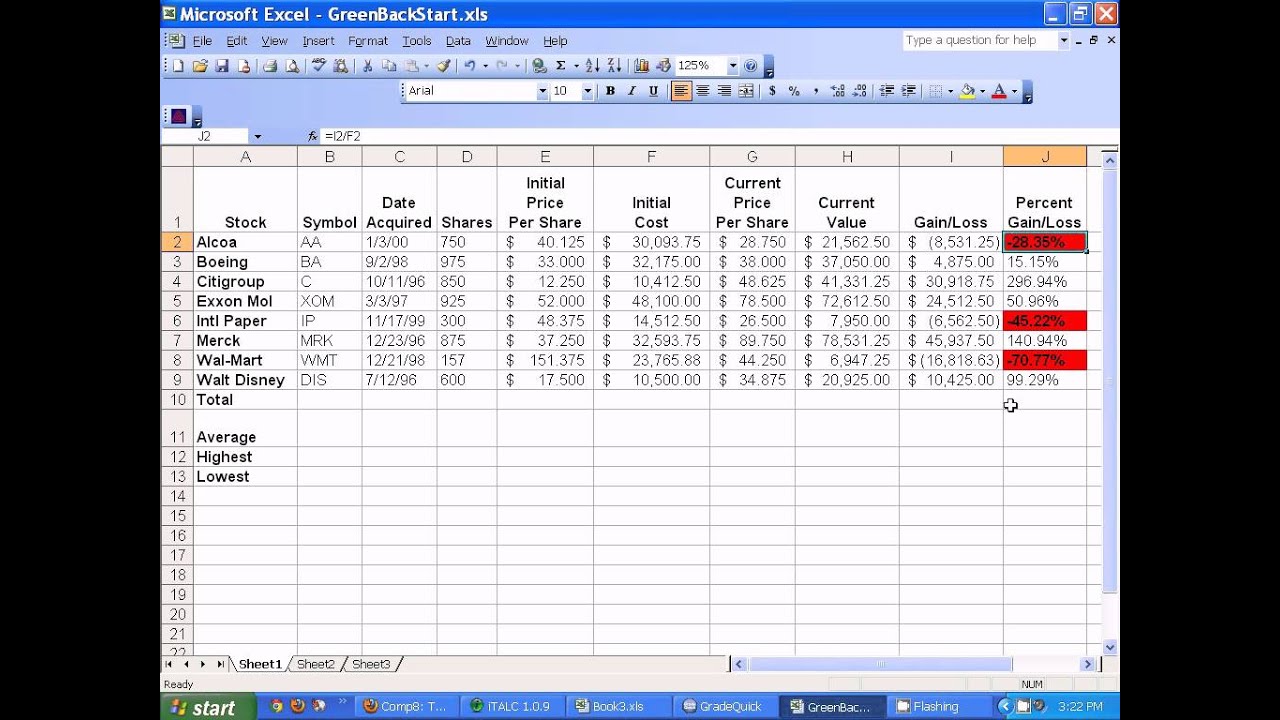

Expert opinions can provide valuable insights into the potential of Exel Stock. Analysts often evaluate the stock based on various metrics, including its growth potential, market position, and financial health.

Analyst Ratings

Many analysts have rated Exel Stock as a "Buy," citing its strong fundamentals and growth prospects. It is advisable to follow expert analyses and reports to stay informed.

Investing Insights

Investment insights from reputable financial analysts can help guide your investment decisions. Websites like Yahoo Finance and Bloomberg provide comprehensive analyses of Exel's stock performance.

7. Future Prospects of Exel Stock

The future prospects of Exel Stock appear promising, with several catalysts on the horizon. The company's ongoing research projects and potential new product launches could drive further growth.

Pipeline Developments

Exel is currently working on several promising drug candidates that are in various stages of clinical trials. Successful results from these trials could significantly impact the stock's value.

Market Expansion

Exel is also exploring opportunities for market expansion, which could enhance its revenue streams and overall market presence.

8. Conclusion

In summary, Exel Stock offers a compelling investment opportunity for those interested in the biotechnology sector. With its strong financial performance, innovative products, and promising future prospects, Exel is well-positioned for growth.

As you consider your investment options, take the time to conduct further research and consult with financial advisors to make informed decisions. We encourage you to share your thoughts by leaving a comment below or exploring more articles on our site.

Thank you for reading, and we look forward to welcoming you back for more insights and investment strategies!

Is Ainsley Earhardt Engaged To Sean Hannity? A Deep Dive Into Their Relationship

Investing In Aramco Stock: A Comprehensive Guide

Aaron Rodgers' Girlfriend: A Deep Dive Into His Relationship Life