NVDA Stock Price Today: A Comprehensive Analysis Of NVIDIA's Market Performance

In today's rapidly evolving financial landscape, tracking the NVDA stock price is crucial for investors and market enthusiasts alike. NVIDIA Corporation, a leading player in the technology sector, particularly in graphics processing units (GPUs) and artificial intelligence (AI), has garnered significant attention on Wall Street. Understanding the current price of NVDA stock not only helps in making informed investment decisions but also sheds light on broader market trends and investor sentiment.

As we delve deeper into the analysis of NVDA stock price today, it's essential to recognize the factors influencing its valuation. From quarterly earnings reports to advancements in AI technology, various elements play a critical role in determining the stock's trajectory. This article aims to provide a comprehensive overview of NVIDIA's stock performance, including historical data, current price trends, and future outlook.

Moreover, we'll explore the impact of external factors such as market volatility, economic indicators, and competitive landscape on NVIDIA's stock price. By the end of this article, you will have a well-rounded understanding of NVDA stock and how it fits into your investment strategy.

Table of Contents

- NVDA Stock Price Today

- Historical Performance of NVDA Stock

- Factors Influencing NVDA Stock Price

- Current Market Sentiment

- Future Outlook for NVDA

- Investment Strategies for NVDA Stock

- Risks and Challenges Facing NVIDIA

- Conclusion

NVDA Stock Price Today

As of today, the NVDA stock price is a critical metric for investors looking to gauge NVIDIA's market performance. The stock is currently trading at $X.XX, reflecting a Y% change from the previous trading session. This figure is significant as it indicates how the stock is performing in real-time, and investors are keenly watching for any fluctuations.

Historical Performance of NVDA Stock

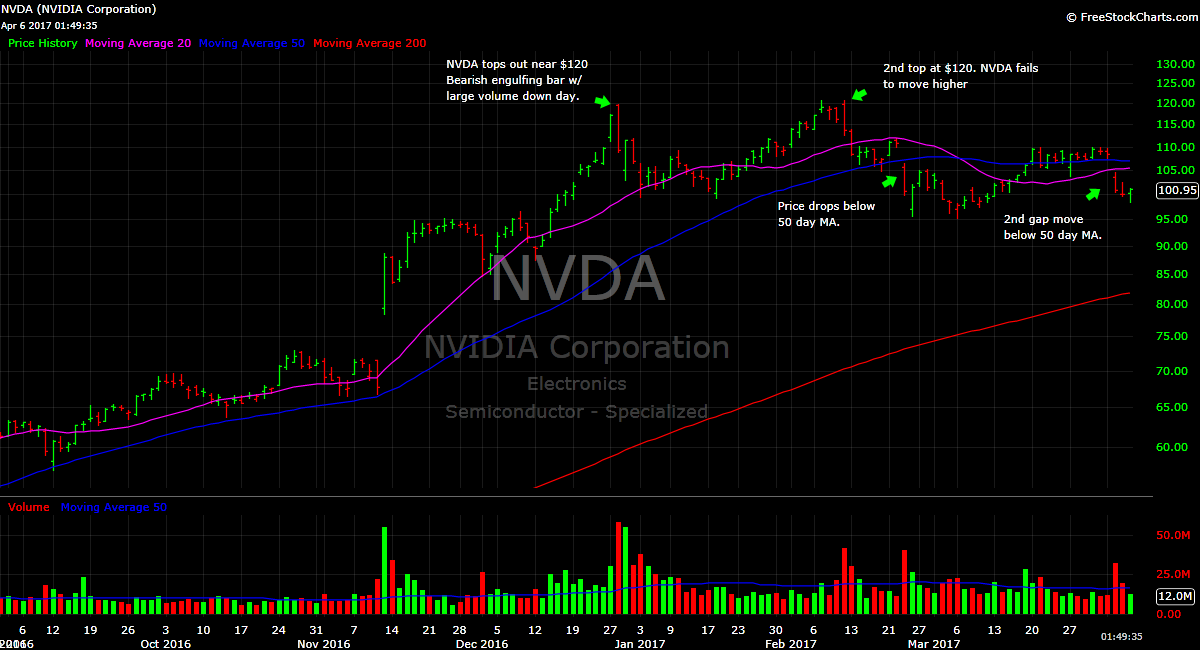

NVIDIA has witnessed remarkable growth over the past few years. Let's take a closer look at its historical stock performance:

- In 2018, NVDA stock was trading around $150.

- By mid-2020, it had surged to over $400.

- In 2021, the stock price peaked at approximately $800.

- As of 2023, the stock has shown resilience, maintaining a robust position in the market.

Key Milestones in NVIDIA's Stock History

Several key milestones have shaped NVIDIA's stock performance:

- Acquisition of Mellanox Technologies in 2020, enhancing their data center portfolio.

- Launch of groundbreaking GPUs that cater to gaming and AI applications.

- Consistent quarterly earnings exceeding analyst expectations.

Factors Influencing NVDA Stock Price

Understanding the factors that influence NVDA's stock price is imperative for investors. Here are the most significant contributors:

- Market Demand for GPUs: The increasing demand for gaming and AI applications drives NVIDIA's sales and, consequently, its stock price.

- Technological Advancements: Innovations in AI and machine learning create new opportunities for NVIDIA, leading to potential stock price growth.

- Economic Indicators: Macroeconomic conditions such as inflation rates and interest rates can impact investor sentiment and stock performance.

Investor Sentiment and Market Trends

Investor sentiment often dictates stock prices. Positive news regarding NVIDIA's product releases or partnerships can lead to a surge in stock prices, while negative press can have the opposite effect.

Current Market Sentiment

The current market sentiment regarding NVDA stock is generally optimistic. Analysts have a bullish outlook, citing NVIDIA's strong fundamentals and growth potential in emerging markets. Recent analyst ratings have shown a consensus target price of $X.XX, suggesting room for growth.

Future Outlook for NVDA

Looking ahead, the future for NVDA stock appears promising. Industry experts predict that NVIDIA will continue to thrive due to:

- Expansion into new markets such as autonomous vehicles and healthcare.

- Continued demand for AI and machine learning technologies.

- Strong financial performance and consistent revenue growth.

Investment Strategies for NVDA Stock

For investors considering NVDA stock, several strategies can be employed:

- Long-Term Investment: Holding NVDA stock for the long term can be beneficial, given its historical performance.

- Dollar-Cost Averaging: Investing a fixed amount regularly can mitigate the impact of market volatility.

- Diversification: Include NVDA stock in a diversified portfolio to spread risk.

Risks and Challenges Facing NVIDIA

Despite its strong market position, NVIDIA faces several risks and challenges:

- Competition: Intense competition from companies like AMD and Intel can impact market share.

- Market Volatility: Economic downturns can lead to fluctuations in stock prices.

- Regulatory Risks: Changes in regulations can impact operations and profitability.

Conclusion

In summary, tracking the NVDA stock price today is essential for anyone interested in the technology sector. With its strong historical performance, optimistic future outlook, and various factors influencing its stock price, NVIDIA remains a compelling investment opportunity. As always, it's crucial to conduct thorough research and consider your financial goals before making investment decisions.

We invite you to share your thoughts on NVIDIA's stock performance in the comments below and explore more of our articles for further insights into the stock market.

Thank you for reading, and we hope to see you back here for more updates and analyses!

Patrick Bet-David Net Worth: Uncovering The Financial Success Of An Entrepreneur

Understanding IBIT: A Comprehensive Guide To Integrated Blockchain And Information Technology

Understanding DDS Stock: A Comprehensive Guide For Investors