Understanding Lyft Stock Price: Trends, Analysis, And Future Outlook

The Lyft stock price has been a subject of keen interest among investors and analysts alike, especially considering the dynamic nature of the ride-sharing industry. As one of the major players in the market, Lyft's stock performance can provide insights into broader economic trends and consumer behaviors. In this article, we will explore the various factors influencing Lyft's stock price, historical trends, and what the future might hold for this transportation giant.

From understanding the company's financial health to analyzing market competition and external economic factors, we aim to provide a comprehensive overview of Lyft's stock. Whether you are a seasoned investor or a newcomer looking to understand how to navigate the stock market, this article will equip you with the knowledge needed to make informed decisions regarding Lyft stock.

Join us as we delve deeper into Lyft's stock performance, examining key metrics, and offering insights that can help you strategize your investments. Let’s embark on this journey to uncover the intricacies of Lyft's stock price and what it means for investors.

Table of Contents

- 1. Overview of Lyft

- 2. Historical Stock Price Trends

- 3. Factors Influencing Lyft Stock Price

- 4. Financial Analysis of Lyft

- 5. Market Competition and Positioning

- 6. Future Outlook for Lyft Stock

- 7. Investment Strategies for Lyft Stock

- 8. Conclusion

1. Overview of Lyft

Founded in 2012, Lyft quickly became a prominent name in the ride-sharing industry, offering services similar to those of its main competitor, Uber. Lyft operates in over 644 cities across the United States and Canada, making it a key player in the transportation market. The company's mission is to improve people's lives with the world's best transportation, and it aims to provide safe, affordable, and reliable rides.

Lyft went public in March 2019, and since then, its stock performance has been closely monitored by investors. The company's stock is traded on the Nasdaq under the ticker symbol "LYFT." Understanding the fundamental aspects of Lyft is crucial for analyzing its stock price and making informed investment decisions.

Biodata of Lyft

| Information | Details |

|---|---|

| Founded | 2012 |

| Headquarters | San Francisco, California, USA |

| CEO | David Risher |

| Number of Employees | Over 4,000 |

| Stock Symbol | LYFT |

2. Historical Stock Price Trends

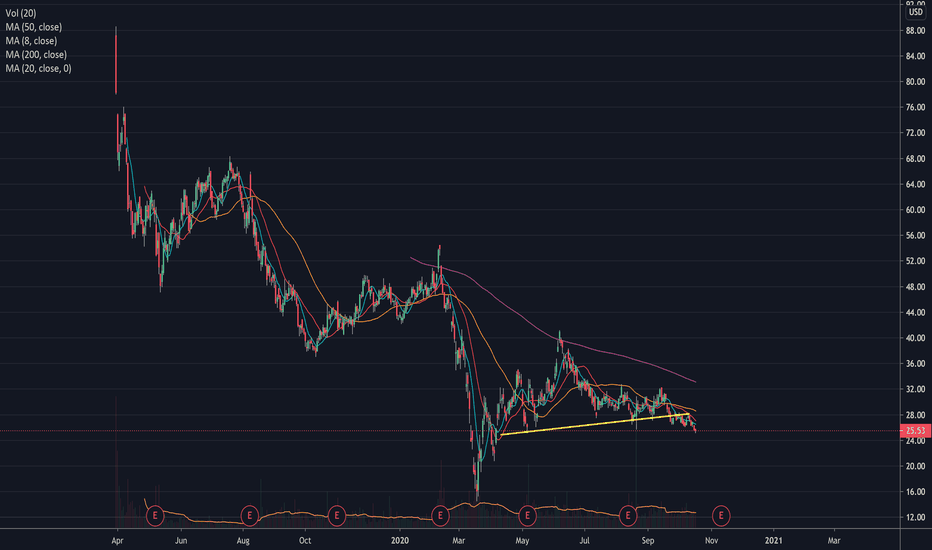

Since its IPO, Lyft's stock price has experienced significant fluctuations. The stock debuted at $72 per share but saw a rapid decline in the following months. To understand the historical trends, it’s essential to analyze the stock's performance over the years.

- 2019: Lyft’s stock price fell sharply after its initial surge, closing the year at about $47.

- 2020: The COVID-19 pandemic severely impacted ride-sharing services, causing Lyft’s stock to drop to around $25.

- 2021: As the economy began to recover, Lyft's stock rebounded, reaching highs of $64.

- 2022: The stock faced headwinds due to inflation and rising fuel costs, dropping to approximately $15.

- 2023: Current trends indicate that Lyft's stock has been volatile, fluctuating between $10 and $20.

3. Factors Influencing Lyft Stock Price

Several factors can influence the stock price of Lyft, including:

Market Trends

The overall performance of the stock market can have a significant impact on Lyft's stock price. Economic indicators, investor sentiment, and market volatility can all play a role.

Regulatory Changes

Changes in regulations affecting ride-sharing services can also impact Lyft's profitability and stock price. This includes changes in driver classification, safety regulations, and insurance requirements.

Competition

Competition from other ride-sharing platforms, such as Uber, can affect Lyft's market share and pricing strategies, ultimately influencing its stock price.

Economic Conditions

The state of the economy, including factors like unemployment rates and consumer spending, can impact Lyft’s business and stock performance.

4. Financial Analysis of Lyft

Analyzing Lyft's financial statements can provide valuable insights into its stock performance. Key metrics to consider include:

- Revenue Growth: Lyft has seen fluctuations in revenue, influenced by ride demand and pricing strategies.

- Profit Margins: Understanding Lyft's profitability and cost structure is crucial for assessing its financial health.

- Cash Flow: Positive cash flow is essential for sustaining operations and funding growth initiatives.

5. Market Competition and Positioning

Lyft operates in a highly competitive market, primarily competing with Uber. Understanding Lyft's competitive position is vital for evaluating its stock price:

Competitive Advantages

Lyft has several competitive advantages, including:

- A strong brand presence in North America.

- A focus on community and social responsibility.

- Innovative features such as Lyft Line, which allows passengers to share rides and costs.

Challenges

Despite its advantages, Lyft faces challenges such as:

- Intense competition from Uber and other ride-sharing platforms.

- Regulatory hurdles that may impact operations.

- Fluctuations in consumer demand due to economic conditions.

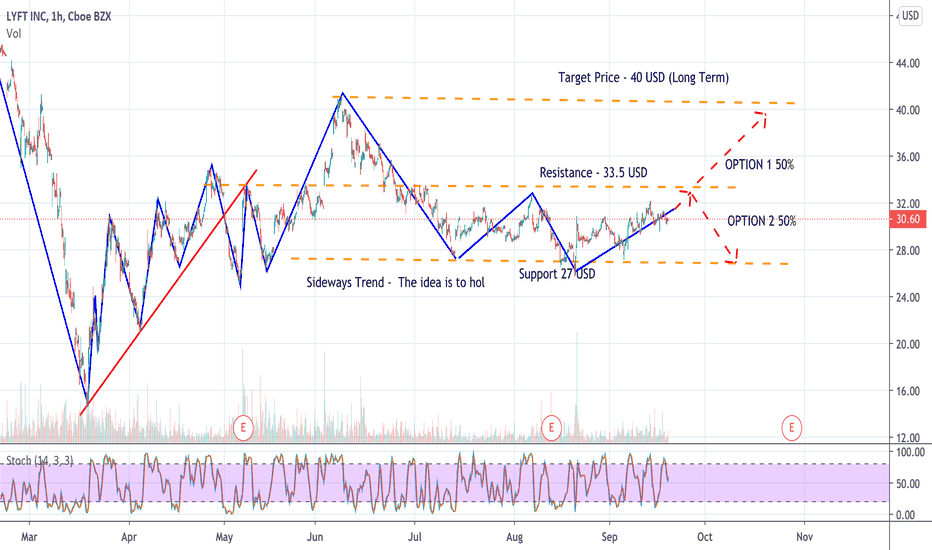

6. Future Outlook for Lyft Stock

Looking ahead, analysts have mixed opinions on Lyft’s stock potential. Factors to consider include:

- The company's ability to adapt to changing market conditions.

- Future growth opportunities, such as expansion into new markets or services.

- Potential partnerships or acquisitions that could enhance its competitive position.

7. Investment Strategies for Lyft Stock

For investors considering Lyft stock, several strategies can be employed:

- Long-term investment: Buying and holding shares for potential future growth.

- Short-term trading: Taking advantage of market volatility for quick profits.

- Diversification: Including Lyft in a diversified portfolio to mitigate risk.

8. Conclusion

In summary, the Lyft stock price is influenced by a variety of factors ranging from market trends to regulatory changes. By understanding these elements and keeping an eye on the company's financial health, investors can make more informed decisions. As always, we encourage you to conduct thorough research and consider consulting with a financial advisor before making investment choices.

If you found this article helpful, please leave a comment, share it with others, or explore our other articles for more insights into the stock market.

Thank you for reading, and we look forward to having you back for more informative content in the future!

Walt Disney Stock: An In-Depth Analysis For Investors

Mara Stock Price: A Comprehensive Analysis Of Trends And Insights

Shawn Grate: The Man Behind The Infamous Crimes