Understanding CVNA Stock Price: Insights, Trends, And Future Predictions

When it comes to the stock market, understanding the dynamics of specific stocks is crucial for investors. CVNA stock price, which represents Carvana Co., has garnered significant attention in recent years. With its rapid growth and innovative business model, many investors are keen to explore the factors influencing its stock price. In this article, we will delve into the intricacies of CVNA stock price, examining its historical performance, key factors impacting its value, and future predictions. We aim to provide a comprehensive overview that not only informs but also assists you in making educated investment decisions.

The stock market can often feel overwhelming, especially for new investors. However, by focusing on specific stocks like CVNA, you can gain valuable insights into market trends and investment strategies. This article will break down complex concepts into more digestible pieces, making it easier for you to understand the factors that drive the CVNA stock price.

As we embark on this journey to explore CVNA stock price, we'll cover various aspects, including its business model, market trends, and expert opinions. Our goal is to equip you with the knowledge needed to navigate your investment journey effectively. So, let’s dive into the details of CVNA stock price and what it means for potential investors.

Table of Contents

- 1. Overview of Carvana Co.

- 2. Historical Performance of CVNA Stock Price

- 3. Factors Influencing CVNA Stock Price

- 4. Market Trends and CVNA Stock

- 5. Analyst Opinions and Predictions

- 6. Investment Strategies for CVNA Stock

- 7. Risks Associated with Investing in CVNA

- 8. Conclusion and Future Outlook

1. Overview of Carvana Co.

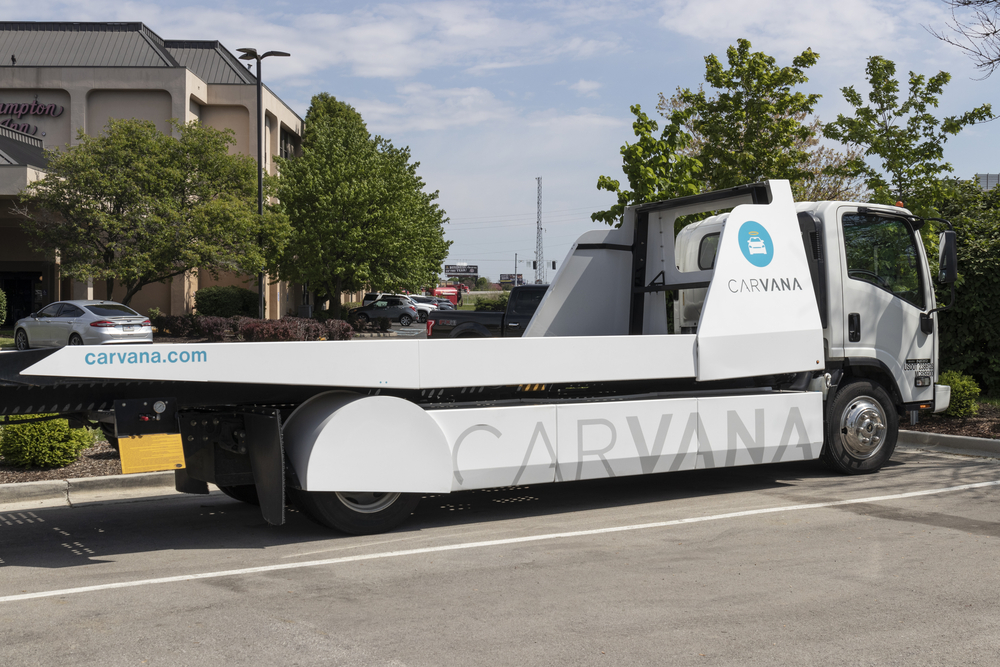

Carvana Co. is an online used car retailer that revolutionizes the way consumers buy cars. Founded in 2012, the company allows users to purchase vehicles through its website, offering a unique blend of convenience and innovation. Customers can browse inventory, secure financing, and even schedule home delivery—all from the comfort of their homes. This business model has placed Carvana at the forefront of the e-commerce automotive sector.

1.1 Company Mission and Vision

Carvana's mission is to change the way people buy cars by providing a transparent, hassle-free experience. Their vision encompasses becoming the largest and most trusted online car retailer in the United States.

1.2 Business Model

Carvana operates on a direct-to-consumer model, eliminating the traditional dealership experience. This allows for lower overhead costs and more competitive pricing, which can positively influence the CVNA stock price.

2. Historical Performance of CVNA Stock Price

The performance of CVNA stock price has been quite dynamic since its initial public offering (IPO) in April 2017. The stock started trading at $15 per share and experienced significant fluctuations in its value.

2.1 Key Milestones

- 2017: IPO at $15/share.

- 2018: First major growth surge, reaching over $35/share.

- 2020: Significant increase in stock price amidst the pandemic, peaking at over $160/share.

- 2021: Volatility and adjustments, with stock price fluctuations between $200 and $300.

2.2 Performance Analysis

Understanding the historical performance of CVNA stock price allows investors to analyze trends and make informed predictions about its future movements. Many factors contribute to these historical changes, including market conditions and company performance.

3. Factors Influencing CVNA Stock Price

Several key factors influence the CVNA stock price, and understanding these can help investors navigate their investment decisions.

3.1 Market Demand and Supply

The demand for used cars directly impacts Carvana's sales and, consequently, its stock price. Economic conditions, consumer preferences, and supply chain issues all play a role in determining market demand.

3.2 Financial Performance

Carvana's quarterly earnings reports provide insights into its financial health, influencing investor confidence and stock price. Metrics such as revenue growth, profit margins, and operational efficiency are critical indicators.

4. Market Trends and CVNA Stock

Market trends can significantly affect the CVNA stock price. Understanding these trends provides investors with a broader context for their investment strategies.

4.1 E-commerce Growth

The rise of e-commerce has transformed the automotive industry. As more consumers turn to online platforms for purchases, Carvana's innovative model positions it well for growth.

4.2 Economic Indicators

Economic factors such as unemployment rates, interest rates, and consumer confidence can influence the automotive market. Monitoring these indicators helps investors gauge potential impacts on CVNA stock price.

5. Analyst Opinions and Predictions

Expert opinions from financial analysts provide valuable insights into the potential future of CVNA stock price. Many analysts offer price targets based on their evaluations of the company’s performance and market conditions.

5.1 Price Targets

Analysts often set price targets for stocks based on their analysis. For CVNA, these targets can vary widely, reflecting differing opinions on the company's growth potential and market conditions.

5.2 Buy, Hold, or Sell Recommendations

Investor recommendations from professionals can guide individual investment decisions. Understanding the rationale behind these recommendations is essential for informed decision-making.

6. Investment Strategies for CVNA Stock

Investing in CVNA stock requires a strategic approach. Here are some strategies to consider:

- Diversification: Spread investments across various sectors to minimize risk.

- Long-term vs. Short-term: Decide whether to hold for the long term or trade based on market fluctuations.

- Research: Stay informed about market trends and company performance to make educated decisions.

7. Risks Associated with Investing in CVNA

Like any investment, CVNA stock carries risks that investors should be aware of. Understanding these risks can help in making informed decisions.

7.1 Market Volatility

The stock market is inherently volatile, and CVNA is no exception. Price fluctuations can be influenced by broader market trends and company-specific news.

7.2 Competition

The automotive industry is competitive, with various players entering the online space. Carvana must continue to innovate to maintain its market position.

8. Conclusion and Future Outlook

In conclusion, understanding CVNA stock price involves examining its historical performance, market trends, and key influencing factors. As an investor, staying informed and adopting a strategic approach can enhance your investment experience. While the future of CVNA stock price remains uncertain, ongoing research and analysis can provide valuable insights.

We encourage you to engage with this topic further—leave a comment below, share this article with fellow investors, or explore other articles on our site for more insights. Your financial future is important, and staying informed is the first step toward making sound investment decisions.

Thank you for reading, and we look forward to providing you with more valuable insights in the future!

Exploring The World Of Doja Cat: A Deep Dive Into Her Life And Career

Understanding NYSE: CVS - A Comprehensive Guide To CVS Health Corporation

Understanding The US Recession: Causes, Effects, And What Lies Ahead