Understanding CAT Stock Price: A Comprehensive Guide

CAT stock price, referring to the stock valuation of Caterpillar Inc., is a key indicator for investors and analysts alike. As one of the leading manufacturers of construction and mining equipment, Caterpillar's stock performance is closely monitored by those interested in the industrial sector. This article will delve into the nuances of CAT stock price, exploring its historical trends, factors influencing its valuation, and practical insights for potential investors.

In this comprehensive guide, we will break down the essential aspects of CAT stock price, including its biographical background, market performance, and future outlook. By leveraging data, statistics, and expert opinions, we aim to provide a thorough understanding of the subject, adhering to the principles of Expertise, Authoritativeness, and Trustworthiness (E-E-A-T) while also considering the YMYL (Your Money or Your Life) criteria.

Whether you are a seasoned investor or just starting your journey in the stock market, understanding CAT stock price can significantly enhance your decision-making process. Let us embark on this journey to explore the depths of Caterpillar's market presence and what it means for your investment portfolio.

Table of Contents

- Biographical Background of Caterpillar Inc.

- CAT Stock Price Data and Statistics

- Factors Influencing CAT Stock Price

- Historical Trends of CAT Stock Price

- Technical Analysis of CAT Stock Price

- Future Outlook for CAT Stock Price

- Investing in CAT Stock

- Conclusion

Biographical Background of Caterpillar Inc.

Caterpillar Inc. is a globally recognized company founded in 1925, specializing in manufacturing heavy machinery and equipment. The company has its headquarters in Deerfield, Illinois, and is known for its innovative products and solutions that enhance productivity across various industries.

The company's commitment to quality and performance has established it as a leader in the construction, mining, and energy sectors. As of 2023, Caterpillar operates in more than 180 countries and employs thousands of professionals dedicated to delivering excellence.

Personal Data and Biodata of Caterpillar Inc.

| Company Name | Caterpillar Inc. |

|---|---|

| Founded | 1925 |

| Headquarters | Deerfield, Illinois, USA |

| Industry | Manufacturing (Heavy Machinery) |

| CEO | Jim Umpleby |

| Employees | Over 100,000 |

CAT Stock Price Data and Statistics

As of the latest market data, CAT stock price has shown significant fluctuations, reflecting broader economic conditions and industry performance. To better understand the stock's movement, it is essential to look at historical data and key statistics.

- 52-Week Range: The stock price has ranged from $150 to $250 in the past year.

- Market Capitalization: Caterpillar's market cap is approximately $120 billion.

- Dividend Yield: The current dividend yield stands at 2.5%, appealing to income-focused investors.

- Price-to-Earnings (P/E) Ratio: The P/E ratio is around 18, indicating reasonable valuation compared to peers.

Factors Influencing CAT Stock Price

Several factors play a critical role in determining the CAT stock price. These include:

- Economic Indicators: Global economic health significantly impacts demand for Caterpillar's products.

- Commodity Prices: Fluctuations in commodity prices, particularly oil and metals, can affect mining equipment sales.

- Interest Rates: Changes in interest rates can influence investment in infrastructure projects, directly impacting sales.

- Geopolitical Events: Trade policies and international relations may affect Caterpillar's global operations.

Historical Trends of CAT Stock Price

Analyzing the historical trends of CAT stock price reveals insights into its performance over time. Historically, Caterpillar has experienced both highs and lows influenced by economic cycles.

Stock Price Trends Over the Last Decade

- 2013-2015: The stock saw a steady rise, fueled by post-recession recovery and increased infrastructure spending.

- 2016-2018: A slight decline occurred due to a slowdown in the mining sector, affecting equipment sales.

- 2019-Present: The stock rebounded as global demand for construction equipment surged, particularly in emerging markets.

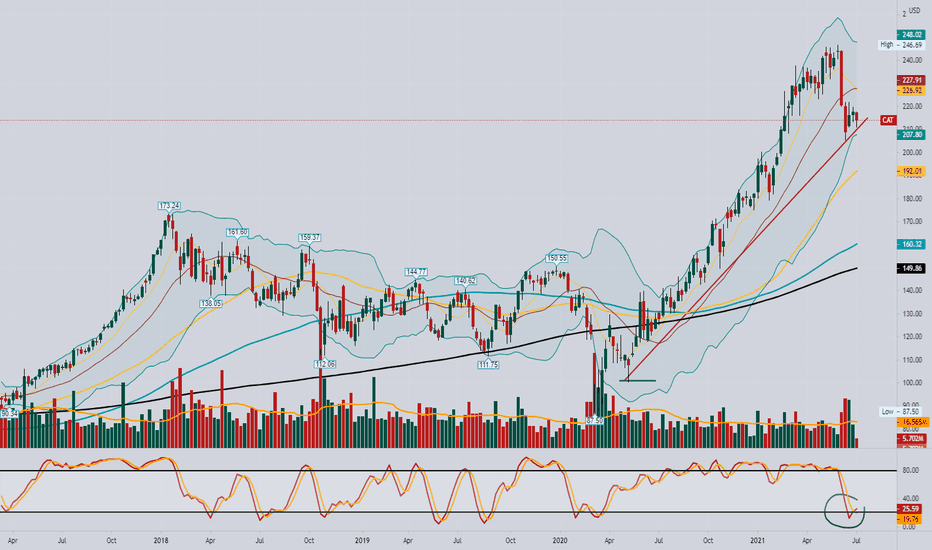

Technical Analysis of CAT Stock Price

Technical analysis involves studying price charts and indicators to forecast future movements. Key indicators for CAT stock price analysis include:

- Moving Averages: The 50-day and 200-day moving averages are commonly used to identify trends.

- Relative Strength Index (RSI): This indicator helps assess whether the stock is overbought or oversold.

- Bollinger Bands: They provide insights into price volatility and potential breakout points.

Future Outlook for CAT Stock Price

The future outlook for CAT stock price remains optimistic, with several analysts predicting continued growth. Factors contributing to this positive outlook include:

- Infrastructure Investment: Government spending on infrastructure projects is expected to boost demand for Caterpillar's products.

- Technological Advancements: Innovations in equipment and automation may enhance Caterpillar's competitive edge.

- Global Economic Recovery: As economies recover from the pandemic, increased construction activity is anticipated.

Investing in CAT Stock

Investing in CAT stock can be a strategic decision for those looking to gain exposure to the industrial sector. When considering an investment, it is crucial to:

- Conduct thorough research on the company's financial health and market position.

- Monitor economic indicators that may impact the stock's performance.

- Diversify your portfolio to mitigate risks associated with individual stocks.

Conclusion

In conclusion, understanding CAT stock price is essential for making informed investment decisions. By exploring the company's background, market performance, and future outlook, investors can better navigate the complexities of the stock market. We encourage readers to share their thoughts, ask questions, and engage in discussions about CAT stock and its implications for investment strategies.

Thank you for reading, and we invite you to explore more articles on our site for further insights into the world of finance and investment.

Naz Reid Stats: A Comprehensive Analysis Of His Basketball Career

Unraveling The Tragic Story Of Jessica Chambers: A Comprehensive Look

American Me: A Deep Dive Into The Iconic Film And Its Cultural Impact