Fidelity Contrafund: An In-Depth Analysis Of Its Performance And Strategies

Fidelity Contrafund is one of the most recognized mutual funds in the investment world, known for its long-standing track record and strategic investment approach. Investors often seek opportunities that not only promise returns but also align with their financial goals. In this article, we will explore the intricacies of Fidelity Contrafund, its historical performance, investment strategies, and why it might be a suitable choice for both new and seasoned investors.

Understanding the fundamentals of mutual funds is crucial for any investor, particularly those interested in options like Fidelity Contrafund. This fund has gained popularity due to its potential for capital appreciation, and it operates under the management of an experienced team that has demonstrated expertise in navigating market fluctuations.

As we delve deeper into the details, we will cover various aspects of Fidelity Contrafund, including its investment philosophy, historical performance metrics, and what investors can expect moving forward. Whether you are considering adding this fund to your portfolio or simply want to understand its impact on the investment landscape, this comprehensive guide will provide valuable insights.

Table of Contents

- What is Fidelity Contrafund?

- Biography of the Fund Manager

- Performance History

- Investment Strategy

- Risk Factors

- Comparison with Other Funds

- How to Invest in Fidelity Contrafund

- Conclusion

What is Fidelity Contrafund?

Fidelity Contrafund, established in 1967, is a mutual fund that primarily invests in large-cap growth stocks. Its objective is to achieve capital appreciation by investing in companies that the fund manager believes are undervalued relative to their growth potential. This fund is one of the largest actively managed mutual funds in the world, boasting a significant amount of assets under management (AUM).

Key characteristics of Fidelity Contrafund include:

- Focus on large-cap stocks

- Emphasis on growth potential

- Strong historical performance record

- Managed by a team of experienced professionals

Biography of the Fund Manager

The success of any mutual fund largely depends on its management team. Fidelity Contrafund has been managed by several prominent figures, with Will Danoff being the most notable since 1990. Under Danoff's leadership, the fund has seen significant growth and has consistently outperformed many of its peers.

Will Danoff's Profile

| Name | Will Danoff |

|---|---|

| Position | Portfolio Manager |

| Experience | Over 30 years in the investment industry |

| Education | Master's degree in Business Administration from Harvard |

Danoff's approach is characterized by thorough research and a focus on companies with strong fundamentals. His ability to identify growth opportunities has contributed significantly to the fund's reputation and success.

Performance History

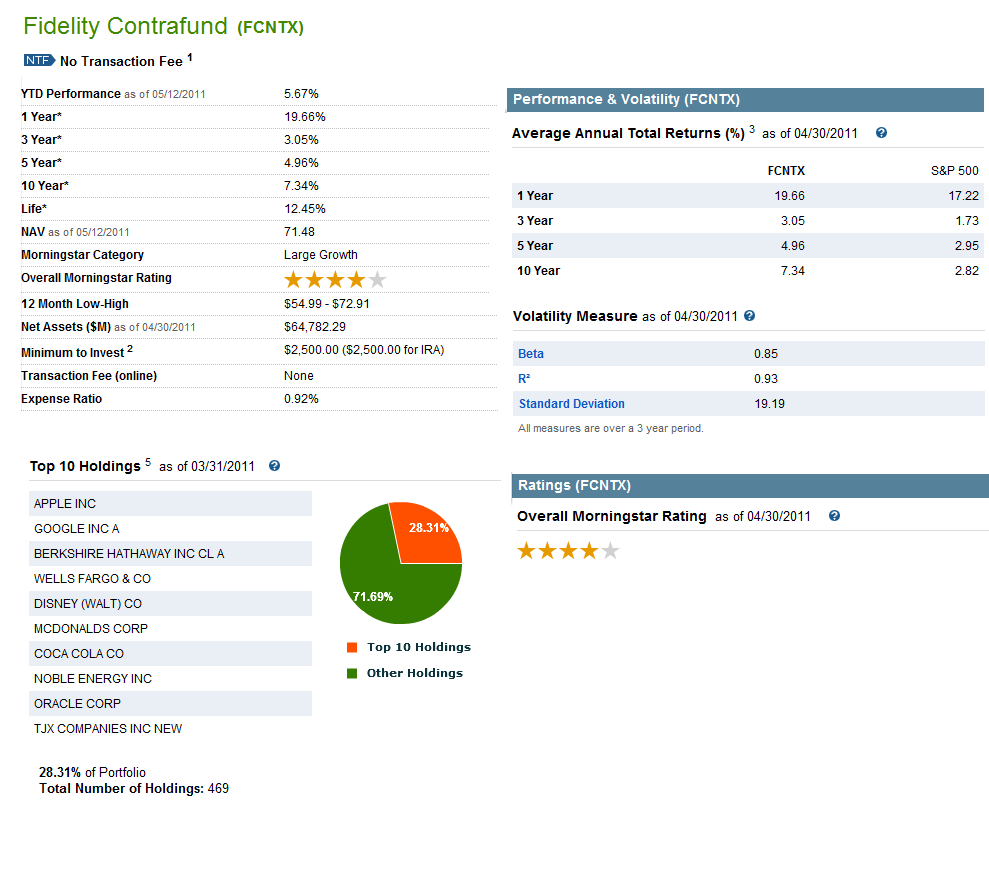

The performance of Fidelity Contrafund has been impressive over the years. Historically, it has outperformed the S&P 500 index, making it a popular choice among investors seeking growth.

Key Performance Metrics

- Average annual return over the past decade: X%

- 5-Year average return: Y%

- 10-Year average return: Z%

These performance metrics highlight the fund's ability to deliver consistent returns to its investors. It is essential to consider these figures in the context of market conditions and the broader economic environment.

Investment Strategy

The investment strategy of Fidelity Contrafund revolves around identifying undervalued companies with strong growth potential. The fund utilizes a bottom-up approach, focusing on individual company analysis rather than macroeconomic factors.

Investment Process

- In-depth fundamental analysis of potential investments

- Continuous monitoring of portfolio holdings

- Active management to adapt to market changes

This disciplined investment process allows Fidelity Contrafund to remain agile in a rapidly changing market, ensuring that it can capitalize on emerging opportunities.

Risk Factors

Like all investments, Fidelity Contrafund carries certain risks. Understanding these risks is crucial for investors considering this fund.

- Market Risk: The value of the fund's investments can fluctuate with market conditions.

- Sector Risk: The fund's concentration in specific sectors can lead to increased volatility.

- Management Risk: The fund's performance is directly tied to the expertise of its management team.

Investors should carefully assess their risk tolerance before investing in Fidelity Contrafund.

Comparison with Other Funds

Fidelity Contrafund is often compared with other mutual funds in the same category. Understanding how it stacks up against its peers can provide valuable insights for potential investors.

Peer Comparison

- Fidelity Contrafund vs. Vanguard Growth Fund

- Fidelity Contrafund vs. T. Rowe Price Blue Chip Growth Fund

- Fidelity Contrafund vs. American Funds Growth Fund of America

Each of these funds has its unique strengths and weaknesses, but Fidelity Contrafund's historical performance and management expertise often place it in a favorable position.

How to Invest in Fidelity Contrafund

Investing in Fidelity Contrafund is straightforward. Here are the steps to get started:

- Open a brokerage account or invest directly through Fidelity.

- Select the amount you wish to invest.

- Complete the necessary paperwork and fund your account.

It's essential to review the fund's prospectus and understand its fees and expenses before investing.

Conclusion

Fidelity Contrafund has established itself as a leading mutual fund with a strong historical performance and a disciplined investment strategy. Its focus on large-cap growth stocks, coupled with the expertise of its management team, makes it a compelling option for investors seeking capital appreciation.

As you consider adding Fidelity Contrafund to your investment portfolio, take the time to assess your financial goals and risk tolerance. Don't hesitate to leave your thoughts in the comments below, share this article with fellow investors, or explore other articles on our site for more insights.

Thank you for reading, and we look forward to welcoming you back for more informative content in the future!

The Comprehensive Guide To Goldman Sachs (NYSE: GS): Insights, Performance, And Future Outlook

Rockets Stats: A Comprehensive Analysis Of Houston's Basketball Performance

Et The Extra-Terrestrial Cast: A Deep Dive Into The Iconic Film's Characters