Understanding RDFN: A Comprehensive Guide To Redfin And Its Impact On Real Estate

RDFN, a stock symbol for Redfin Corporation, is an innovative player in the real estate industry. As a technology-powered real estate brokerage, Redfin has transformed how people buy and sell homes by leveraging the power of technology and data. In this article, we will explore the various facets of RDFN, its services, and its impact on the real estate market. Through an in-depth analysis of Redfin’s business model, market performance, and customer experience, we aim to provide valuable insights for both potential investors and homebuyers.

Whether you are considering using Redfin’s services to buy or sell a home or looking to invest in RDFN stocks, understanding the nuances of this company is essential. We will delve into Redfin’s unique selling propositions, its competitive landscape, and the future outlook of the company. Additionally, we will provide you with data and statistics that highlight Redfin's growth trajectory and market position.

Join us as we navigate through the world of RDFN and uncover the opportunities it presents in the real estate sector. This comprehensive guide is designed to equip you with the knowledge you need about Redfin, ensuring you make informed decisions regarding your real estate endeavors or investments.

Table of Contents

- 1. What is Redfin (RDFN)?

- 2. Redfin's Business Model

- 3. The Services Offered by Redfin

- 4. Market Performance of RDFN

- 5. Competitive Landscape of Redfin

- 6. Customer Experience with Redfin

- 7. Future Outlook for Redfin

- 8. Conclusion

1. What is Redfin (RDFN)?

Redfin, traded under the ticker symbol RDFN, is a technology-driven real estate brokerage founded in 2004. The company was established with the mission to redefine real estate in the consumer's favor. Redfin operates a unique model that combines traditional real estate services with innovative technology tools to enhance the home buying and selling experience.

One of the distinguishing features of Redfin is its use of data and technology to streamline the real estate process. Through its user-friendly website and mobile app, customers can access a wealth of information about properties, neighborhoods, and market trends. This approach not only empowers consumers but also helps them make informed decisions.

Biographical Data of Redfin Corporation

| Detail | Information |

|---|---|

| Name | Redfin Corporation |

| Founded | 2004 |

| Headquarters | Seattle, Washington, USA |

| CEO | Glenn Kelman |

| Stock Symbol | RDFN |

2. Redfin's Business Model

Redfin operates on a hybrid business model that combines elements of traditional real estate brokerage with technology-driven services. Unlike traditional real estate agents who often charge a commission based on the sale price, Redfin employs a different pricing structure that includes lower fees for buyers and sellers.

Key aspects of Redfin's business model include:

- Direct Listings: Redfin allows homeowners to list their properties directly on its platform, increasing visibility and reducing time on the market.

- Technology Integration: The company provides advanced search tools, virtual tours, and detailed property information to enhance the customer experience.

- Data-Driven Insights: Redfin uses data analytics to offer insights on pricing trends, neighborhood statistics, and market conditions, helping buyers and sellers make informed choices.

- Lower Commission Rates: Redfin typically charges lower commission rates compared to traditional brokerages, making it an attractive option for cost-conscious consumers.

3. The Services Offered by Redfin

Redfin offers a range of services designed to assist customers throughout the home buying and selling process. These services include:

- Home Buying: Redfin’s agents help buyers find suitable properties, schedule tours, and negotiate offers.

- Home Selling: The platform enables sellers to list their homes, conduct market analysis, and receive professional assistance from Redfin agents.

- RedfinNow: This service allows homeowners to sell their homes directly to Redfin for a quick and hassle-free transaction.

- Mortgage Services: Redfin offers mortgage solutions with competitive rates, making the financing process more accessible for buyers.

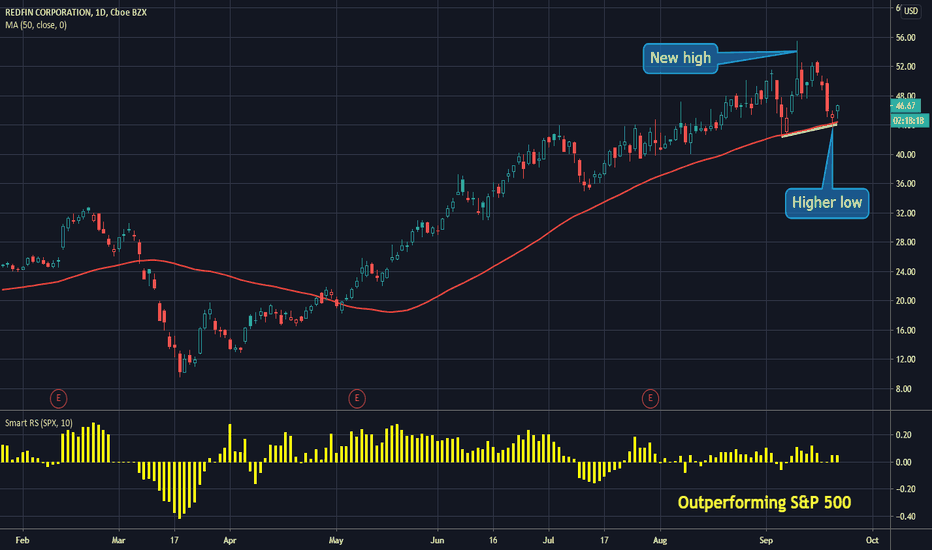

4. Market Performance of RDFN

Since its initial public offering (IPO) in 2017, RDFN has experienced significant fluctuations in its stock performance. Investors and analysts closely monitor key metrics such as revenue growth, market share, and profitability.

Recent statistics show that Redfin has been expanding its market presence and increasing its revenue year over year. For instance, in the latest financial report, Redfin reported a revenue growth of over 40%, indicating strong demand for its services.

Key performance indicators to consider include:

- Revenue Growth: Continuous growth in revenue suggests a strong market position.

- Market Share: Redfin’s increasing market share in various regions highlights its competitiveness.

- Customer Satisfaction: High customer satisfaction ratings contribute to repeat business and referrals.

5. Competitive Landscape of Redfin

The real estate industry is highly competitive, with various players vying for market share. Redfin competes with traditional brokerages, online platforms, and emerging startups. Key competitors include:

- Zillow: A leading online real estate marketplace that provides property listings and home value estimates.

- Realtor.com: Another popular platform for searching real estate listings and connecting with agents.

- Opendoor: A startup that focuses on instant home buying and selling.

Redfin differentiates itself through its technology integration and lower commission rates, appealing to a tech-savvy demographic.

6. Customer Experience with Redfin

Customer experience is a vital component of Redfin's success. The company places a strong emphasis on providing exceptional service to its clients. Through user-friendly technology and dedicated agents, Redfin aims to create a seamless experience for homebuyers and sellers.

Key aspects of Redfin's customer experience include:

- Transparency: Redfin provides detailed information about properties, pricing, and market trends, fostering trust among customers.

- Responsive Agents: Redfin agents are known for their responsiveness and willingness to assist clients throughout the process.

- User-Friendly Platform: The website and mobile app are designed to be intuitive, allowing users to navigate easily and access relevant information.

7. Future Outlook for Redfin

The future of Redfin appears promising, given its innovative approach and expanding market presence. Analysts predict continued growth driven by:

- Technological Advancements: As technology continues to evolve, Redfin is well-positioned to leverage new tools and platforms to enhance its services.

- Market Expansion: Redfin is actively expanding into new markets, increasing its footprint and customer base.

- Increased Demand: The ongoing demand for real estate services, particularly in a competitive housing market, presents opportunities for growth.

8. Conclusion

In conclusion, RDFN represents an innovative approach to real estate that combines technology with traditional brokerage services. Through its unique business model, lower fees, and commitment to customer experience, Redfin has carved out a significant niche in the market.

For potential investors and homebuyers alike, understanding Redfin’s offerings and market position is essential. As you consider your next steps in real estate, whether buying, selling, or investing, we encourage you to explore what Redfin has to offer.

Stephen Amell: The Journey Of A Versatile Actor And Philanthropist

Sunrun Stock: An In-Depth Analysis Of Growth And Investment Potential

Understanding PAAS Stock: Insights And Investment Potential

![PREMIERE NOSUCHKEY ACD RDFN [Art Of Memory] YouTube](https://i.ytimg.com/vi/jFGTQgWKrsY/maxresdefault.jpg)