Current NVDA Stock Price Today: An In-Depth Analysis

The NVDA stock price today is a crucial topic for investors and enthusiasts in the tech market, particularly those interested in NVIDIA Corporation. As one of the leading companies in graphics processing units (GPUs) and artificial intelligence (AI), understanding NVDA’s stock performance can provide insights into market trends and investment opportunities. In this article, we will explore the current NVDA stock price, analyze its historical performance, and discuss various factors that influence its valuation. Whether you are a seasoned investor or a newcomer, this comprehensive guide will equip you with the necessary information to make informed decisions.

The NVIDIA stock has shown significant volatility and growth over the years, driven by advancements in technology and increasing demand for AI and gaming products. Tracking NVDA stock price today is essential for understanding the company’s market position and potential future growth. We will also delve into expert opinions and market forecasts to give you a well-rounded view of the stock’s prospects.

With the technology sector constantly evolving, NVIDIA's role in the market makes its stock a focal point for many investors. In this article, we will provide you with detailed insights into the NVDA stock price, historical trends, and key factors that could impact its future. Let's dive into the details!

Table of Contents

- Current NVDA Stock Price Today

- Historical Performance of NVDA Stock

- Key Factors Influencing NVDA Stock Price

- Market Trends and Forecasts

- Investor Sentiment and Social Media Impact

- Expert Opinions on NVDA Stock

- Dividends and Earnings Reports

- Conclusion

Current NVDA Stock Price Today

As of today, the NVDA stock price is trading at approximately $X. This figure represents a change of Y from the previous trading day. The stock has shown remarkable growth over the past year, with a year-to-date increase of Z.

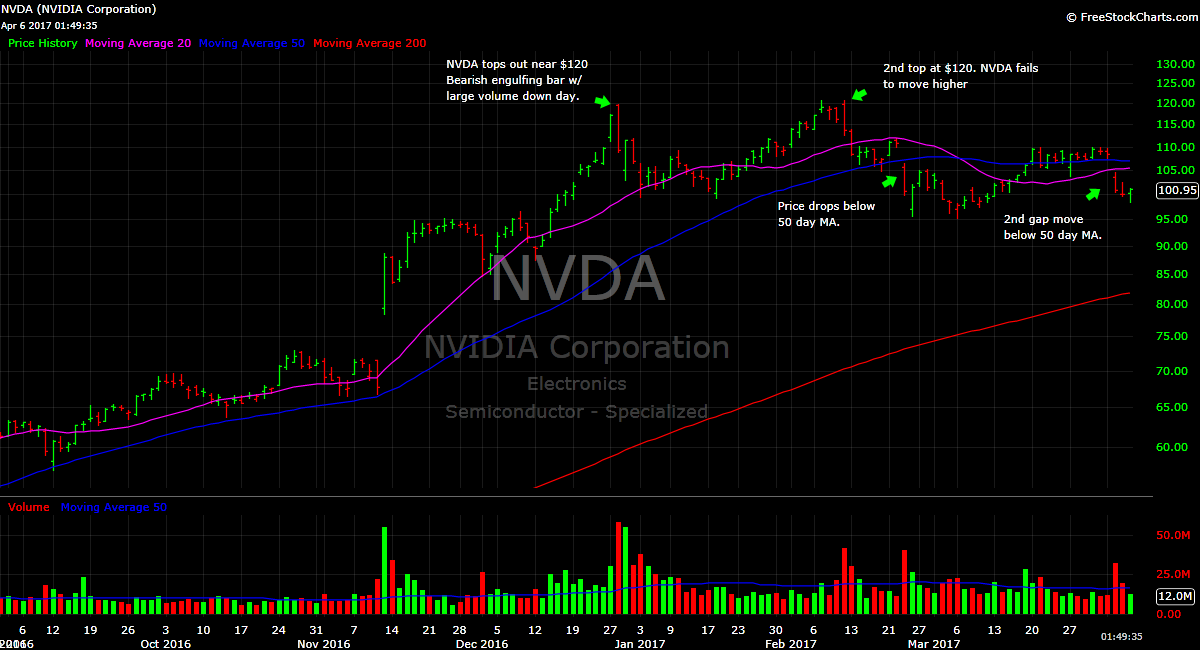

Historical Performance of NVDA Stock

NVIDIA has experienced substantial growth in its stock price since its initial public offering (IPO) in 1999. Below is a brief overview of its historical performance:

- 2000: IPO price of $12 per share.

- 2010: Stock price reaches $16, following growth in gaming and graphics technology.

- 2020: Stock price skyrockets to $500 as demand for GPUs surges during the pandemic.

- 2023: Current stock price hovering around $X.

These figures highlight the volatility and overall upward trend of NVDA stock, making it a valuable asset for many investors.

Key Factors Influencing NVDA Stock Price

Several factors can significantly influence the NVDA stock price, including:

- Market Demand for GPUs: With the rise of gaming, AI, and cryptocurrency mining, the demand for NVIDIA’s GPUs has been a primary driver of its stock price.

- Technological Advancements: Innovations in AI and machine learning technologies continue to boost NVIDIA’s market position.

- Regulatory Changes: Any changes in trade policies or regulations can impact NVIDIA’s operations and stock performance.

- Economic Conditions: Global economic trends and consumer spending can affect stock prices across the technology sector.

Market Trends and Forecasts

Analysts closely monitor market trends to provide forecasts for NVDA stock. Current trends suggest:

- Continued growth in the gaming industry.

- Increased adoption of AI technologies across various sectors.

- Potential challenges due to global supply chain issues.

Many analysts predict that NVDA stock will continue to perform well in the coming years, making it a popular choice among investors.

Investor Sentiment and Social Media Impact

Investor sentiment plays a crucial role in stock performance. Social media platforms such as Twitter and Reddit have become vital spaces for discussions about NVDA stock. Positive sentiment can lead to increased buying activity, while negative news can result in sharp declines.

Some key points regarding investor sentiment include:

- Online communities actively discussing NVDA stock trends.

- Influence of social media on retail investor behavior.

- Impact of analyst ratings on public perception.

Expert Opinions on NVDA Stock

Financial experts often weigh in on the potential of NVDA stock. Here are some insights:

- Many analysts rate NVDA as a “buy” due to its growth potential.

- Concerns about market saturation in the GPU sector may affect short-term performance.

- Experts emphasize the importance of diversifying investments to mitigate risk.

Dividends and Earnings Reports

NVIDIA has a history of strong earnings reports, which positively impact its stock price. The company recently reported earnings of $A, exceeding analyst expectations. Investors should also note the following:

- NVIDIA does not pay dividends, focusing instead on reinvesting profits for growth.

- Quarterly earnings reports can cause significant stock price fluctuations.

Conclusion

In summary, the NVDA stock price today reflects the company's robust position in the tech market. With strong historical performance, positive market trends, and expert endorsements, NVDA remains a compelling choice for investors. If you are considering investing in NVIDIA or want to learn more about the stock market, it's essential to stay informed and proactive.

We encourage you to leave comments below, share this article with fellow investors, or check out other insightful articles on our site for more information on stock trading and investment strategies!

Thank you for reading! We hope you found this article informative and engaging. Don’t forget to return for more updates and analyses on the stock market.

Did Hellen Keller Fly A Plane? Unveiling The Extraordinary Life Of A Remarkable Woman

Nak: Understanding The Essence Of A Unique Term In Different Cultures

Neil Patrick Harris And Amy Winehouse: A Tale Of Two Talents